Impact of Retail Sales on Markets

> As a significant part of the U.S. economy, retail sales reflect the health of consumer spending.

> Strong retail sales signal a healthy economy, while weak sales indicate potential economic weakness.

> Along with PMI, retail sales serve as a leading indicator for the U.S. economy.

4. Other Economic Data

In addition to retail sales, other consumption-related data, such as durable goods, energy, and housing, should be considered. While these components are smaller parts of GDP, they can still provide valuable insights, especially if you're investing in specific sectors like real estate. Monitoring housing sales trends, for example, can help predict future market movements.

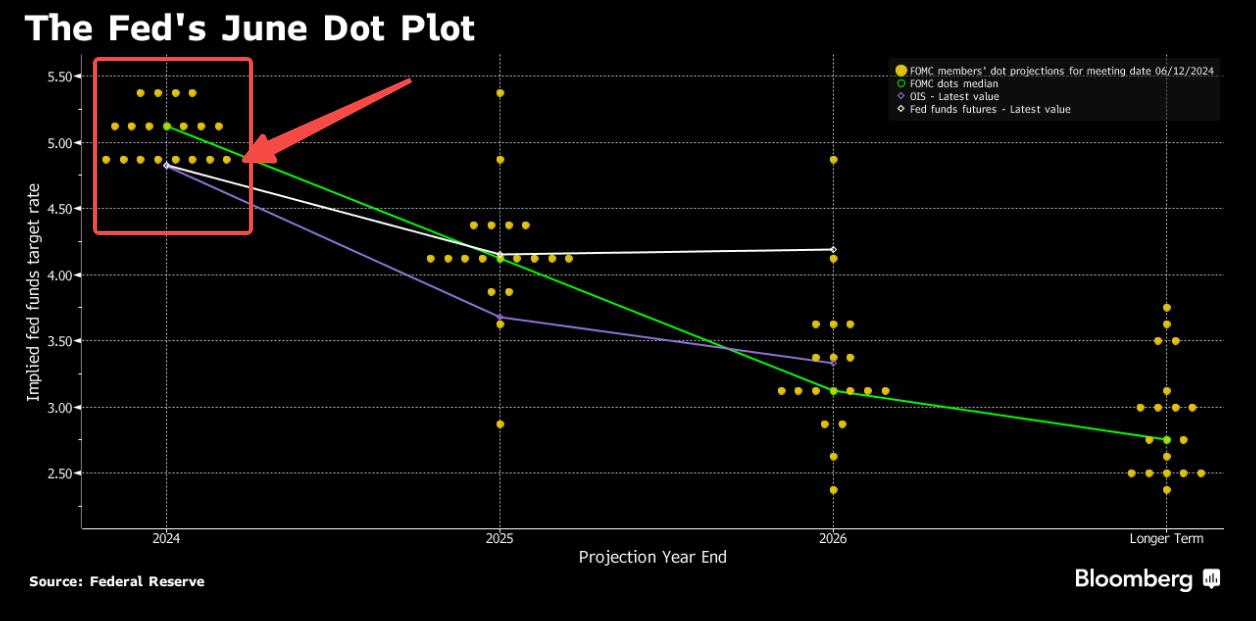

5. Interest Rates

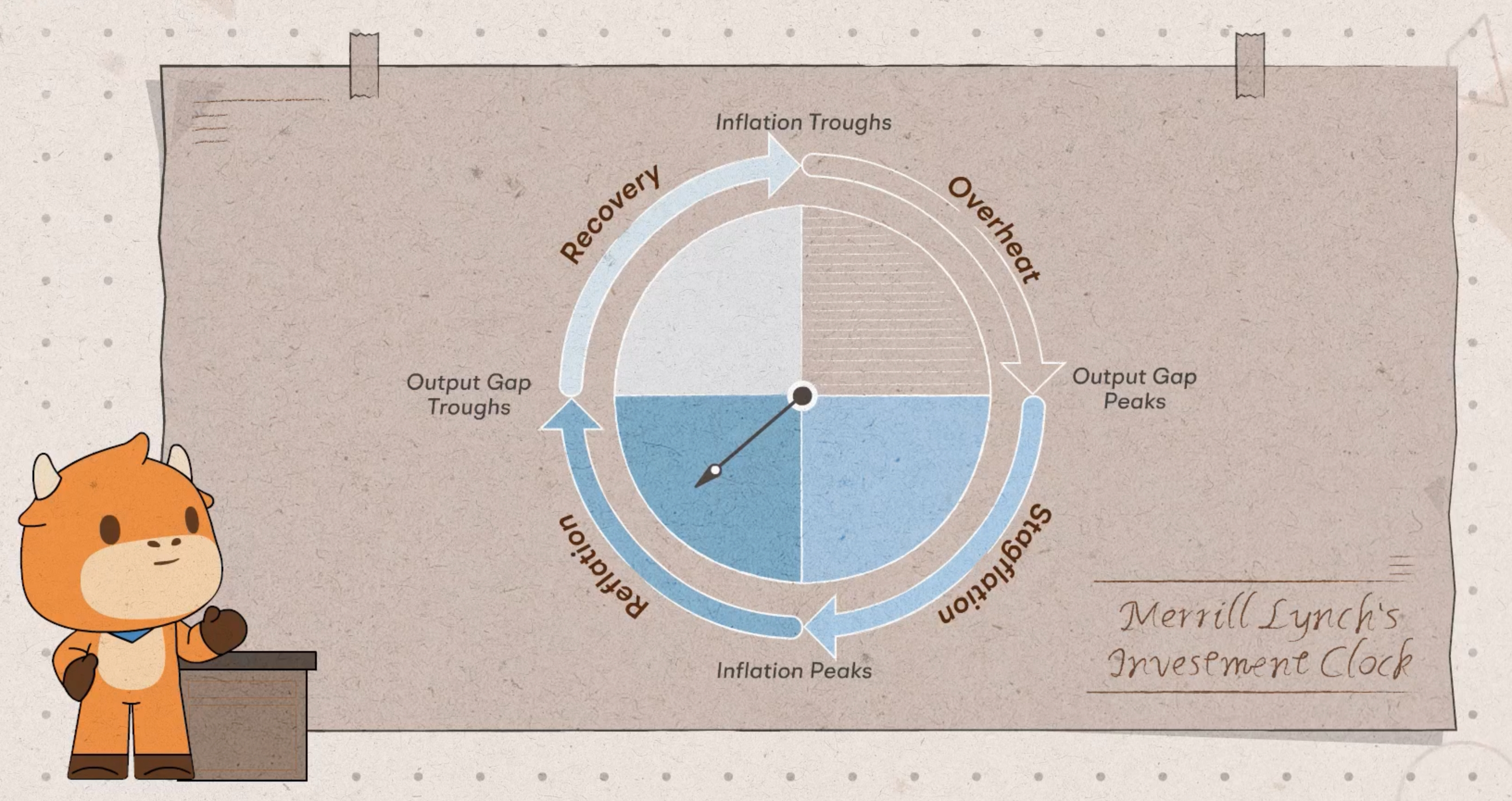

After understanding these indicators, you'll have a general idea of the current state of the U.S. economy and whether the stock market has underlying support. However, should one sell all stocks postition during an economic downturn? Not necessarily. Governments often adjust interest rates to influence monetary policy, either to stimulate the economy or to cool it down.

Phil Dunn : Quiz 1: A,B,C

Quiz 2: C

102362254 : Quiz 1 - A, B, C, D

Quiz 2 - C

Wonder : Q1 - ABC

Q2 - C

103285602 : Q1 - A B C D

Q2 - C

George Soros II : 1) A, B & C

2) C

sociable Dingo_8604 : Quiz 1: A B C D

Quiz 2: C

Dadacai : 1. ABCD 2. C

Nedinsellian : Q1 - A, B, C,

Q2 - C

Max The Water Blower : Quiz 1 - A, B, C, D

Quiz 2 - C

103618100 : Q1 - A,B,C

Q2 - C

View more comments...