NetEase 23Q3 Financial Report Review: Strong Performance With Profits Exceeding Expectations

Follow me, let's make money together!

On November 16th, NetEase released its Q3 earnings report. On the same day, J.P. Morgan issued a commentary on NetEase's Q3 earnings report, stating that the company had performed strongly in the third quarter with profits exceeding expectations, mainly due to the expansion of online game profits.

1. Valuation

Stock Rating: Overweight

Closing price (at the time of the preview release): $112.35 (November 16, 2023)

Current closing price: $114.3 (November 27, 2023)

J.P.Morgan target price: $125

2. Key Points

The Q3 earnings report showed strong profitability that exceeded expectations, primarily due to the robust revenue generating capability of NetEase's online gaming segment. Benefitting from a series of new games, NetEase's online game revenue accelerated YoY growth from 2% to 18%. Additionally, gross profit margin in the online gaming and value-added services segment further improved. J.P. Morgan considers NetEase as their top pick in China's online gaming sector and expects double-digit growth in online game revenue again in 2024.

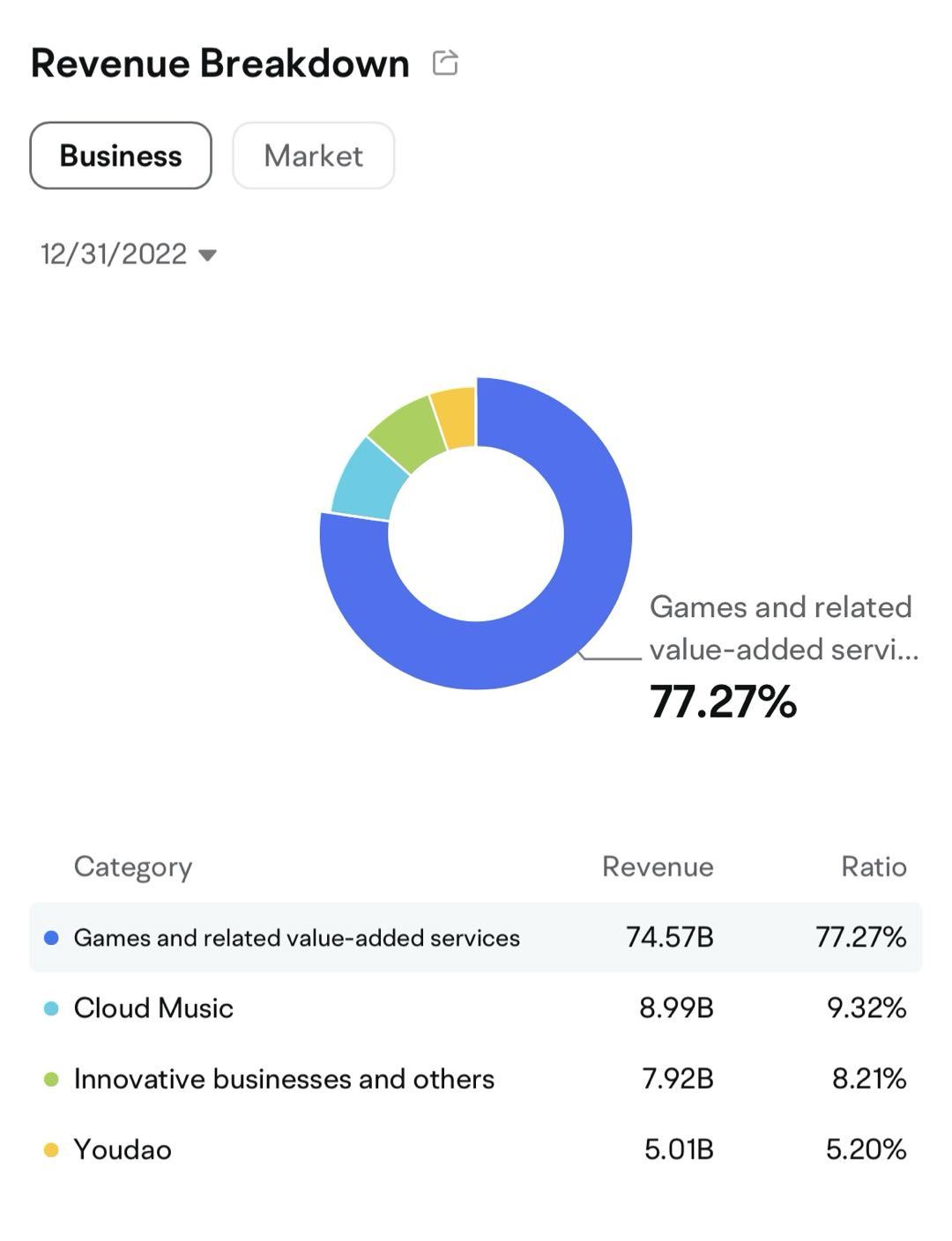

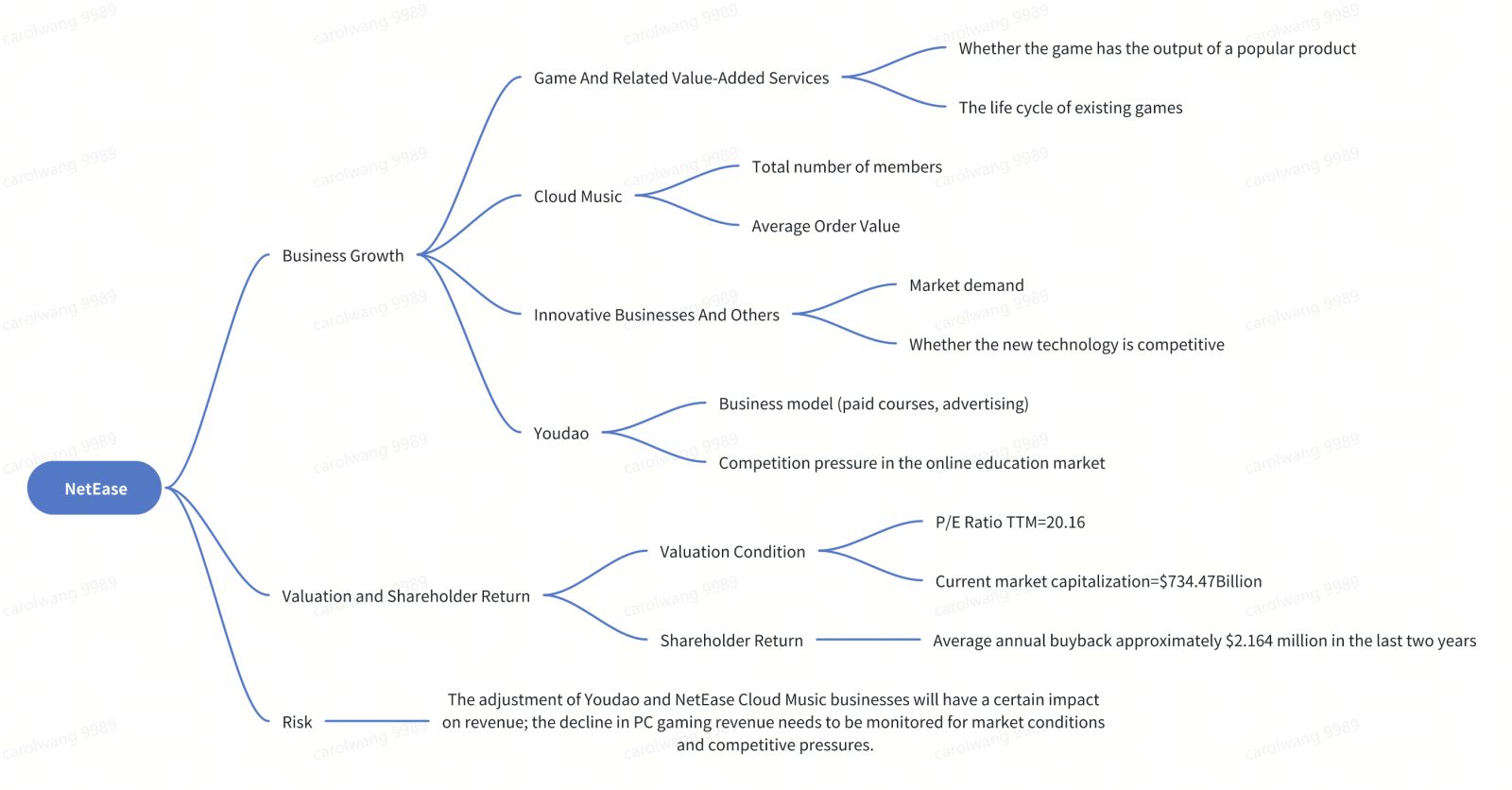

The main business is shown in the following figure:

3. Performance Outlook

(1). NetEase achieved 22% profit exceeding market expectations in Q3

NetEase's Q3 revenue met expectations, with profits exceeding market expectations by 22%, aided by the strong profitability of its online gaming segment. YoY growth in online gaming revenue accelerated to 18%. Gross profit margin in the online gaming and value-added services segment further improved, driving adjusted operating profit up 52% YoY.

(2). NetEase is the top pick for China's online gaming sector

The better-than-expected Q3 results once again demonstrate NetEase's strong profitability in the online gaming sector. Future market expectations for NetEase are expected to increase further due to the release of several new games that will bring about unexpected online gaming profits. J.P. Morgan expects NetEase's online game revenue to achieve double-digit growth again in 2024.

4. Positive Factors in Q3

4. Positive Factors in Q3

Online game revenue in Q3 was RMB 20.4 billion, of which mobile game revenue was the main driver, reaching RMB 15.8 billion. PC game revenue declined, but deferred revenue increased by 2% YoY and 10% QoQ, indicating potential growth in total game revenue. According to J.P. Morgan's forecast, total game revenue grew by 14% YoY and 26% QoQ in Q3, and its future growth potential was also discussed.

5. Negative Factors

Mr. Charles Zhaoxuan Yang, the CFO of NetEase, resigned from his position on November 30th, 2023, and will continue to serve as a consultant for NetEase until June 30th, 2024, to ensure a smooth transition as the company searches for a successor.

Follow me, let's make money together!

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment