Early morning report: U.S. iron & steel manufacturers request tariff increases, including Japan, to President Trump. Yen strengthened again due to speculation on U.S. rate cut in December, around 149 yen.

Moomoo users, good morning!![]() Here are the key points of the early morning report today.

Here are the key points of the early morning report today.

●【Tokyo Stock Market Forecast Range】845,000-875,000 yen (closing price on the 2nd 851,302 yen)

●US Iron & Steel Manufacturers Request Trump to Strengthen Tariffs

●Federal Reserve Board Governor Waller leans towards rate cut for December FOMC = NY Exchange

●Court Again Rules Against Musk's Tesla Huge Remuneration Plan

●Intel CEO Gelsinger Resigns

●Volkswagen Faces Intensifying Labor-Management Conflict with Strike at German Plant

●Today's stock price material - Resona Holdings aims to increase fee income by introducing AI business support to regional banks

- Moomoo News Mark

●【Tokyo Stock Market Forecast Range】845,000-875,000 yen (closing price on the 2nd 851,302 yen)

●US Iron & Steel Manufacturers Request Trump to Strengthen Tariffs

●Federal Reserve Board Governor Waller leans towards rate cut for December FOMC = NY Exchange

●Court Again Rules Against Musk's Tesla Huge Remuneration Plan

●Intel CEO Gelsinger Resigns

●Volkswagen Faces Intensifying Labor-Management Conflict with Strike at German Plant

●Today's stock price material - Resona Holdings aims to increase fee income by introducing AI business support to regional banks

- Moomoo News Mark

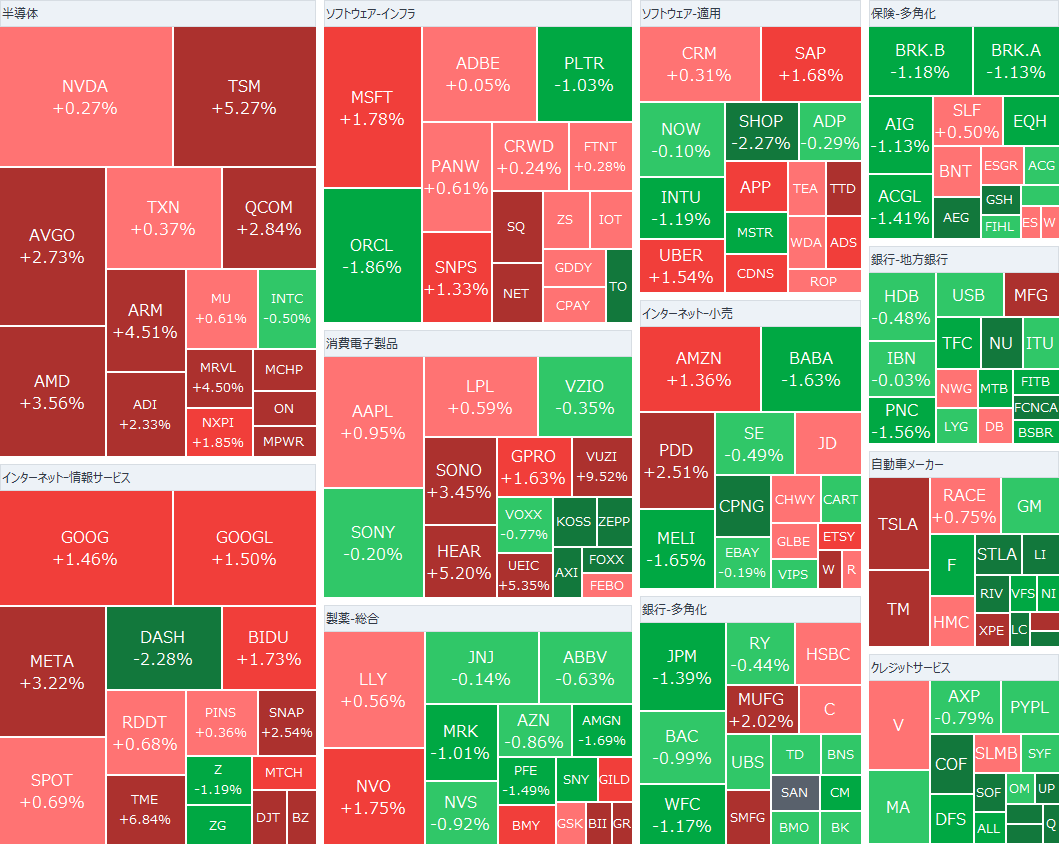

Market Overview

◇On the 2nd, the US stock market was mixed. The 'Magnificent Seven (7 major high-tech companies)' stocks all rose, pushing both the S&P 500 and Nasdaq to record highs at the closing. This week, adjustments intensified as important economic indicators such as employment statistics were scheduled for release, resulting in a mixed performance after the opening. The Dow was cautious throughout the day due to concerns about rising long-term interest rates, geopolitical risks in the Middle East, and the possibility of the collapse of the cabinet in France facing a vote of no confidence. In terms of sectors, automobile & auto parts as well as media & entertainment rose, while utilities industry declined.

◇On the 3rd, buying continued for a wide range of stocks in the Tokyo stock market, and the Nikkei Stock Average is expected to show resilient movements in the mid-28000 yen range.

◇On the 3rd, buying continued for a wide range of stocks in the Tokyo stock market, and the Nikkei Stock Average is expected to show resilient movements in the mid-28000 yen range.

Top News

US iron & steel manufacturers request tariff increase to President Trump

Some US iron & steel manufacturers are supporting President Donald Trump's announced plans to impose tariffs on Mexican and Chinese products, while also calling for further measures. The Steel Manufacturers Association (SMA) is urging the reintroduction of additional tariffs on steel imported from the UK, the European Union (EU), and Japan.

US iron & steel manufacturers request tariff increase to President Trump

Some US iron & steel manufacturers are supporting President Donald Trump's announced plans to impose tariffs on Mexican and Chinese products, while also calling for further measures. The Steel Manufacturers Association (SMA) is urging the reintroduction of additional tariffs on steel imported from the UK, the European Union (EU), and Japan.

Federal Reserve Board Governor Waller leans towards a rate cut for the December FOMC = NY foreign exchange

As the trading day in New York comes to a close, there is selling pressure on the dollar. The dollar-yen pair is dropping back to the 149 yen level, while the euro-dollar pair is moving back towards the 1.05 dollar level. It seems to be in response to comments from Federal Reserve Board Governor Waller, who stated that the December FOMC is leaning towards a rate cut.

Related Articles

New York Fed President: Further rate cuts may be necessary over time, timing depends on data.

New York Fed President Williams did not discuss whether he supports a rate cut at this month's meeting, stating that decisions are made meeting by meeting. However, he emphasized the need for further interest rate cuts. It is appropriate to transition to a more neutral policy setting over time. Timing depends on data, and the outlook remains uncertain.

As the trading day in New York comes to a close, there is selling pressure on the dollar. The dollar-yen pair is dropping back to the 149 yen level, while the euro-dollar pair is moving back towards the 1.05 dollar level. It seems to be in response to comments from Federal Reserve Board Governor Waller, who stated that the December FOMC is leaning towards a rate cut.

Related Articles

New York Fed President: Further rate cuts may be necessary over time, timing depends on data.

New York Fed President Williams did not discuss whether he supports a rate cut at this month's meeting, stating that decisions are made meeting by meeting. However, he emphasized the need for further interest rate cuts. It is appropriate to transition to a more neutral policy setting over time. Timing depends on data, and the outlook remains uncertain.

U.S. November ISM Manufacturing Purchasing Managers' Index (PMI) is positive, prices are decreasing, will the Federal Reserve (FRB) maintain the rate cut trajectory for December?

The Institute for Supply Management (ISM) released the Manufacturing Purchasing Managers' Index (PMI) for November at 48.4. It rose more than expected from 46.5 in September to reach the highest level since June. The results did not significantly impact the probability of a rate cut at the December Federal Open Market Committee (FOMC) meeting.

The Institute for Supply Management (ISM) released the Manufacturing Purchasing Managers' Index (PMI) for November at 48.4. It rose more than expected from 46.5 in September to reach the highest level since June. The results did not significantly impact the probability of a rate cut at the December Federal Open Market Committee (FOMC) meeting.

米デラウェア州の判事は、電気自動車(EV)大手 $Tesla (TSLA.US)$のイーロン・マスク最高経営責任者(CEO)に対する巨額報酬案について、無効とした前回の判決を支持した。これを受け、テスラ取締役会は、マスク氏の10年間の職務に対する報酬の決定方法を巡り、さらなる不透明感に直面している。

米インテル、ゲルシンガーCEOが退任

Top U.S. semiconductor company. $Intel (INTC.US)$は2日、パット・ゲルシンガー氏が12月1日付で最高経営責任者(CEO)と取締役を退任したと発表した。約4年にわたるゲルシンガー氏の指揮下で、インテルの株価は60%近く下落した。暫定共同CEOにデビッド・ジンスナー最高財務責任者(CFO)と、「クライアント・コンピューティング・グループ(CCG)」のゼネラルマネジャー、ミシェル・ジョンストン・ホルトハウス氏を充てた。

Top U.S. semiconductor company. $Intel (INTC.US)$は2日、パット・ゲルシンガー氏が12月1日付で最高経営責任者(CEO)と取締役を退任したと発表した。約4年にわたるゲルシンガー氏の指揮下で、インテルの株価は60%近く下落した。暫定共同CEOにデビッド・ジンスナー最高財務責任者(CFO)と、「クライアント・コンピューティング・グループ(CCG)」のゼネラルマネジャー、ミシェル・ジョンストン・ホルトハウス氏を充てた。

マーベル・テクノロジーが上昇 AWSとの戦略的提携を拡大

半導体の $Marvell Technology (MRVL.US)$が上昇。一時97.63ドルまで上昇し、過去最高値を更新した。アマゾン・ウェブ・サービシズ(AWS)との戦略的提携を5年契約で拡大すると発表したことが材料視されている。AWSはAIおよびデータセンター接続製品に関して、同社とのサプライヤー関係を拡大すると声明で発表した。

半導体の $Marvell Technology (MRVL.US)$が上昇。一時97.63ドルまで上昇し、過去最高値を更新した。アマゾン・ウェブ・サービシズ(AWS)との戦略的提携を5年契約で拡大すると発表したことが材料視されている。AWSはAIおよびデータセンター接続製品に関して、同社とのサプライヤー関係を拡大すると声明で発表した。

VW, strikes begin at German factories, labor-management confrontation intensifies.

At Volkswagen's (VW), a major German automaker's domestic factory, employees have started a strike on the 2nd. The confrontation between labor and management has escalated over personnel reduction, wage cuts, and factory closure plans. Warning strikes have started in 9 locations since the morning of the 2nd. Normally, a warning strike is a short-term work stoppage of a few hours a day, temporarily suspending production as part of labor disputes.

Related Articles

GM plans to sell its stake in the EV battery plant in Michigan to a joint venture partner.

At Volkswagen's (VW), a major German automaker's domestic factory, employees have started a strike on the 2nd. The confrontation between labor and management has escalated over personnel reduction, wage cuts, and factory closure plans. Warning strikes have started in 9 locations since the morning of the 2nd. Normally, a warning strike is a short-term work stoppage of a few hours a day, temporarily suspending production as part of labor disputes.

Related Articles

GM plans to sell its stake in the EV battery plant in Michigan to a joint venture partner.

Foreign exchange

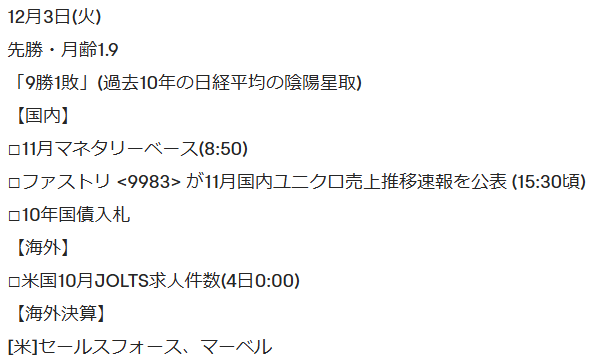

Key Market Events

Source: Dow Jones, MINKABU, Trader's Web, Fisco

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment