MORE PAIN AHEAD!

‘Right now, nothing is standing in the way of higher Treasury yields,’ says Schwab’s Kathy Jones

- 💼 Bank stocks facing yearly losses due to higher interest rates.

- 💰 Banking industry's reserves at a 30-year high.

- 📈 Bond yields surging to levels not seen since before the 2007-2008 financial crisis.

- 🏦 Banks holding exposure to commercial property loans, which could be problematic if rates stay high.

- 📉 S&P 500's financial sector down 5.5% for the year.

- 💳 Banking reserves at 225% of nonperforming loans, indicating preparation for credit deterioration.

- 📚 Banking reforms since the 2007-2008 crisis have positioned the industry to weather potential economic storms.

- 💵 Banks exposed to significant unrealized losses on underwater securities.

- 🏢 Regional banks experiencing a more acute selloff in stocks.

- 🌐 Concerns about higher rates and recession focus at the Federal Reserve and Treasury Department.

- 📊 March higher in longer-dated Treasury yields impacting bond-market returns.

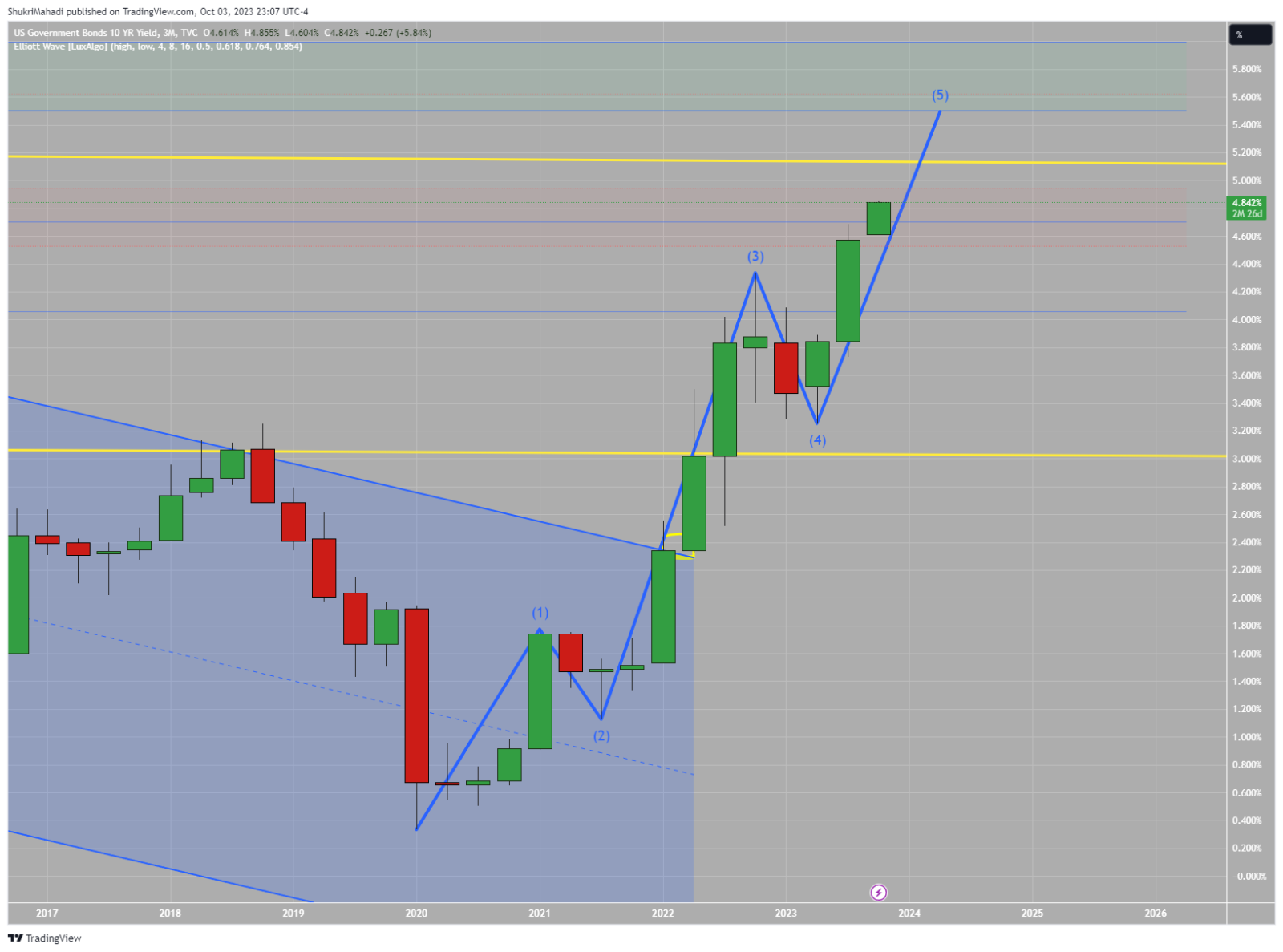

- 🔍 Potential for the 10-year Treasury yield to reach 5% or higher.

- 📉 Dow Jones Industrial Average and S&P 500 facing negative or reduced yearly gains.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

tun lwin : Thank you everyday Sir

tun lwin : 5 Win

tun lwin : Lucky number 5