NVDA

NVIDIA

-- 143.159 TSLA

Tesla

-- 411.290 PLTR

Palantir

-- 80.461 AAPL

Apple

-- 222.610 TEM

Tempus AI

-- 53.950 .......identifying overbought conditions in the semiconductor sector, specifically focusing on NVDA and the semiconductor ETF. I noticed that these stocks had been experiencing significant upward momentum, and I anticipated a pullback due to overvaluation and market sentiment. Read more>>

What you do with great profit? Sell and realise the gain? Or continue to hold?To me, it depends. Most of the stocks in my potfolio has been a long, some over 10 years, and many over 5 years. I hold becuase I still see significant growth in them, great competition edge over their competitors.Do I sell? Yes but those are different kind of stocks.

......previous ER climbed from 90 to 140 peak. around 125 to 130 back then, everyone think is kind of pricey already. and indeed 2nd peaked at 136 thus forming double top. (clearly shows market acceptance level was in this range of 130-140 deemed expensive) correction came because of semi cons overextension just this year.

now at current value now people are actually saying it's undervalue (factoring if the coming ER is a triple break..

102362254 : Investing in leveraged ETFs of high-liquidity stocks like Nvidia might seem tempting, but it's important to think about how much risk you can handle and how long you plan to invest. If you're a medium-level investor, be careful as these ETFs can swing a lot in value and you could lose a lot of money. They're better suited for experienced investors who are okay with taking bigger risks and keeping a close eye on their investments. Always think about the potential to earn more versus the chance of losing more before deciding to invest in leveraged ETFs

Southgate : Was hesitating after losing a sizeable chunk of my capital shorting it.

After reading this article, immediately deposit fresh fund to put up an order to fill this position

It’s quite obvious $NVIDIA (NVDA.US)$ is on an upward trajectory all the way to earnings on 28/8, very similar to price pattern of $Taiwan Semiconductor (TSM.US)$ .

Then just when my order is filled, prices start to fall sharply. Oh well.

ArcherZ : I have been investing in NVidia since 2020, buy on dip and hold. If anyone read the article about a week or so about Trump urging Democratic to embrace Bitcoins and cryptocurrency. He made a comment about enhancing the capacity to mine these coins. To do that, you need AI development, a fast processor, and a strong power grid. So, which company supplies over 60% of these processors for AI development? Even Elon Musk, a big advocate of Bitcoin and has his own AI development companies, purchases all of his stocks from NVidia. As a long-term investor, one needs to understand the importance of Maintenance Margin for times of market decline.

151307827 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

151307827 : Following

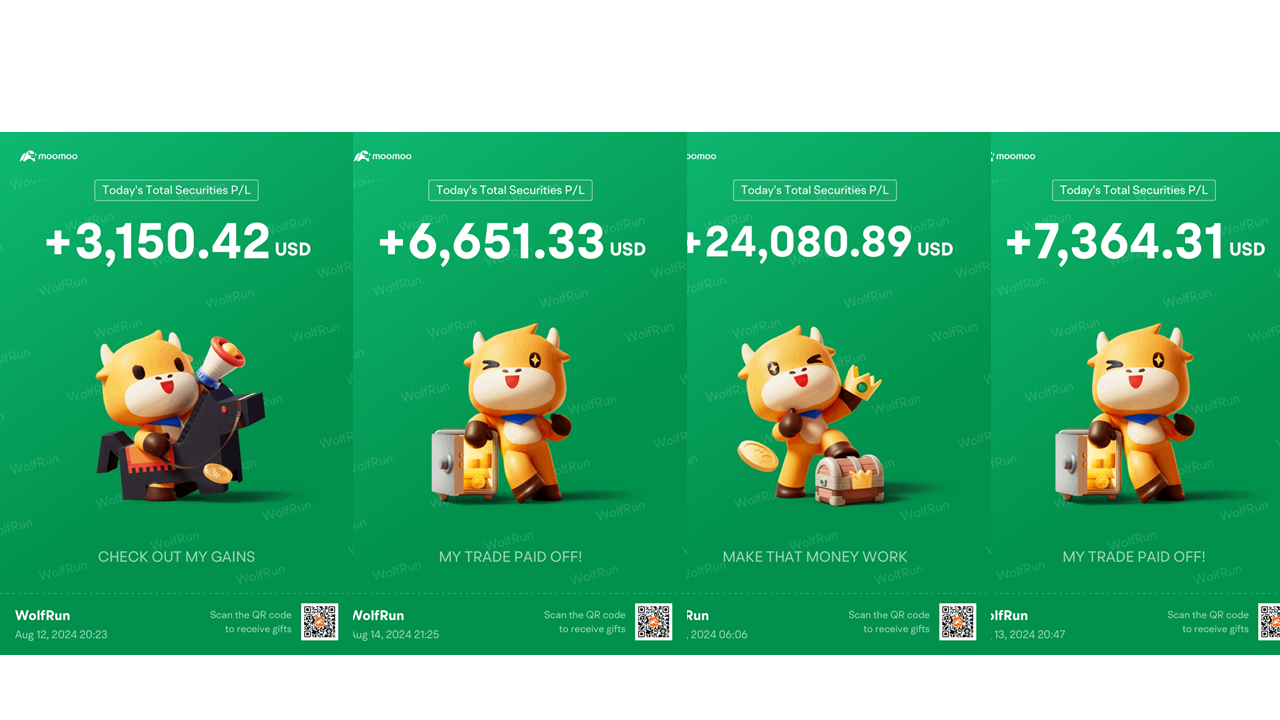

Andre110 : Love to see everybody eats

151307827 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

152268119(me) :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

151307827 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

kiteve1 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...