[Moo Brief] Anticipating a BoC interest rate cut in June: Where to invest?

Recent inflation data and GDP figures have fueled speculation, with Bank of Canada (BoC) interest rate cut bets in June now reaching a staggering 65%. As an investor, where would you like to put your money in if there's a rate cut?

![[Moo Brief] Anticipating a BoC interest rate cut in June: Where to invest?](https://ussnsimg.moomoo.com/sns_client_feed/77777022/20240604/1717492116408-dd0cfbcccf.jpeg/big?area=103&is_public=true)

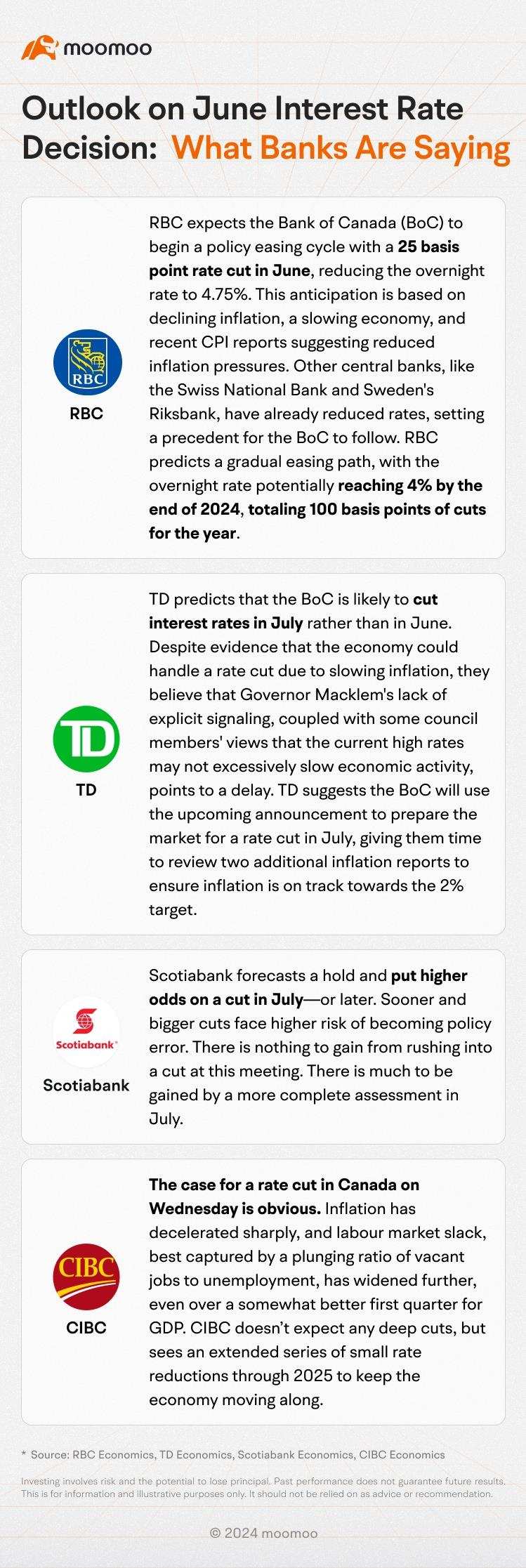

RBC projects that the Bank of Canada will initiate a policy easing cycle on Wednesday, cutting the overnight rate by 25 basis points to 4.75%. This move would align with recent rate cuts by the Swiss National Bank and the Riksbank of Sweden. RBC anticipates a total of 100 basis points in rate cuts this year, reducing the overnight rate to 4% by the end of 2024.

Historical Interest Rate Situation

The Bank of Canada has maintained its overnight rate at around 5% for nearly a year. This prolonged period of stable interest rates is now facing potential disruption as market conditions evolve and economic indicators suggest a shift may be necessary.

GDP and Inflation Data

Recent economic data has been pivotal in shaping expectations. The first quarter GDP growth was lower than both market expectations and the BoC's own forecasts. Additionally, inflation has shown significant signs of easing. For instance, if we exclude mortgage interest costs, which are directly influenced by high interest rates, the Consumer Price Index (CPI) growth rate over the past year stands at merely 1.6%. This lower inflationary pressure suggests that the economy may no longer require the stringent measures implemented six months ago.

Historical Interest Rate Situation

The Bank of Canada has maintained its overnight rate at around 5% for nearly a year. This prolonged period of stable interest rates is now facing potential disruption as market conditions evolve and economic indicators suggest a shift may be necessary.

GDP and Inflation Data

Recent economic data has been pivotal in shaping expectations. The first quarter GDP growth was lower than both market expectations and the BoC's own forecasts. Additionally, inflation has shown significant signs of easing. For instance, if we exclude mortgage interest costs, which are directly influenced by high interest rates, the Consumer Price Index (CPI) growth rate over the past year stands at merely 1.6%. This lower inflationary pressure suggests that the economy may no longer require the stringent measures implemented six months ago.

If your friends haven't tried Moomoo before, you can invite them and win rewards through our [Friends Invitation Promotion]

![[Moo Brief] Anticipating a BoC interest rate cut in June: Where to invest?](https://ussnsimg.moomoo.com/sns_client_feed/77777022/20240604/1717492291356-27dd11391e.png/big?area=103&is_public=true)

[New Customer Promotion]

![[Moo Brief] Anticipating a BoC interest rate cut in June: Where to invest?](https://ussnsimg.moomoo.com/sns_client_feed/77777022/20240604/1717492319249-2b94c68061.png/big?area=103&is_public=true)

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

长线铁多头 : Hreu

poem_view : Invest in dollars. The US dollar should be able to maintain interest above 3% until 2026.