MicroStrategy Sees Millions of Dollars of Bearish Option Trades as Stock Climbs to Record

$MicroStrategy (MSTR.US)$ saw millions of dollars in bearish option positions at a time when the stock was climbing to a record.

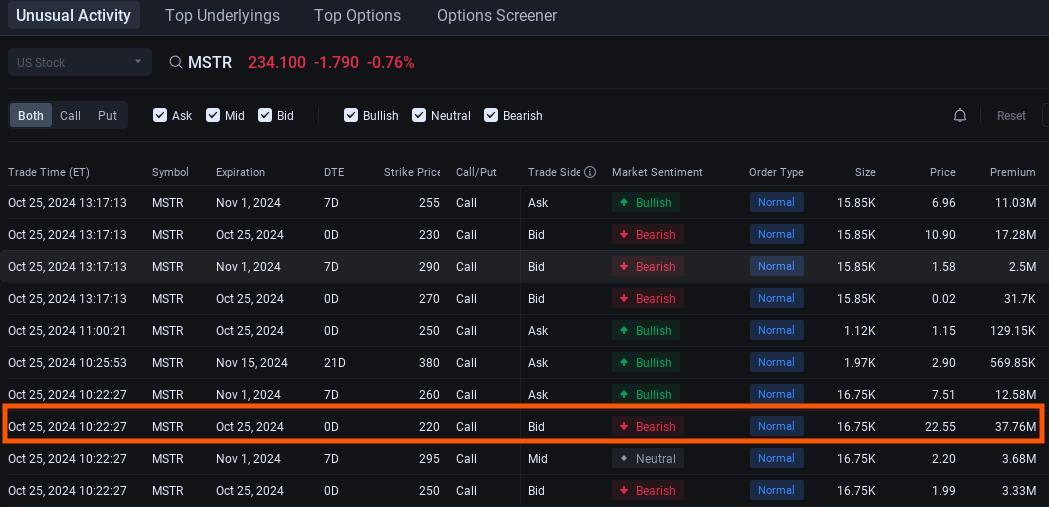

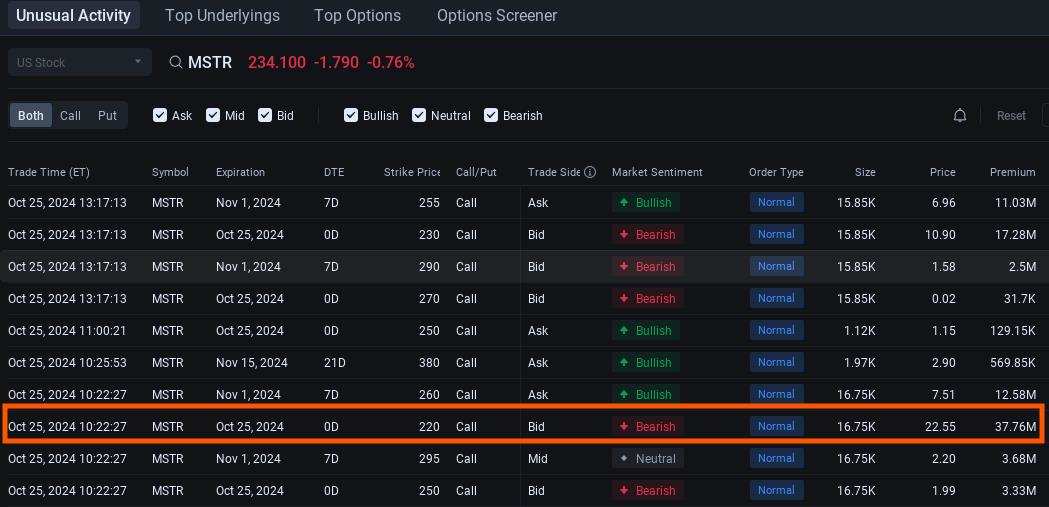

The biggest of those bearish positions was posted at 10:22:27 a.m. Friday. An active seller collected a $37.8 million premium for call options that give the holders the right to buy 1.674 million MicroStrategy shares by close of trading today, exchange data tracked by moomoo showed. The contract was priced at $22.55 per share when the stock was trading at $242.67.

If that seller was merely closing out an existing position, he or she sold just $3 below the contract's peak. If it were a new position, the seller could have bought back the contracts at a cheaper price hours later, potentially pocketing a profit. This morning's sale occured just before the stock price's slight pull back from its intra-day record high of $245.57.

The contrarian trades were posted three days after BlackRock increased its stake in MicroStrategy to 5.2%. The world's largest asset manager reported in a filing with the Securities and Exchange Commission earlier in the week that it now holds 9.48 million shares in the software company.

MicroStrategy, which invests in Bitcoin, benefited as the value cryptocurrency surged. The largest crypto currency jumped 93% over the past year, fueling MicroStrategy's 450% rally. The five bearish option trades today were posted just as Bitcoin was nearing its intra-day high.

Amid the stock rally, technical indicators tracked by moomoo are flashing early warning signals. Twelve of the 15 gauges that you can find on the moomoo app are showing that MicroStrategy could now be overbought, and the trend may be turning bearish.

Share your thoughts on MicroStrategy and bitcoin in the comments section.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors readCharacteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

J Servai (JLAPT) :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Mark Martin592 : how to place a trade

Chak : Anytime it’ll dump hundred dollars, but how did this option seller magistrate sounds

Laine Ford : okay

sandeep sivananda : I would be careful now re bearish

Laine Ford : okay to me

Ultratech : never go bearish.

EZ_money : it's been overpriced. what kinda CEO dares bears to short his stock. Saylor is the only one.

CEO dares bears to short his stock. Saylor is the only one.

73638957 : That boat left without me. Who says MSTR can’t go higher by another 400%. I rather be out wishing I was in the trade than being in trade wishing I was out.

Kinni420 73638957 : hope for another stock split![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...