TSLA

Tesla

-- 421.060 NVDA

NVIDIA

-- 134.700 PLTR

Palantir

-- 80.550 RGTI

Rigetti Computing

-- 9.3700 AMD

Advanced Micro Devices

-- 119.210

Does this fund focus on ESG?

What’s the breakdown of geographical focus?

Do we look in terms of global or some particular area or countries?

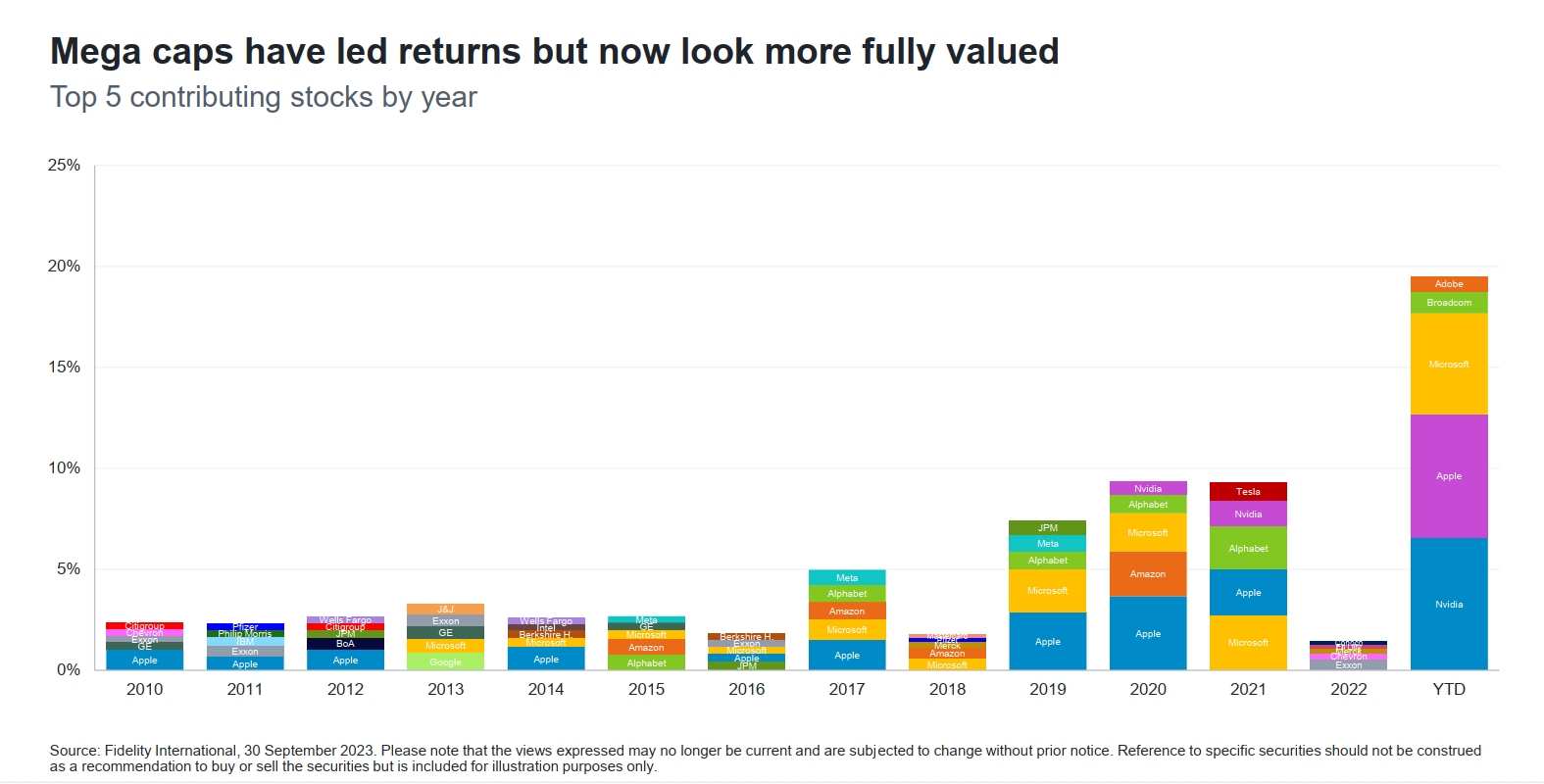

We have witnessed significant outperformance from a select group of large-cap technology stocks, such as Apple and Nvidia, influencing the equity returns in the US markets. With speculation surrounding a potential recession in 2024, do you believe these mega-cap tech stocks serve as a reliable hedge against a potential recession risk next year?

Given the fund focuses on technology. What recent technological advancements or industry trends do you believe will have a significant impact on the performance of technology stock in the near future. and how might investors strategically position themselves to capitalize on these trends

Anything we should specifically look out for when investing in technology-related companies?

mr_cashcow : My key takeaway from the moomoo technology investing live webinar is to also keep an open eye out for other lesser know but emerging tech sectors and not just sololy focusing on the popular ones![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Jaspher : yes... learning and trying to understand the fundamentals

Thy GoD : Main takeaways would be to monitor the evolving landscape of technology and constantly adapt how we perceive it's growth and potential as new technology gets introduced and we find opportunities in such new technologies. (block chain tech and ai tech would've made us alot if we invested in it's early stages.)

Regarding fidelity's tech funds, from my personal fund analysis, while $Fidelity Funds-Global Technology Fund (LU1823568750.MF)$ has a lower expected return than the $Invesco QQQ Trust (QQQ.US)$ etf, its risk/variance is lower, so I chose it over QQQ due to higher risk adjusted returns and I wouldn't need to bother w currency conversion or dividends.

Currently it's up arnd 12% which is damn good already.

I also love Fidelity's managed portfolios that moomoo offers, I don't know how to place it's ticker here but I've calculated it's returns to be on-par with syfe, with an added bonus of no portfolio management fees.

小trader : The Fidelity webinar highlighted the dominance of a few tech stocks in the S&P 500, leading to valuation anomalies. While optimistic about tech fundamentals, potential headwinds from an uncertain macro backdrop were acknowledged. The emphasis on underappreciated sectors, like data management and customer service companies, and opportunities in European software companies resonated. The nuanced approach to risks, particularly in monetizing AI, added depth. The exploration of themes such as pricing power, M&A prospects, and the resilience of video gaming companies provided actionable insights. Looking ahead, the discussion prompts reflection on the evolving tech landscape, with consideration for technology-related funds for a well-rounded investment strategy.

102362254 : I will consider investing in technology-related funds to improve my investment portfolio. Technology is one of the most dynamic and innovative sectors in the global economy, and it offers many opportunities for growth and diversification.

10161187 : From the webinar, I learned about the intricate dynamics impacting tech stocks' valuations, the importance of underappreciated sectors, and the potential hurdles in monetizing AI. Considering the evolving tech landscape and diverse opportunities discussed, I foresee continued growth in the technology sector, albeit with challenges. The potential in emerging tech segments, such as digitization in manufacturing and underpenetrated software areas, presents a promising outlook. Personally, I find the depth and variety in tech-related investment avenues appealing. Considering the sector's innovation and adaptability, investing in technology-related funds could be a strategic move to augment and diversify my investment portfolio for the future.

ZnWC : I'm looking for funds investment with artificial intelligence and gaming themes. Fidelity seems to fit the criteria. My next question is the return and how long do I need to hold the funds in order to get the return.

My concern is volatility risk. Hence I will need to analyse the opportunity cost against stocks and ETFs. I also wonder how Fed rate pivoting will impact funds which may happen in Q2.