Nasdaq's Historic Rally: Pullback on the Horizon?

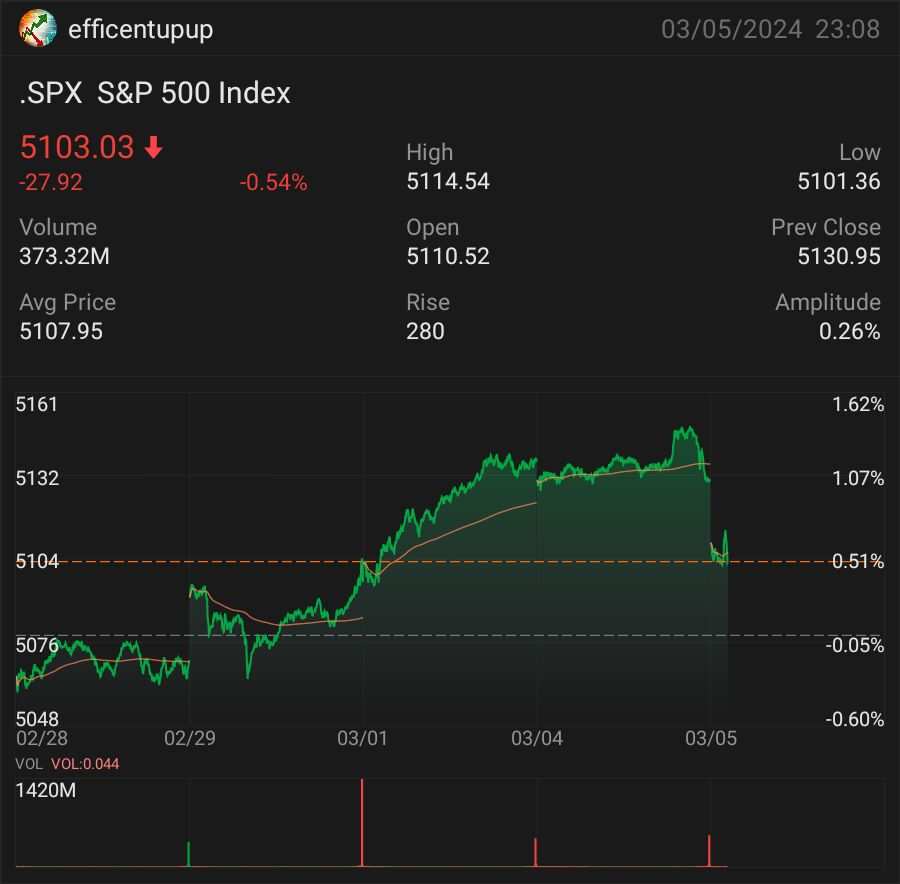

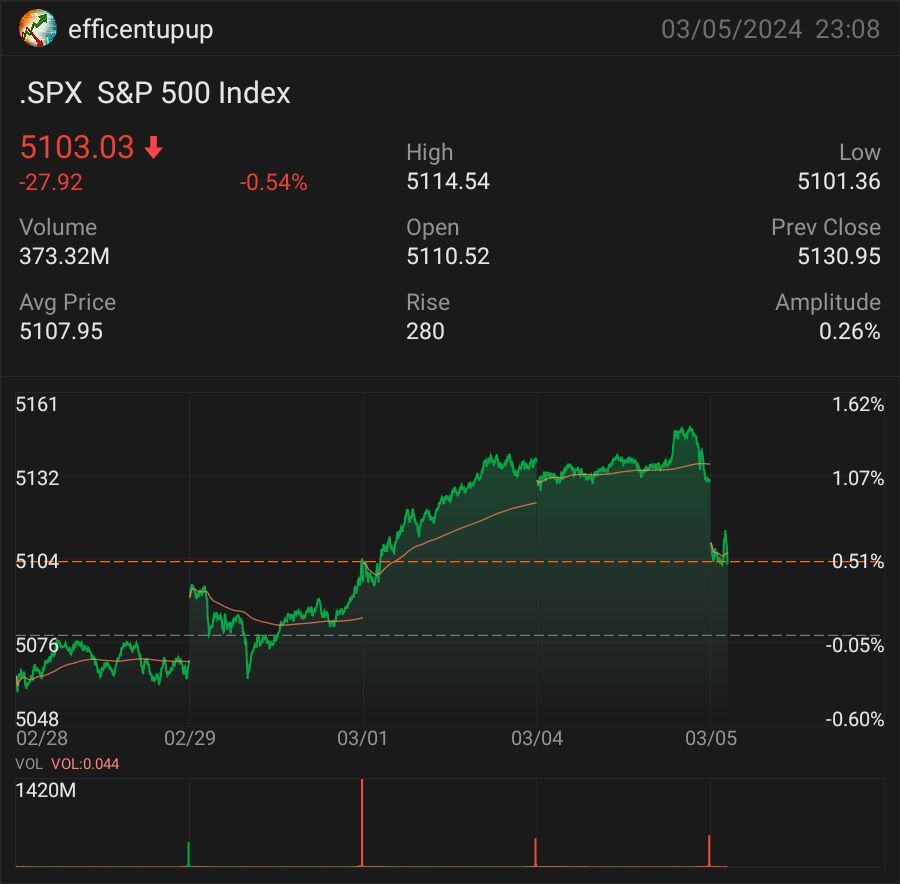

S&P 500 surpasses 5,100 amid AI optimism and rate cut hopes, despite warnings of potential overextension and market correction. $S&P 500 Index (.SPX.US)$

Navigating the Heights: A Closer Look at the US Equities Surge

In recent weeks, the US stock market has been on an impressive ascent, with the S&P 500 breaking past the 5,100 threshold for the first time and the Nasdaq Composite boasting a nearly 39% increase over the past 12 months. This remarkable rally, fueled by the burgeoning optimism around artificial intelligence and the anticipation of rate cuts by the Federal Reserve, has not only captured the attention of investors but also sparked a debate on the sustainability of these record highs.

A Rally Built on AI and Rate Cut Hopes

The driving forces behind this surge are multifaceted. The excitement surrounding artificial intelligence has injected a new vigor into the tech sector, propelling stocks to new heights. Coupled with this is the widespread expectation that the Federal Reserve might ease up on interest rates, further buoying investor sentiment. This combination of technological promise and favorable monetary policy has set the stage for the market's recent achievements.

Wall Street Whispers: The Fear of Overextension

Despite the bullish momentum, some Wall Street analysts are sounding the alarm on potential overextension. Chris Montagu of Citi and Jonathan Krinsky of BTIG have pointed out several unusual market conditions that warrant caution. Notably, long Nasdaq positions have reached their highest level in three years, and there's a striking divergence in performance metrics within Big Tech. For instance, Apple's 14-day relative strength index (RSI) has dipped to 27, contrasting sharply with the Nasdaq 100-tied Invesco QQQ Trust's RSI at 66. This discrepancy signals a potential imbalance, suggesting that parts of the market may be stretching too thin.

Echoes of the Past: Lessons from Historical Volatility

The market's current state bears resemblance to previous periods that preceded significant volatility. Krinsky highlights a particularly rare occurrence: the last time Apple's RSI was below 30 while QQQ's RSI exceeded 65 was just before the "volmageddon" in early 2018. That period was marked by a dramatic spike in the Cboe Volatility Index (VIX), more than doubling its value. While a repeat of such extreme volatility is considered unlikely, the Nasdaq-100's record of 302 trading days without a 2.5% decline—the longest streak since 1990—suggests that a market correction could be on the horizon.

Navigating the Market's Next Moves

As the market navigates through these record highs, the contrasting signals of robust gains and potential overextension present a complex landscape for investors. The excitement around technological advancements and favorable economic policies has undoubtedly played a crucial role in the current rally. However, the warnings from seasoned analysts remind us of the importance of vigilance and the historical precedents that caution against complacency.

In this environment, investors are advised to keep a close eye on market indicators and divergences within sectors, especially in technology, where the rally has been most pronounced. While the potential for continued growth remains, the lessons from past volatility underscore the need for a balanced approach, blending optimism with a healthy dose of caution. As we move forward, the market's ability to sustain its momentum amidst these warning signs will be a critical test of its resilience and the underlying strength of the current economic and technological trends. $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

In recent weeks, the US stock market has been on an impressive ascent, with the S&P 500 breaking past the 5,100 threshold for the first time and the Nasdaq Composite boasting a nearly 39% increase over the past 12 months. This remarkable rally, fueled by the burgeoning optimism around artificial intelligence and the anticipation of rate cuts by the Federal Reserve, has not only captured the attention of investors but also sparked a debate on the sustainability of these record highs.

A Rally Built on AI and Rate Cut Hopes

The driving forces behind this surge are multifaceted. The excitement surrounding artificial intelligence has injected a new vigor into the tech sector, propelling stocks to new heights. Coupled with this is the widespread expectation that the Federal Reserve might ease up on interest rates, further buoying investor sentiment. This combination of technological promise and favorable monetary policy has set the stage for the market's recent achievements.

Wall Street Whispers: The Fear of Overextension

Despite the bullish momentum, some Wall Street analysts are sounding the alarm on potential overextension. Chris Montagu of Citi and Jonathan Krinsky of BTIG have pointed out several unusual market conditions that warrant caution. Notably, long Nasdaq positions have reached their highest level in three years, and there's a striking divergence in performance metrics within Big Tech. For instance, Apple's 14-day relative strength index (RSI) has dipped to 27, contrasting sharply with the Nasdaq 100-tied Invesco QQQ Trust's RSI at 66. This discrepancy signals a potential imbalance, suggesting that parts of the market may be stretching too thin.

Echoes of the Past: Lessons from Historical Volatility

The market's current state bears resemblance to previous periods that preceded significant volatility. Krinsky highlights a particularly rare occurrence: the last time Apple's RSI was below 30 while QQQ's RSI exceeded 65 was just before the "volmageddon" in early 2018. That period was marked by a dramatic spike in the Cboe Volatility Index (VIX), more than doubling its value. While a repeat of such extreme volatility is considered unlikely, the Nasdaq-100's record of 302 trading days without a 2.5% decline—the longest streak since 1990—suggests that a market correction could be on the horizon.

Navigating the Market's Next Moves

As the market navigates through these record highs, the contrasting signals of robust gains and potential overextension present a complex landscape for investors. The excitement around technological advancements and favorable economic policies has undoubtedly played a crucial role in the current rally. However, the warnings from seasoned analysts remind us of the importance of vigilance and the historical precedents that caution against complacency.

In this environment, investors are advised to keep a close eye on market indicators and divergences within sectors, especially in technology, where the rally has been most pronounced. While the potential for continued growth remains, the lessons from past volatility underscore the need for a balanced approach, blending optimism with a healthy dose of caution. As we move forward, the market's ability to sustain its momentum amidst these warning signs will be a critical test of its resilience and the underlying strength of the current economic and technological trends. $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment