Money Managers Dump REITs to Lehman Levels: Omen or Opportunity?

US real estate stocks are struggling amid fears of tighter lending standards and commercial real estate headwinds. The $Dow Jones Equity REIT Index (.DJR.US)$ fell 1.55%, compared to the $S&P 500 Index (.SPX.US)$'s strong 16% return for the year.

Abandoning REITs

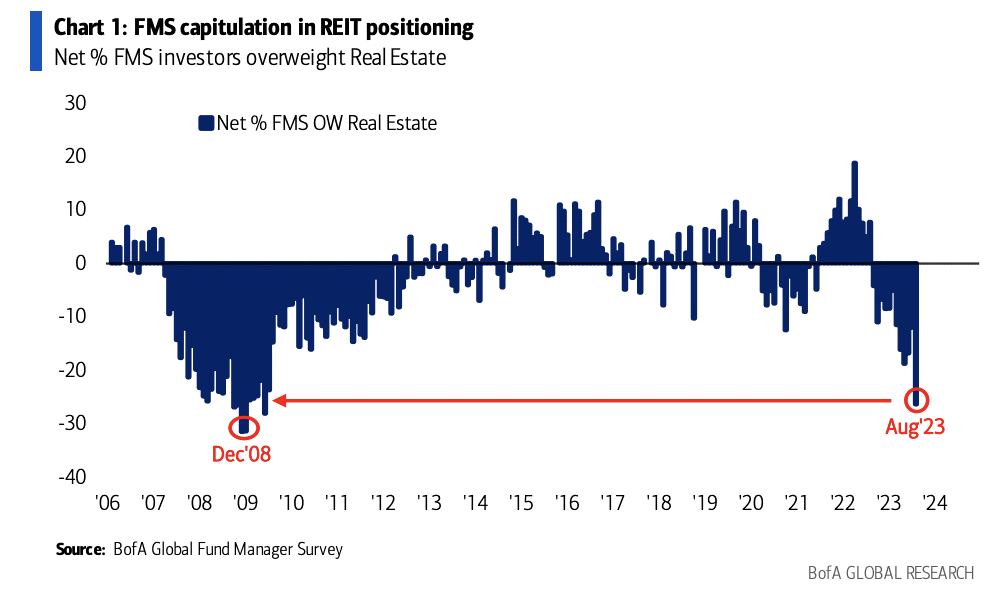

Fund managers are piling out of REITs, with positioning showing a "capitulation" to Lehman/GFC levels, BofA strategist Michael Hartnett wrote.

"REITs (are) most fascinating to watch," Hartnett added. If there is "no recession, FMS says go max long, but if REITs can't recover with Lehmanlike positioning, then recession could be just around the corner."

Fund managers are not alone, retail investors are also shunning REITs, with the implied allocations to REITs ETFs by US investors tracking at the lowest level on record.

Investors are pivoting away from REITs ETFs as they don't see it as a good opportunity, according to Callum Thomas, head of research at Topdown Charts.

Omen or Opportunity?

"REITs as a group are not really cheap yet in terms of absolute valuations, and still face real challenges and macro headwinds — but at this point everyone seems to already understand this and have adjusted accordingly," said Thomas.

If REITs simply avoid 2008-style apocalypse (when REITs fell 75% top-to-bottom which compares to declines of just over 30% last year for US REITs), it could be an interesting contrarian bull setup, Thomas added.

Mooers, are REITs really this bad? Or just an opportunity for investors to now step in?

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment