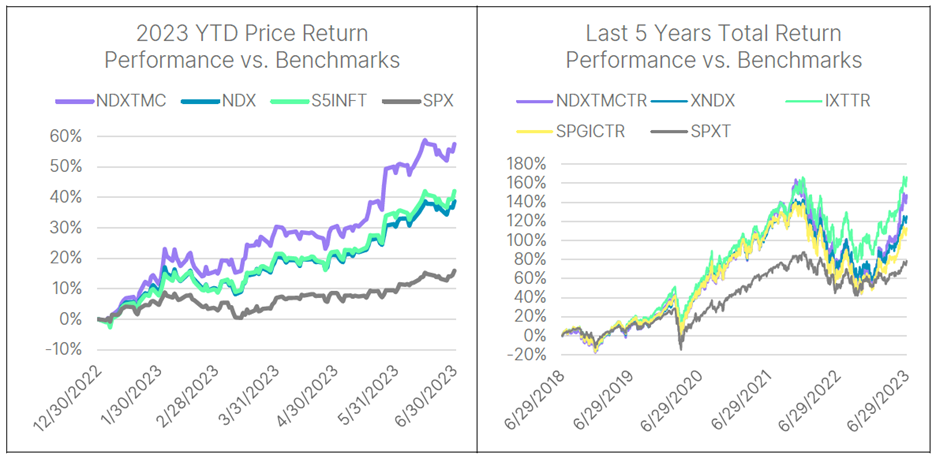

The Nasdaq-100 Technology Sector Market-Cap Weighted Index (NDXTMC) offers investors a concentrated approach to tracking many of the most recognizable leaders in innovation-driven growth, by selecting only those companies classified within the Technology industry as per ICB. As of June 30, 2023, the index tracked 38 such companies, including leaders in the biggest new secular growth theme of AI such as NVIDIA, Microsoft, Alphabet, Meta Platforms, Apple, Adobe, AMD, and Broadcom.

Mr And Mrs Jade : ﷺ

151832816 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) @FUTU @Mars Mooo @Movers and Shakers @Moomoo Recap US @moomoo Rewards @Moomoo News AU @Moomoo Learn @Moo Options Explorer @Moomoo US @Moomoo Lily @Moo Live @Nasdaq @ONE WAY TO HELL @Options Newsman @Prog @Popular on moomoo @Stevey221 @Silverbat @Spinee @TRIUMPHANT RETURNS @Team moomoo @WETRADE GROUP @102951343 @151084955 @102882965 @102470670 @Moo Earnings @Moomoo Team @Mooers Radar @Moomoo Breakfast US @Moomoo News SG @modest Crow_1687 @Investing with moomoo @In One Chart @FUTU @efficentupup @entertainment family @doctorpot1 @Dadacai @Dumb Money Space Ape @Cow Moo-ney @Charstey @bullrider_21 @Analysts Notebook @Alvinnnnnnn89 @areecep @ATS A trade sniper

@FUTU @Mars Mooo @Movers and Shakers @Moomoo Recap US @moomoo Rewards @Moomoo News AU @Moomoo Learn @Moo Options Explorer @Moomoo US @Moomoo Lily @Moo Live @Nasdaq @ONE WAY TO HELL @Options Newsman @Prog @Popular on moomoo @Stevey221 @Silverbat @Spinee @TRIUMPHANT RETURNS @Team moomoo @WETRADE GROUP @102951343 @151084955 @102882965 @102470670 @Moo Earnings @Moomoo Team @Mooers Radar @Moomoo Breakfast US @Moomoo News SG @modest Crow_1687 @Investing with moomoo @In One Chart @FUTU @efficentupup @entertainment family @doctorpot1 @Dadacai @Dumb Money Space Ape @Cow Moo-ney @Charstey @bullrider_21 @Analysts Notebook @Alvinnnnnnn89 @areecep @ATS A trade sniper

151035536 : What's the difference between this and qqq

TRIUMPHANT RETURNS : this is like buying Nasdaq stocks via china or Hong Kong exchange? might as well buy IVV or Wisdomtree AI WTAI for ai related stocks.

73264994 : hi

THE MACHINE23 : https://app.asana.com/0/1205439144159269/1205462530406643

Luis Chaparro : $Tronox (TROX.US)$

151054826Z : Can you helpe trade? it is for a good cause