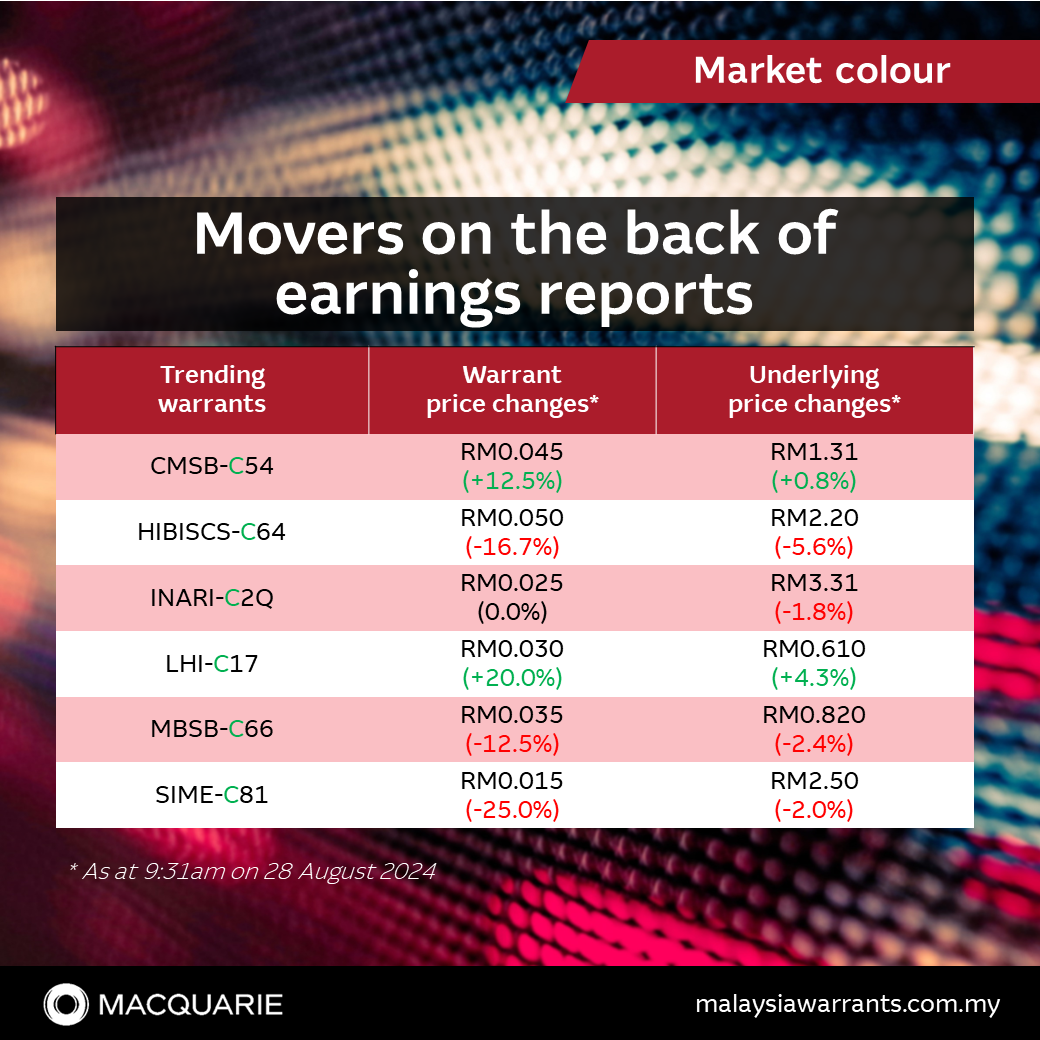

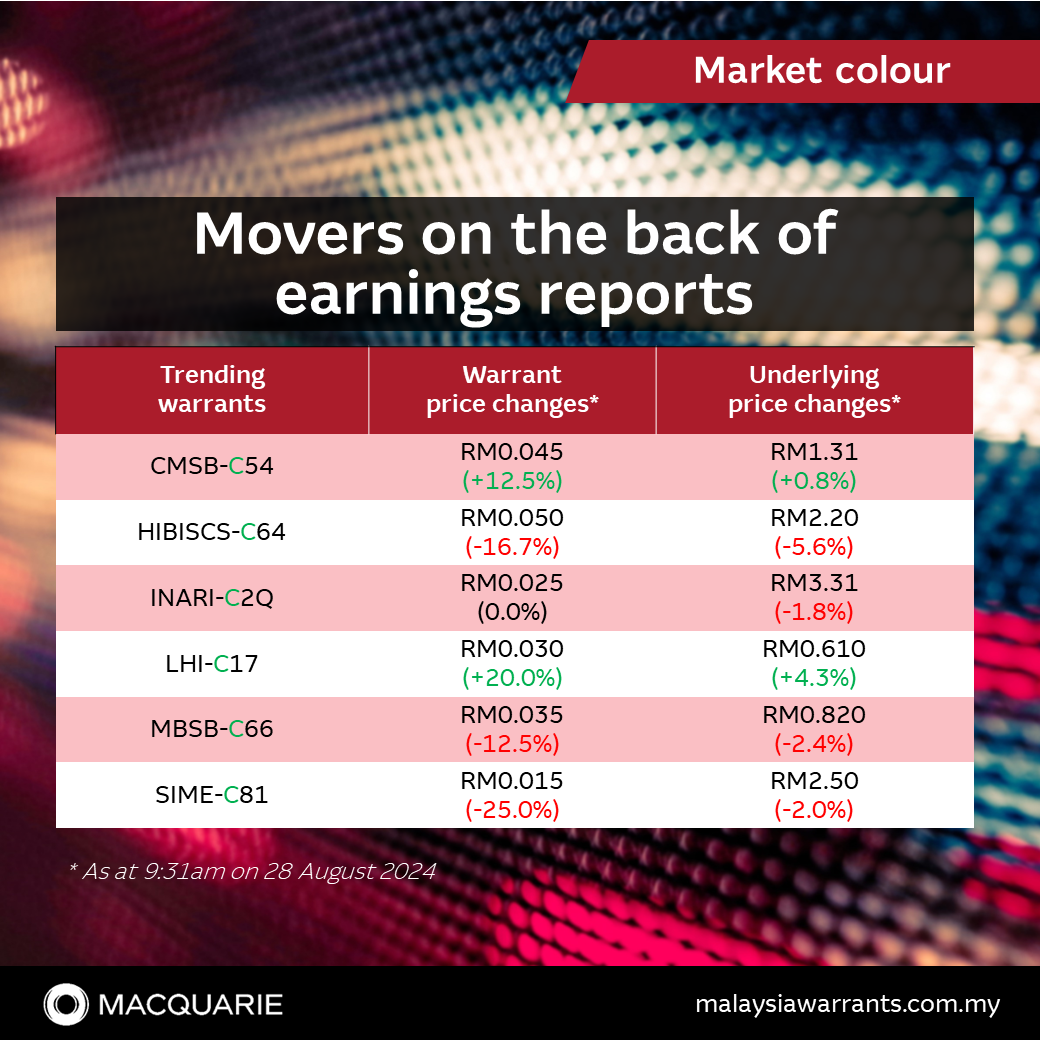

📈Movers on the back of earnings reports

•MBSB reported a 34.5% decline in net profit for 2Q 2024, falling to RM54.83m RM83.7m in the same period last year due to increased operating expense and higher impairment allowances.

•Cahya Mata Sarawak (CMSB) announced on Tuesday that its net profit for 2Q 2024 surged by 26.6% year-on-year (y-o-y), boosted by improved gross profit margin in its cement and oiltools divisions, attributed to reduced clinker costs and the sale of higher-margin products.

•Leong Hup International (LHIB) reported a 48.4% increase in net profit for 2Q 2024, reaching RM96.5m, up from RM65.03m in the same period last year. This growth was driven by higher prices and increased sales volume of day-old chicks and broiler chickens in Indonesia and the Philippines, along with improved feedmill margins.

•Inari Amertron’s (INARI) net profit for 4Q 2024 declined by 17.54% to RM54.68m, down from RM66.31m in the same quarter last year due to unfavourable forex movements, increased operating costs and the early staging of new products.

•Hibiscus Petroleum’s (HIBISCS) net profit for 4Q 2024 decreased by 11.84% y-o-y as equipment impairment and increased expenses outweighed the higher revenue generated by the oil and gas production company.

•Sime Darby’s (SIME) net profit surged to RM3.31b in FY2024, more than doubling from RM1.46b the previous year, primarily driven by the RM2b gain from the sale of Ramsay Sime Darby Health Care.

📌Check out the recent price changes in the image and the live matrix for the respective warrants here.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment