The same account will automatically sync to different terminals. That is to say, if you add indicators on the PC version and log in to the mobile version with the same account, you can see the newly added indicators and directly call them up.

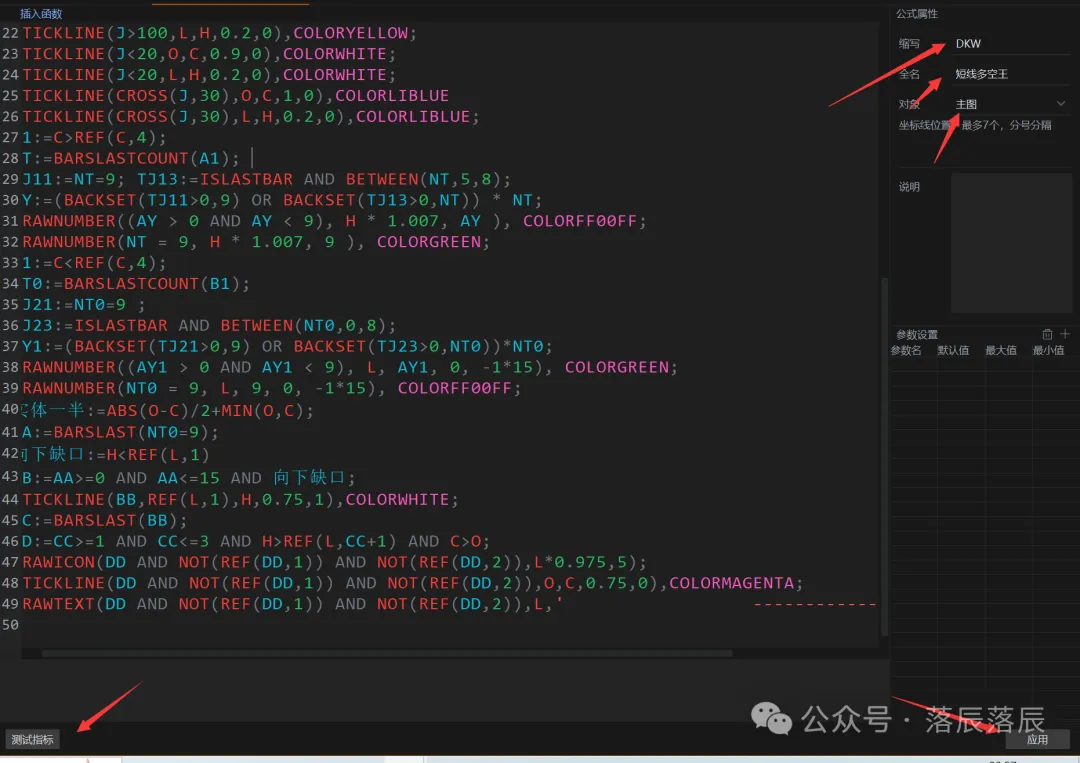

If there is an error, check if you have entered full-width punctuation marks and change all the code to English input methods and re-enter.

Next, I will explain the code principle to you.

This indicator consists of four parts:

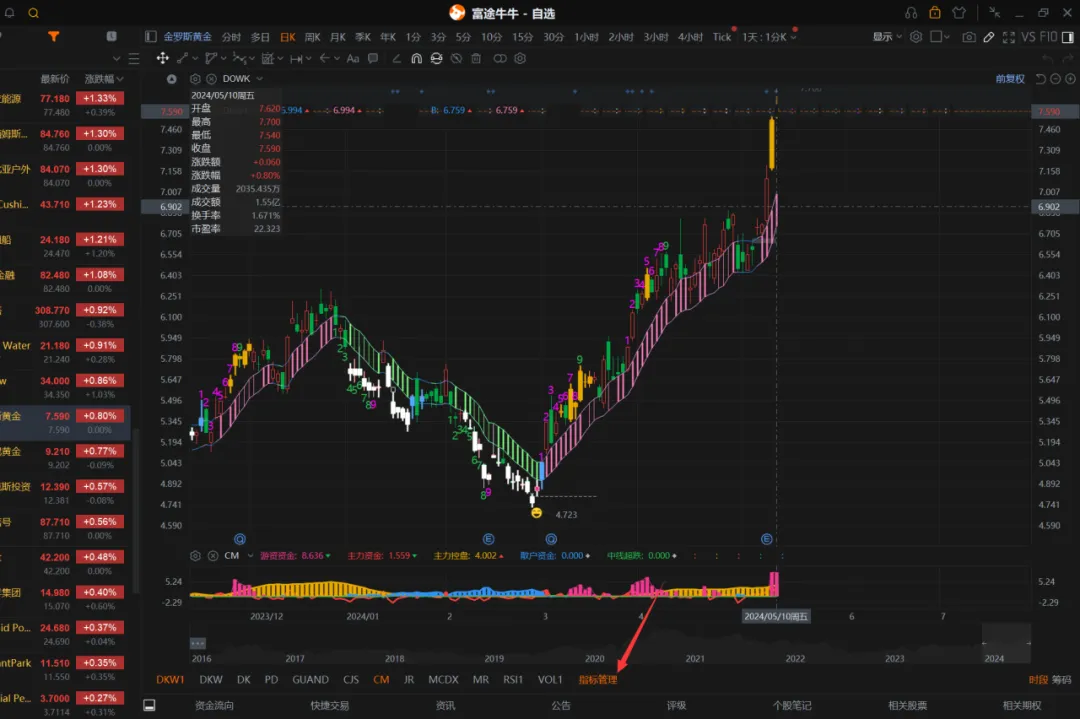

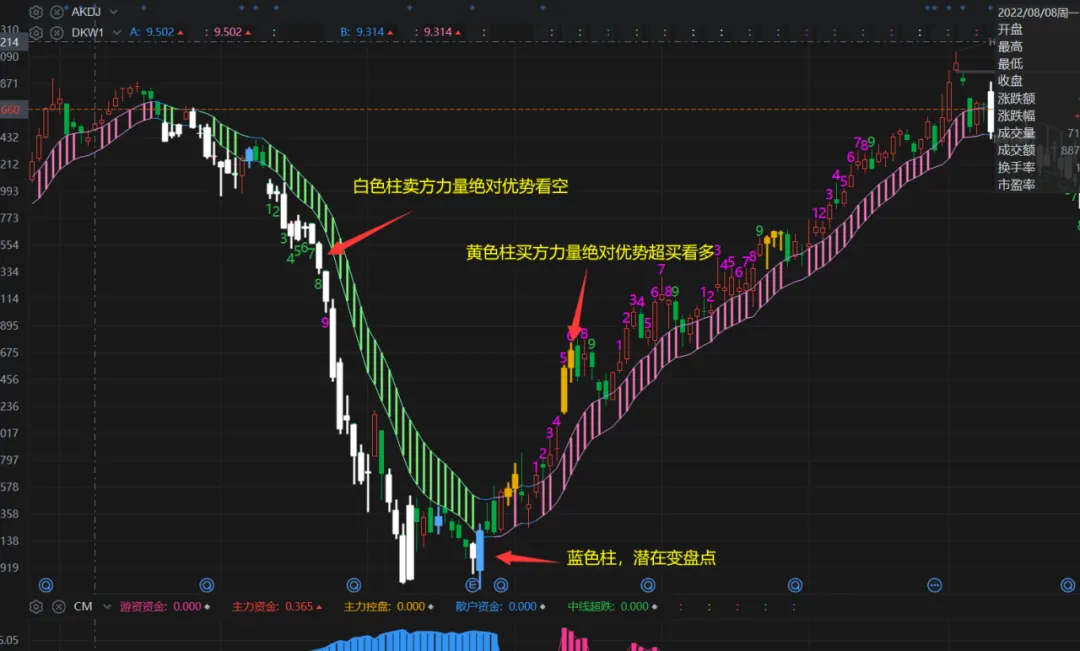

Part 1: Long and short trend lines

Define variable TF for the time period of the exponential moving average (EMA). (This indicator is a short-term indicator with a period of 13, users can adjust it according to their preferences).

Calculate the EMA of the highest and lowest prices of stocks, referred to as UP and DW, and calculate them according to the specified time period.

Define the conditions F1 and F2 to identify the candlestick pattern of call and put engulfing.

COND combines these conditions to identify potential reversals.

COND1 and COND2 check whether the EMA is rising/falling compared to the previous period.

COND3 is the inverse of COND1 or COND2, used to identify periods where the EMA is flat.

Then use these conditions to draw colored lines (A and B), representing potential support and resistance levels based on the trends and channels formed by EMA. Pink is for uptrends, and green is for downtrends.

斯似楼阑 OP : Everyone is welcome to pay attention, and everyone is welcome to work together to improve the indicators

一如既往跟你到月球 : Great, installed, thanks!

小baby : It seems like my code is working now.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) Grateful, seeking advice.

Grateful, seeking advice.