Netflix $20 Million Bearish Options Position May Turn a Profit as Stock Price Slides

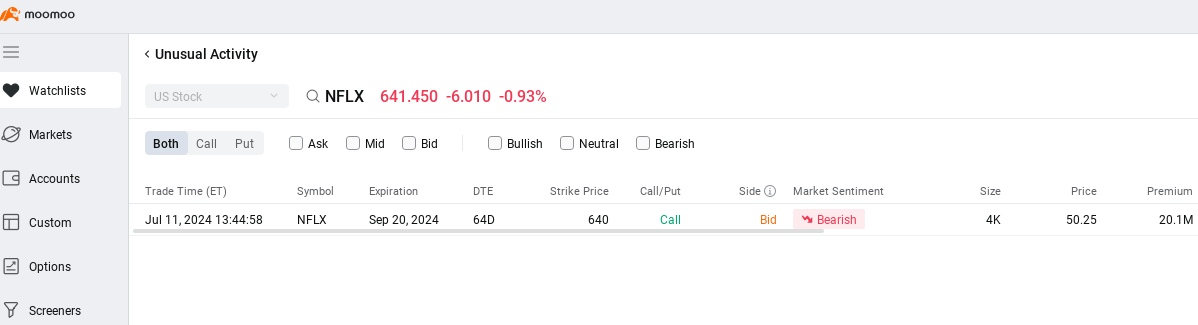

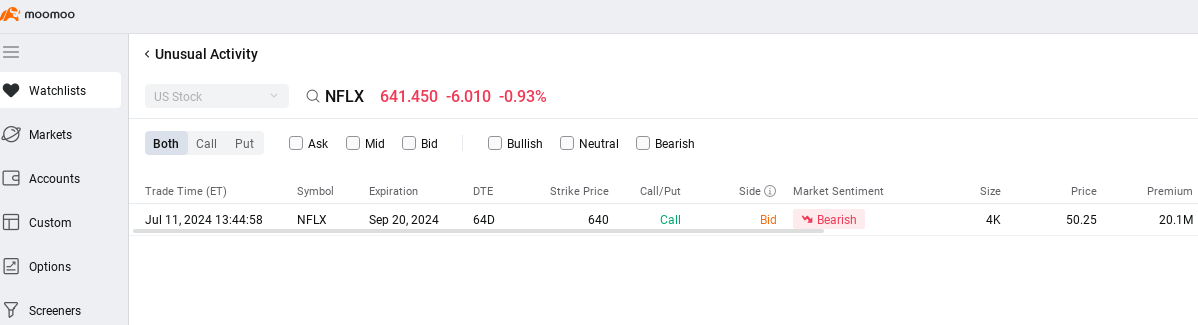

Big money took on a $20 million bearish position on $Netflix (NFLX.US)$options last week that could turn a profit as the stock price declines heading into earnings due after the market closes Thursday.

A seller wrote call options that give the holders the right to buy 400,000 Netflix shares at $640 each by Sept. 20. Those call options were sold at a price of $50.25 a share, and the trade was posted on July 11, when the stock was still trading at a higher level.

(To see Netflix's options chain, click here.)

Since then, the contract has fallen to $45.70 as of 12:49 p.m. in New York Thursday, making it cheaper for the seller to buy back the call options and book the profit, should he or she decide to close the position before the price reverses. The price of the call options slid as the stock fell to $644.73, tracking declines in the broader market.

(To see the options market page, click here.)

Among the options expiring tomorrow, the most active contract is the put option that gives the holders the right to sell Netflix shares at $500. More than 2,700 of such puts changed hands as of 12:26 p.m. in New York, more than double the open interest of 1,280. Its price climbed 43% to 33 cents a share, amid increasing demand for protection against further stock price slump hours before the company reports its second quarter financial results.

The TV and movie streaming giant is expected to report second quarter earnings of $4.74 a share after the market closes on Thursday, on revenue of $9.53 billion, according to analysts' estimates compiled by Capital IQ. More importantly, investors are looking for signs on progress to the company's password-sharing crackdown and whether that continues to help boost the number of its paying subscribers.

Netflix is seen reporting 4.5 million additional paying subscribers for the second quarter, the Wall Street Journal reported. The company has said it will stop providing quarterly subscriber numbers beginning next year and will add an annual revenue guidance in its filing.

After declining 6.3% over the past month, technical indicators tracked by moomoo are now flashing a positive signal. Seven of the 15 indicators are implying that the stock may now be oversold and could turn bullish, while the rest of neutral.

Fund inflows into the stock outpaced outflows by $23.2 million, driven by small orders, capital trend data tracked by moomoo showed. That helps trim its first monthly net outflow since the end of March.

Share your thoughts on Netflix below.

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See thislinkfor more information.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

102338790 : That's where the price hovers

73627093 : ok

jarett ringelspaugh : who cares

103991611 : idkkk

54088 FROM RWS : good

104534743 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

PAUL BIN ANTHONY : don't support community Maybank in the world with this now I'm in at home today I am going to visit dare and the staff very bed people

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104371487 On Paris : Thanks you