Middle East Powder Keg Ignites: Here Are the Geopolitical Events and Stock Market Reactions

A new round of military conflict broke out between Israel and Palestine on the Oct 7th, with Hamas launching military action against Israel and Israeli forces launching multiple rounds of airstrikes on the Gaza Strip. The conflict is still ongoing, and its impact on the market will depend on its duration, intensity, and whether it spreads to other parts of the Middle East.

Agustin Carstens, General Manager of the Bank for International Settlements (BIS), stated in a speech to the National Association for Business Economics (NABE) that it is "premature" to say what impact the Middle East conflict may have on the economy, although oil and stock markets may be immediately affected.

Based on historical analysis, it is suggested that oil prices tend to see prolonged increases following the Middle East crises. On the other hand, although stocks may experience a period of volatility at first, they tend to eventually rebound and continue to trend upwards.

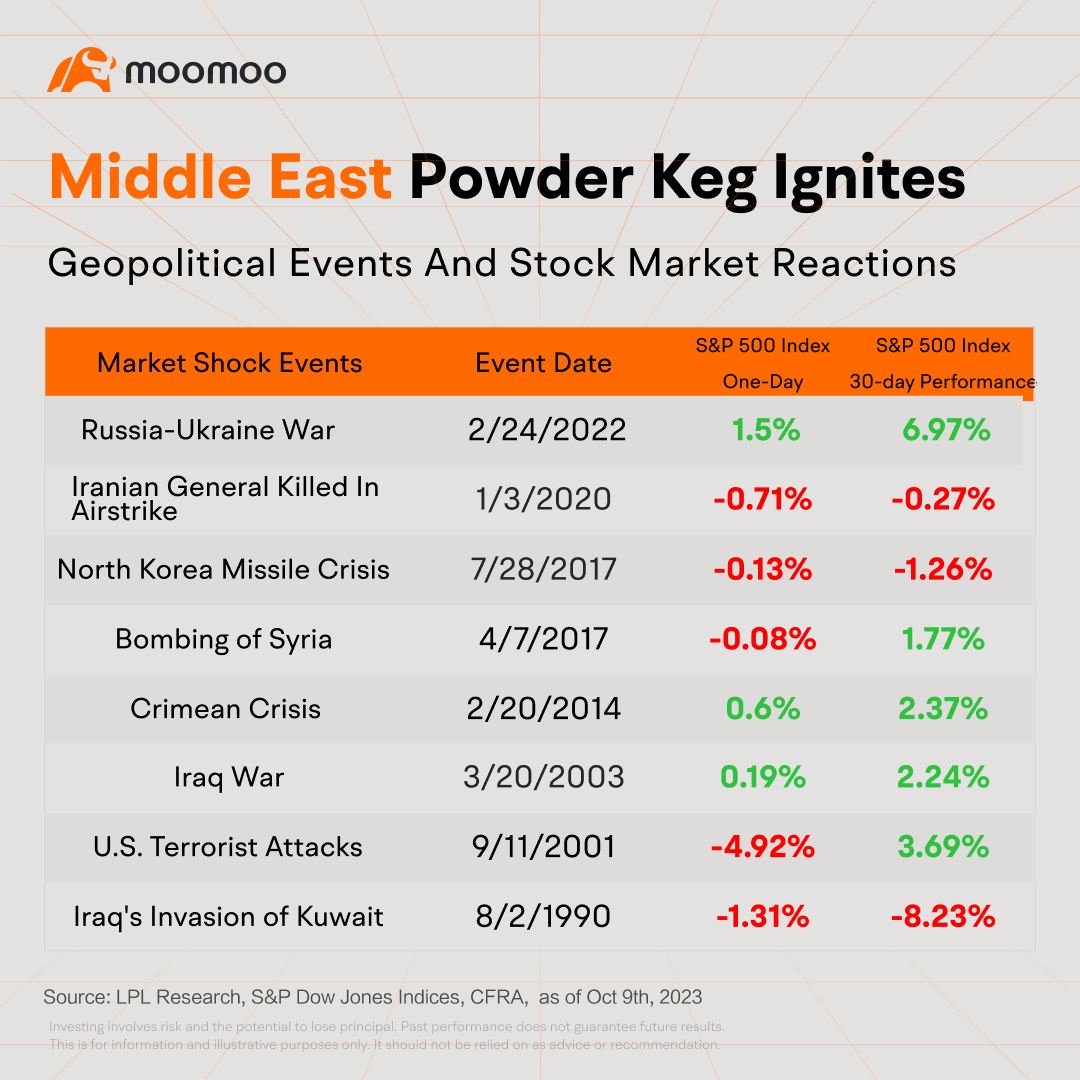

Here is a summary of the impact of geopolitical risks on the S&P 500 throughout history.

Source: FXS, Yahoo Finance, Moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment