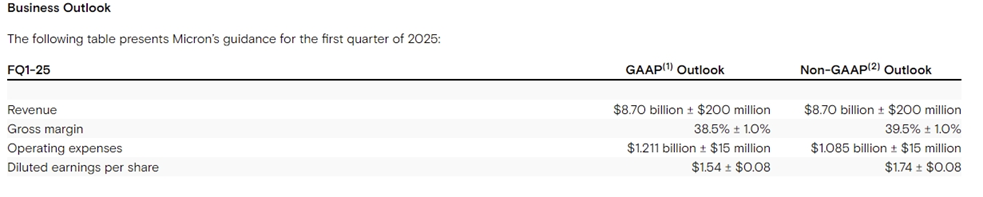

Looking ahead, due to the sustained demand for AI servers, the demand for the company’s related storage products remains very strong, while industry chip capacity has already declined, creating a very optimistic supply-demand landscape for the future, particularly with HBM products experiencing supply shortages. At the same time, the company will prioritize shifting capacity towards higher-value, higher-margin product combinations, such as HBM, high-capacity DIMM, more LP solutions, and data center product line NAND SSDs. Against the backdrop of optimized supply-demand dynamics and product portfolio enhancements, the company’s profit margins are expected to gradually increase.