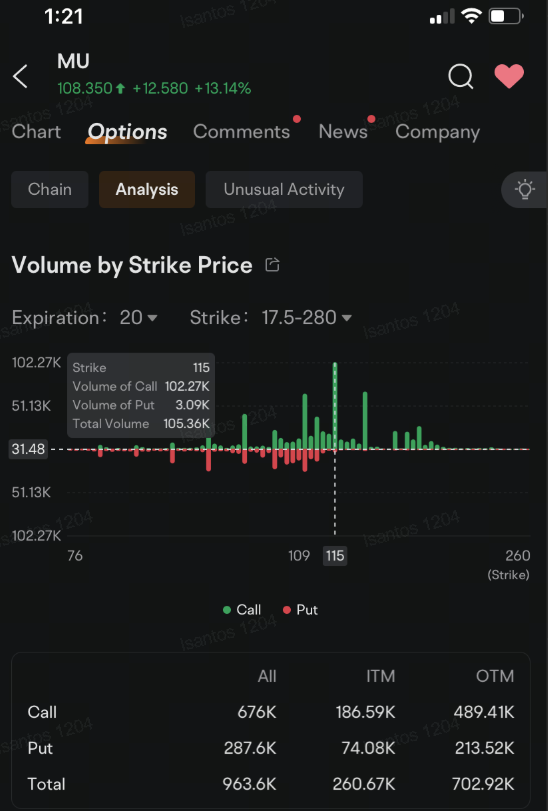

The earlier surge in stock price put the $115 call options closer to being in-the-money before they expire and sending the contract price up to as high as $2.19. As the rally weakened, buyers pulled back, sending the contract price down 64% to 16 cents. That volatility took the volume to 35,640, almost six times the open interest. The $115 calls expiring in the next few weeks are faring better, up more than 50%.

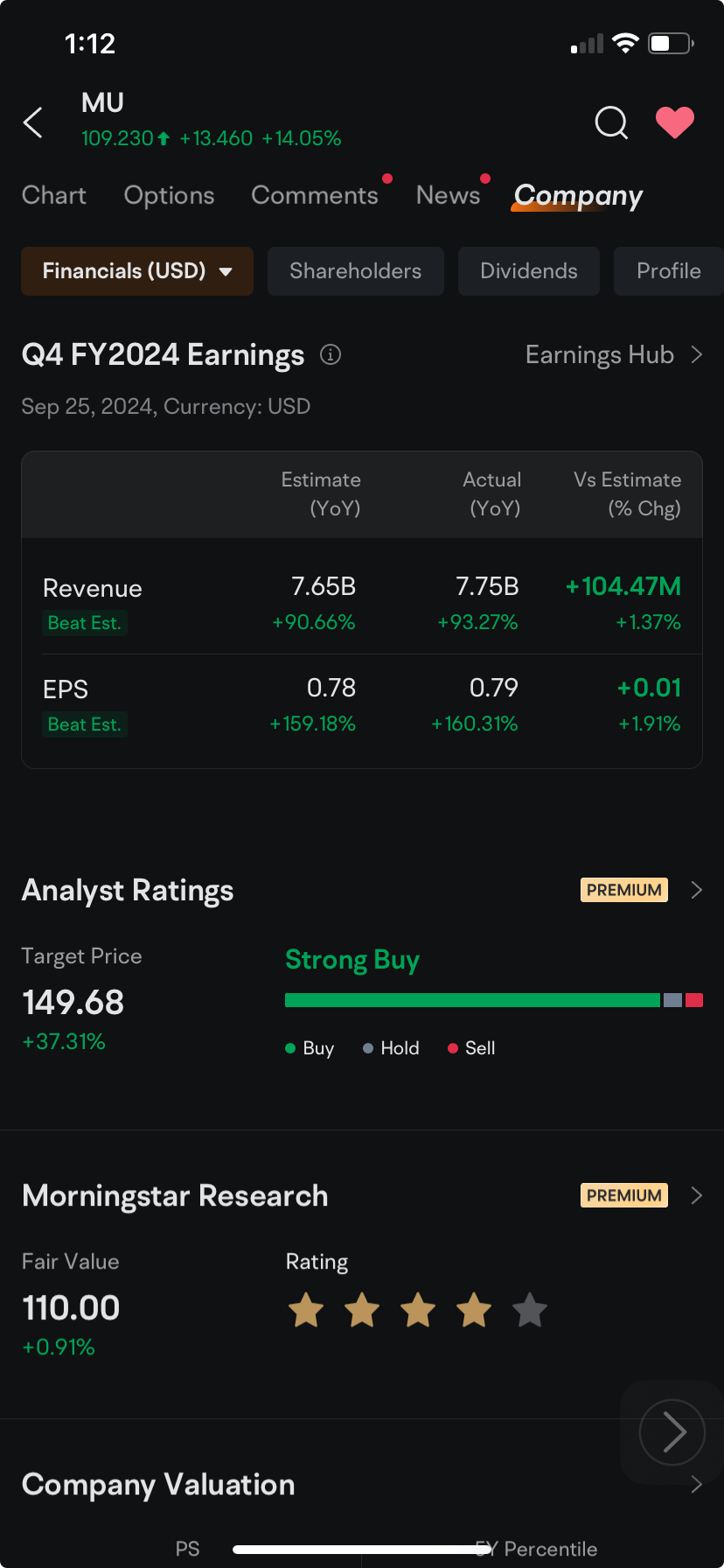

john song : good news for micron

BLACKLIST00 : My name hmm

BLACKLIST00 :

Laine Ford : good stock here

102181510 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)