[Moo Brief] Apple dips 1% despite beating earnings: Still worth wagering on Apple intelligence next quarter?

Hey, mooers! ![]() $Apple (AAPL.US)$ released its Q3 fiscal year results yesterday, beating earnings expectations.

$Apple (AAPL.US)$ released its Q3 fiscal year results yesterday, beating earnings expectations. ![]() However, $Apple (AAPL.US)$ closed at $218.36 with a 1.68% drop on Aug 1, rising by 0.59% to $219.65 after-hour at 7:59 PM EDT.

However, $Apple (AAPL.US)$ closed at $218.36 with a 1.68% drop on Aug 1, rising by 0.59% to $219.65 after-hour at 7:59 PM EDT.

💭 Slowing iPhone sales?

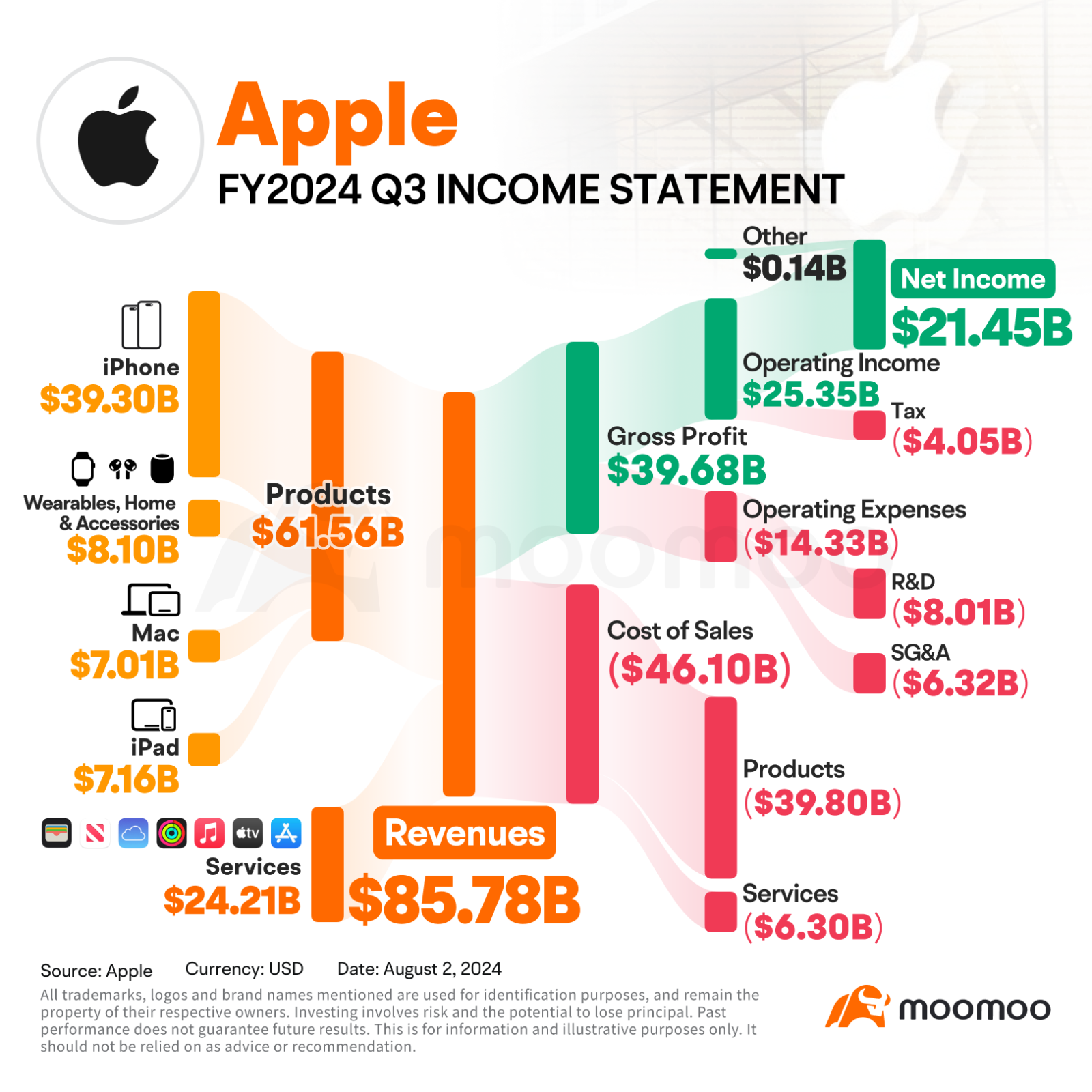

$Apple (AAPL.US)$'s Q3 earnings beat analysts' expectations despite iPhone revenue falling 0.9% YoY to $39.3 billion (analysts expected $38.95 billion). Mac revenue grew 2.5% to $7.01 billion (analysts expected $6.98 billion), while iPad revenue surged 23.7% to $7.16 billion (analysts expected $6.63 billion). Wearable devices, home, and peripheral revenue fell 2.3% to $8.1 billion (analysts expected $7.79 billion), and service revenue increased 14% to $24.213 billion (above the market expectation of $23.96 billion).

![[Moo Brief] Apple dips 1% despite beating earnings: Still worth wagering on Apple intelligence next quarter?](https://ussnsimg.moomoo.com/sns_client_feed/77777022/20240805/1722827220921-f4f2daca77.png/big?area=103&is_public=true)

![[Moo Brief] Apple dips 1% despite beating earnings: Still worth wagering on Apple intelligence next quarter?](https://ussnsimg.moomoo.com/sns_client_feed/77777022/20240802/1722582143222-74356adfd8.jpeg/big?area=103&is_public=true)

💭 Decreasing Great China sales?

Greater China's revenue was the only geographic region to decline year-on-year, and the decline was greater than expected. Greater China, which contributes about 20% of Apple's revenue, had revenue of $14.73 billion, down 6.5% YoY from $15.76 billion in the same period last year. Greater China is Apple's third largest sales market after North America and Europe. As a core business with sales far exceeding other hardware products, the health of the iPhone, especially the sales trend in Greater China, will be particularly noteworthy.

![[Moo Brief] Apple dips 1% despite beating earnings: Still worth wagering on Apple intelligence next quarter?](https://ussnsimg.moomoo.com/sns_client_feed/77777022/20240802/1722582143292-7edfb5770c.jpeg/big?area=103&is_public=true)

⚠️But wait!

Q3 earnings did not reflect the sales of coming Apple Intelligence. Going forward, Will Apple Intelligence drive the growth of $Apple (AAPL.US)$?

Despite the slowing iPhone sales, the market generally believes that new AI features will become the main driving force for the "super cycle" of $Apple (AAPL.US)$'s hardware product upgrades, led by the iPhone. There is still confidence in the Chinese market in the long run due to Apple Intelligence. Despite the development of AI, $Apple (AAPL.US)$'s Q3 gross profit margin was 46.3%, higher than the market expectation of 46.1%. Company executives said that the total revenue growth rate in the fourth quarter will be similar to that in the third quarter, and service revenue is expected to record a double-digit percentage growth.

🌠Apple Intelligence leads the way

Apple Intelligence is expected to drive a new round of phone replacement.

Apple Intelligence has three major features: system-level AI, cross-application information integration capabilities, and deployment in a terminal-cloud and private-cloud manner:

⓵ System-level AI is integrated into its operating system, allowing for direct calls to AI capabilities in applications and improving efficiency through a smarter Siri.

⓶ Cross-application information integration capabilities sort and extract information from various applications, allowing Apple Intelligence to discover and understand information between applications and providing cross-application information processing capabilities. This is due to $Apple (AAPL.US)$'s integrated advantages in operating system + model + chip + terminal.

⓷ Built-in large models have achieved better performance in user experience, text processing, and security, providing powerful capabilities in language, images, personal context, etc. through modeling processes such as pre-training, post-training, optimization, and fine-tuning.

To get back on track, do you believe in Apple Intelligence? Would you still invest in $Apple (AAPL.US)$? ![]()

Please drop your answer with reasonable comments, and you will receive 66 points. ![]()

Many mooers shared their gains. Here are some of their sharing:

![[Moo Brief] Apple dips 1% despite beating earnings: Still worth wagering on Apple intelligence next quarter?](https://ussnsimg.moomoo.com/sns_client_feed/77777022/20240802/1722583113247-7638d777b8.webp/big?area=103&is_public=true)

![[Moo Brief] Apple dips 1% despite beating earnings: Still worth wagering on Apple intelligence next quarter?](https://ussnsimg.moomoo.com/sns_client_feed/77777022/20240802/1722583187985-d1fa03992f.jpeg/big?area=103&is_public=true)

![[Moo Brief] Apple dips 1% despite beating earnings: Still worth wagering on Apple intelligence next quarter?](https://ussnsimg.moomoo.com/sns_client_feed/77777022/20240725/1721874870929-cd126c6410.webp/big?area=103&is_public=true)

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102362254 : Yes. Apple Intelligence is an exciting development, showing Apple's commitment to innovation and enhancing user experience. Given their track record and the potential of these new AI features, I believe investing in Apple remains a smart choice.

mr_cashcow : Yes, apple fans are all eagerly waiting for new iPhone models to drop so that they can get their hands on it![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Everyone wants the next new thing it is just basic human nature

Connie C : why not,it's still a good fundamental company.

Ricky178 : yes. apple fan will change apple ai phone.