Navigating the Triple Witching Curse: Options Trading Strategies in a Post-Rate Cut Market

This Friday marks a major event, the year's third Triple Witching Day in the US stock market![]() .

.

Recently, a lot has been happening. Just a couple of days ago, the Federal Reserve announced a 50 basis point rate cut, the first in over four years. Meanwhile, the $S&P 500 Index (.SPX.US)$ is nearing its all-time high.

There's a myth surrounding Triple Witching Days—that they bring a 'curse' of plunging stock prices, especially in September![]() .

.

According to Bloomberg data, since 1990, the S&P 500 has on average dropped 1.1% in the week following the September Triple Witching Day. There were only four exceptions: in 1998, 2001, 2010, and 2016, when the index actually rose.

Today, let's discuss whether this myth is true. Will the September Triple Witching Day lead to another market drop? And what impact will it have on options trading?

Note: The term 'Triple Witching Day' has replaced 'Quadruple Witching Day' after the cessation of single stock futures trading in the US in 2020.

Ⅰ. What is Triple Witching Day

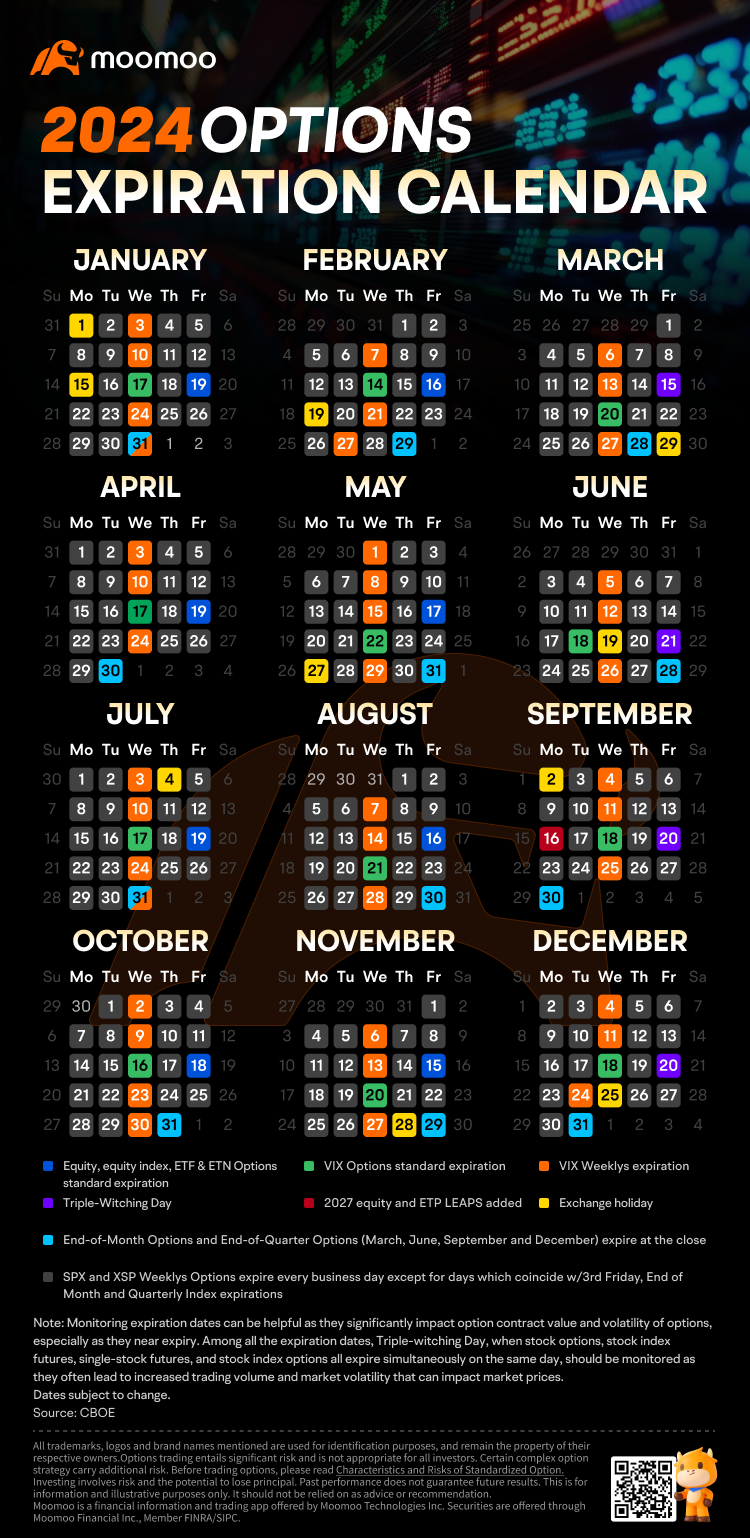

Triple witching occurs quarterly—on the third Friday of March, June, September, and December.

On this day, three types of financial market contracts expire simultaneously:

This day is crucial for the market because futures and options trading is a zero-sum game, meaning there are always winners and losers in the market.

On this day, whether individual traders, large institutions, or market makers, everyone has their calculations, aiming to move prices in a direction that profits them.

As the expiration of their derivative contracts approaches, some hurry to square off their positions, some choose to roll over, and others try every means to hedge risks, not to let their investments be in vain.

Thus, the market becomes lively, especially in the last trading hour when price volatility can be extreme.

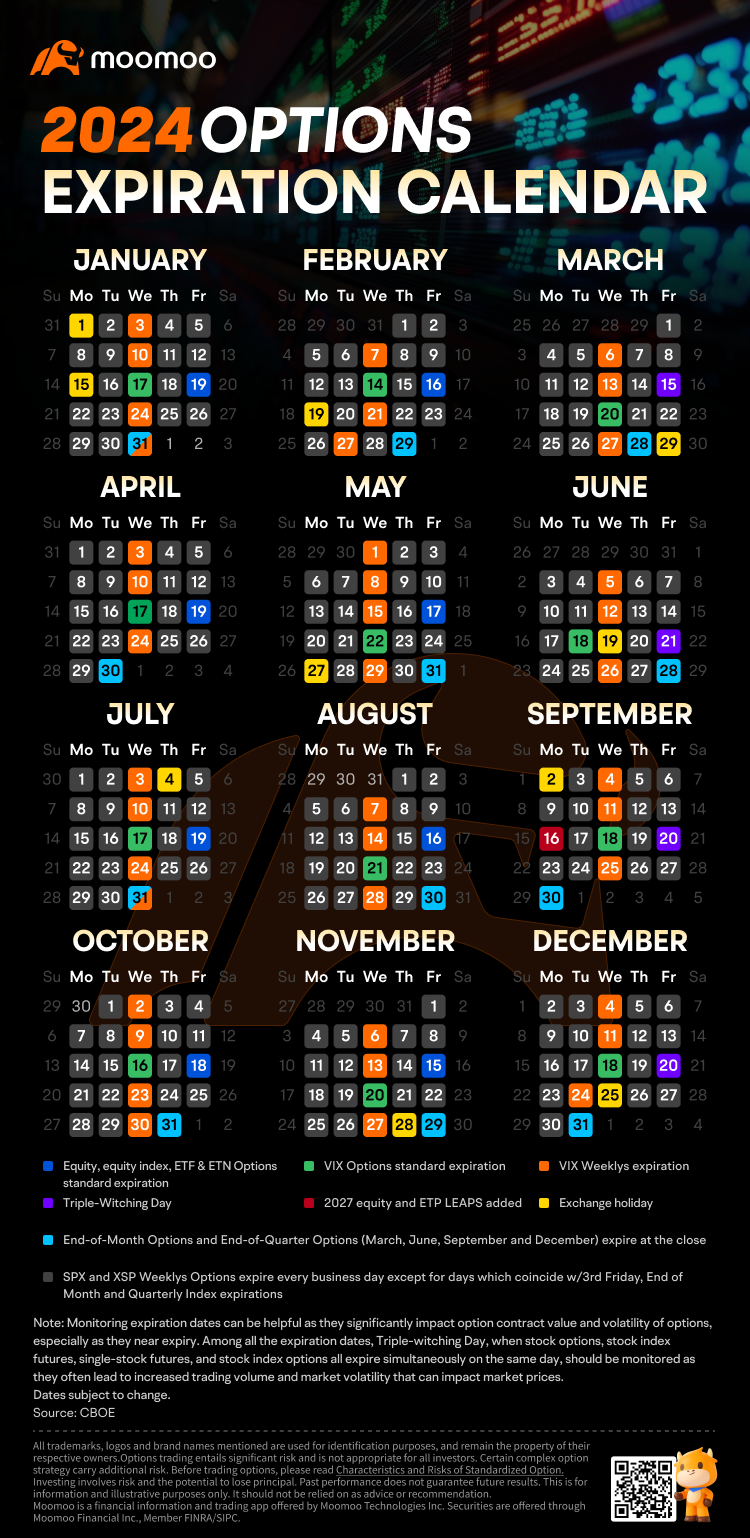

Below is the 2024 options expiration calendar 2024 provided by moomoo:

Ⅱ. Key Considerations for Triple Witching Day

Is the Triple Witching Day 'curse' – that stock prices always fall – something to be wary of?

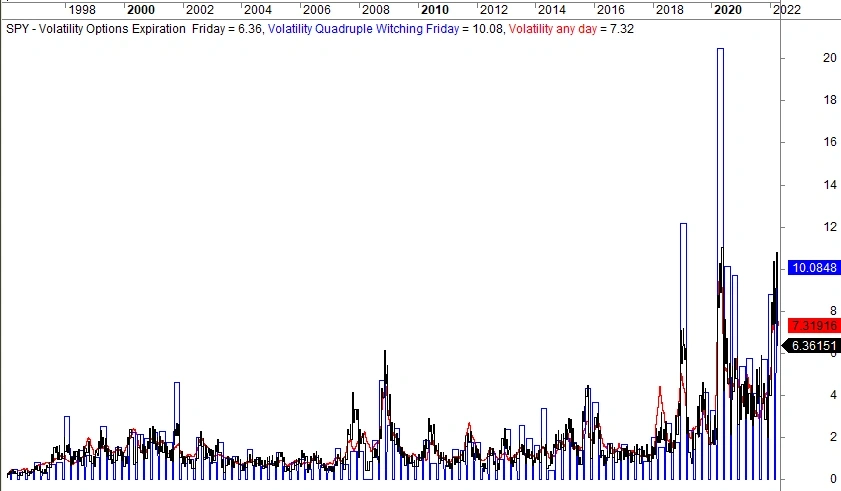

The chart below is the average of the high minus the low of the last 50 observations of options expiration day (black line), quadruple witching (blue line – the flat “top” is the observation), and any trading day (red line).

It should be noted that Triple Witching Day is perhaps somewhat more volatile than both options expiration day and a random day.

Based on the backtest by Quantified Strategies of 117 trades, the average loss per trade is 0.1% and the win rate is 51%.

For comparison, the average overnight gain on any random day is about 0.05%. Therefore, the Triple Witching Day is generally bearish.

More specifically, Bloomberg's 1994-2023 statistics on the historical returns of Triple Witching Days in the U.S. market show that the performance varies across different months.

Notably, Triple Witching Days in March and December seem more inclined to yield positive returns, while those in June and September might face some challenges.

When Triple Witching Day rolls around, there's no need to get anxious or worry about some kind of 'curse'.

The best mindset is to keep calm and make rational decisions based on your usual strategies.

Here are some considerations when it comes to Triple Witching Day:

a. Focus on Index Options and Index ETF Options

On Triple Witching Day, it's worth paying special attention to the performance of index options; you might spot some good arbitrage or trading opportunities.

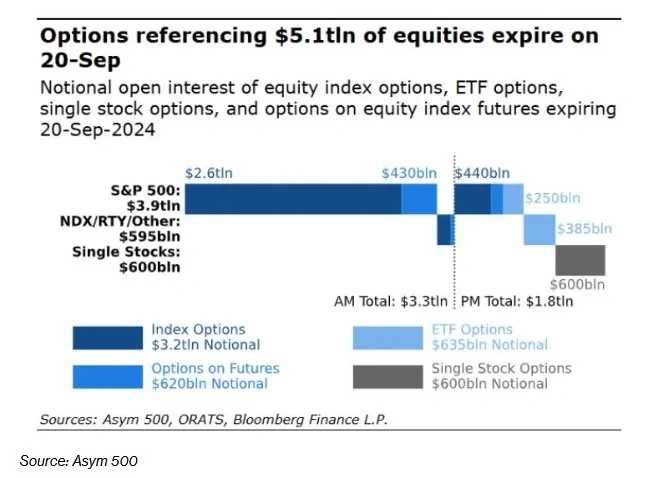

According to derivative analytics firm Asym 500, around $5.1 trillion worth of index, stock, and ETF options will expire on Friday.

As shown in the chart below, most of this activity is concentrated in index options and index ETF options.

In the current options market, many options are tied to indices, and moomoo supports both index options and index ETF options.

Unlike stock options, index and index ETF options cover more companies, offering high trading volumes and liquidity, and providing investors with diverse trading choices.

Index options with large trading volumes include $S&P 500 Index (.SPX.US)$ and $CBOE Volatility S&P 500 Index (.VIX.US)$. Index ETF options with large trading volumes include $SPDR S&P 500 ETF (SPY.US)$ and $Invesco QQQ Trust (QQQ.US)$.

b. Focus on 0DTE Options

Zero-day to-expiration options, also known as 0DTE options, are options that are nearing their expiration date.

The appeal of these options is in their capacity for potentially substantial short-term profits.

Presenting an opportunity to earn significant returns from a comparatively modest investment — the quintessential 'high risk, high reward' scenario.

Under the stimulation of triple witching days, the value of options at expiration can sometimes achieve growth of dozens or even hundreds of times, allowing us to wait and see what the market will bring this Friday.

However, during witching days, the value of options expiring on these days can be highly unstable and risky, so it is important for options trading novices to be aware of the risks.

Ⅲ. Triple Witching Day Strategies

Much like any other trading day, triple witching offers the opportunity to make profits on a variety of different strategies. Some of the most common strategies utilized on triple witching are highlighted below.

a. Option Volatility Strategies

During the final stages of a triple witching day, especially within the last hour before closing, price volatility often intensifies. Such abnormal fluctuations sometimes create opportunities for options arbitrage.

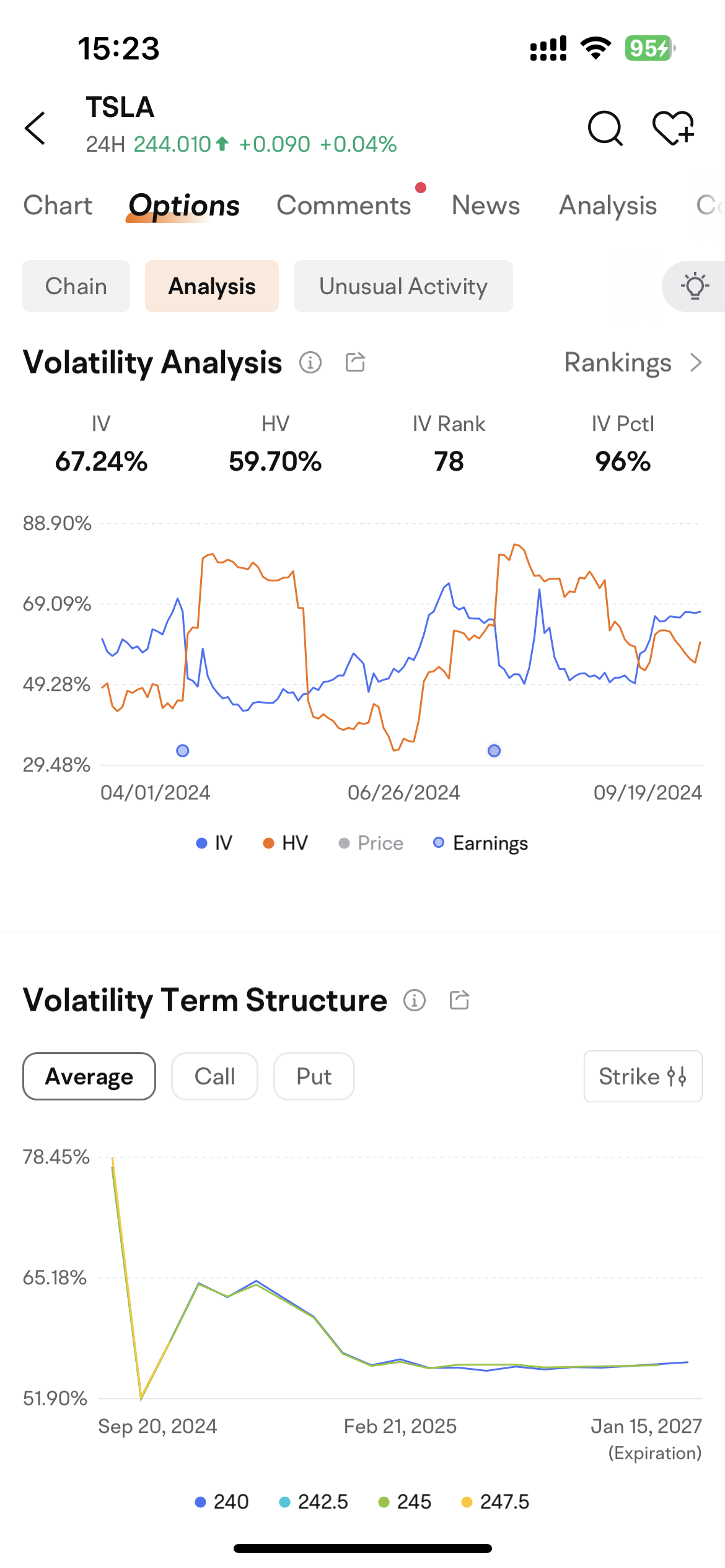

Firstly, we can look for arbitrage opportunities by analyzing volatility across the entire options chain, making judgments on the direction of options trades by observing comprehensive indicators such as IV (Implied Volatility), HV (Historical Volatility), IV Rank, and IV Percentile.

For instance, if both IV Rank and IV Percentile are high, it may indicate that the current options are expensive, and one might consider employing options seller strategies, such as aShort Straddle or aShort Strangle.

Conversely, if both IV Rank and IV Percentile are low, it may suggest that the current options are cheap, in which case one might consider options buyer strategies, such as aLong Straddle or a Long Strangle.

However, these strategies require a high level of knowledge and practical experience from investors. Novices attempting these should be cautious of the risks involved.

Step: Detailed Quotes of underlying stock > Options > Analysis > Volatility Analysis

b. Seizing Short-Term Arbitrage Opportunities in 0DTE Options

In the options market, particularly during pivotal times like triple witching days, 0DTE Options attract attention due to their potential for short-term trading.

Volume and open interest are two important indicators. They not only assist in assessing whether options have liquidity but also help determine market capital trends. For short-term traders, they are key tools to evaluate liquidity and market trends.

Investors can use these indicators to identify 0DTE options with higher liquidity. By using a price calculator to set reasonable take-profit and stop-loss levels, and employing specific order types for precise execution, traders can effectively capture the best moments to enter and exit trades, increasing their chances of successful arbitrage.

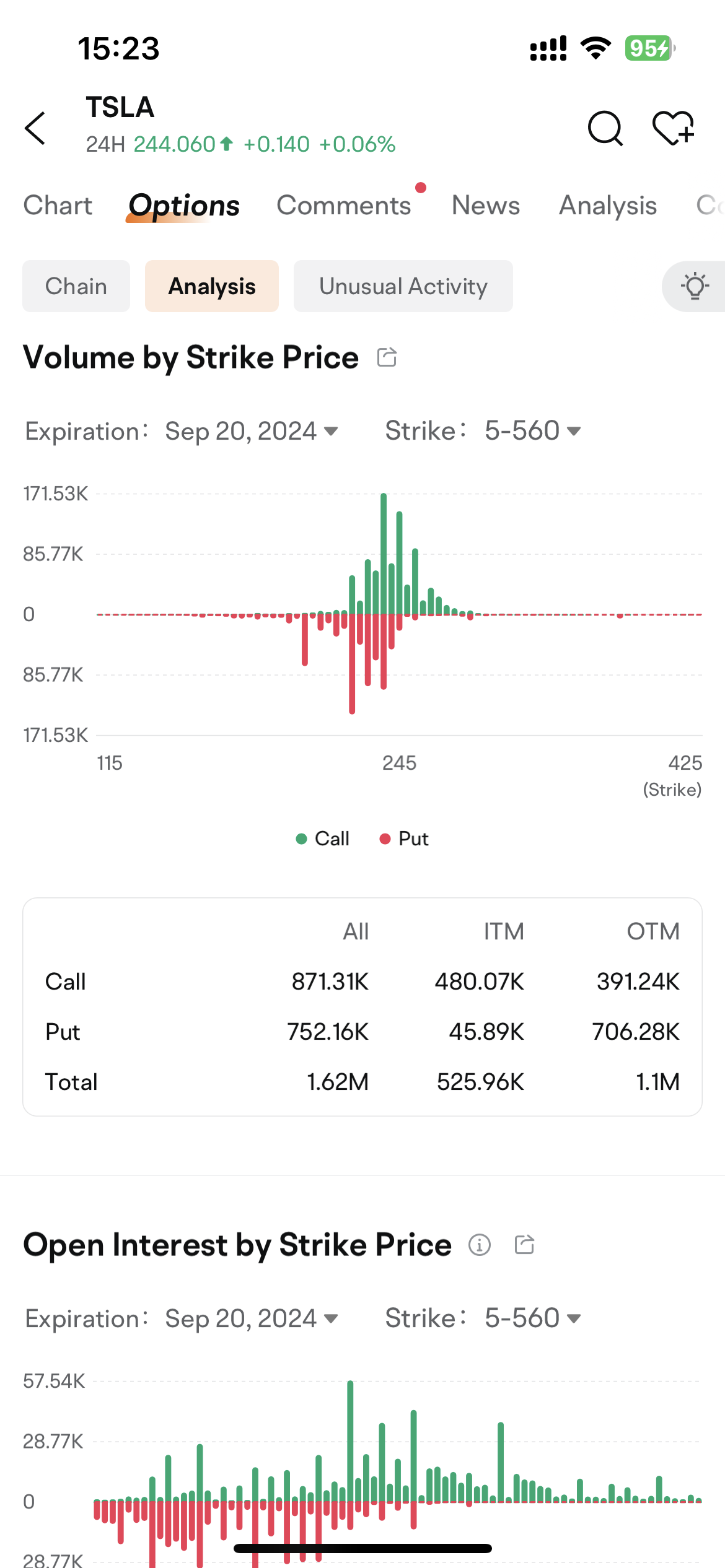

Step: Detailed Quotes of underlying stock > Options > Analysis > Volume by Strike Price / Open Interest by Strike Price

That’s all for today. If you have other ideas about Triple Witching Day, feel free to share and discuss them in the comments section.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

edmaxx76 :

Joey Bagadonuts : ok

CornpopBadDude : meh

Lets Gamble :

Wolverines :

70536953 :

Kelly_Liu :

Octavio GC :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

图图 :

70190156 :

View more comments...