Netflix Q423 Earnings Preview: Optimistic Forecast for Q4 Subscriber Growth

Netflix is set to release its 23Q4 financial report after the market closes on January 23, 2024. How should we view this report?

I. Two key performance indicators for Netflix: Subscriber count and ARM

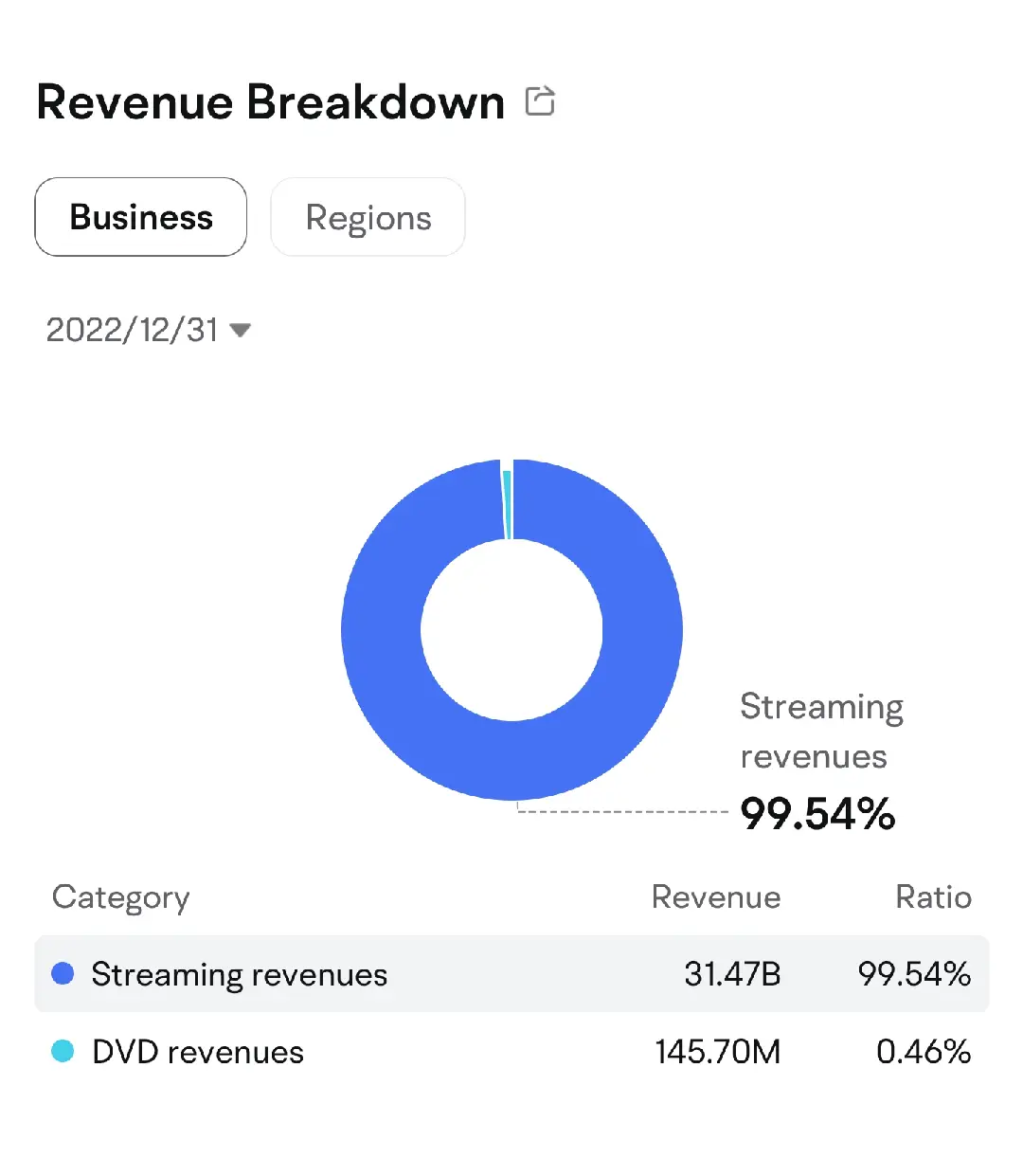

Netflix is the world's largest streaming media company, with streaming subscription revenue accounting for 99.54% of its main business revenue, while DVD revenue is negligible. Content is king in the streaming media industry, and high-quality film and television content is the fundamental guarantee for the company's growth. Based on the principle that content is king, subscriber count and ARM (revenue contribution per subscriber) growth will be the main driving forces for the company's performance growth.

Therefore, for Netflix, the key to predicting performance is to track the growth of subscriber count and ARM.

II. What drives the company's new user growth?

The company is currently promoting subscriber growth through two main methods:

(1) Continuously cracking down on shared accounts.

(2) Attracting new subscribers through low-priced advertising packages.

The company expects the number of new subscribers in Q4 to be basically the same as the 8.76 million in Q3. Considering the effectiveness of the ongoing crackdown on pay-sharing, the strong content in the fourth quarter, and optimistic data for advertising package subscription users, I predict that:

The company's new subscriber numbers in the fourth quarter are expected to exceed expectations.

The logic behind the expected exceeding of new subscriber numbers is as follows:

(1) Pay-sharing continues to drive user growth. According to current data, the number of users who cancel their subscription due to crackdown on shared accounts is very small, and some shared accounts are directly converted into full-paying users, reflecting very good user stickiness and high retention rates. According to data disclosed by the company in early 2023, there are as many as 100 million shared accounts worldwide, including 30 million users in the United States and Canada. It is estimated that 50% of shared accounts will become pay-sharing users or full-paying users. Currently, the company still adopts a phased approach to promote pay-sharing policies, and some users are expected to gradually convert into full-paying users or additional paying users in the following quarters. Considering the strong content in the fourth quarter, it is a good conversion opportunity.

(2) Advertising paying users are growing rapidly. According to the company's latest disclosed data, the number of monthly active users of advertising members exceeded 23 million at the beginning of 2024, an increase of 8 million in less than three months, with an accelerating growth rate. Advertising membership was launched in 12 markets including the United States in November 2022, with 15 million monthly active users in November last year and 5 million in May last year. Among advertising members, 85% of users watch for more than two hours per day. Considering the 23 million MAUs disclosed in January 2024 (which may be converted into 9.2 million to 11.5 million subscribers), I predict that the number of advertising layer subscribers will reach 10 million by the end of 2023.

III. Can the company's ARM grow in the fourth quarter?

The company's ARM was under pressure in the third quarter. In Q323, the company's ARM decreased by 1% YoY and 6.5% QoQ, mainly because the company has not yet taken any price increase measures this year. At the same time, most of the new users came from regions with relatively low subscription prices, and the increase in low-cost advertising package users all to some extent dragged down ARM growth.

ARM is expected to remain flat YoY in the fourth quarter. Although the company announced a price increase of about 10%-20% for basic and premium memberships in the United States, the United Kingdom, and France in the third quarter, considering the relatively small coverage area and the increase in the proportion of advertising packages, which will lower some ARM, the expected price increase is expected to alleviate the downward pressure on ARM, but its impact on the improvement of ARM in the fourth quarter is limited.

Therefore, our judgment on ARM is basically consistent with the company's guidance, and I predict that ARM will be roughly flat YoY in the fourth quarter, and the company's revenue in the fourth quarter will continue to be mainly driven by user growth.

IV. The company's Q423 performance is expected to be optimistic, but the stock price has already partially digested the growth expectations.

It is expected that the company's revenue will exceed expectations. The company's guidance for Q423 is expected to increase revenue by 11% YoY to $8.7 billion, with Bloomberg's unanimous expectation of a 10.8% increase. Considering the strong content lineup in Q4 and the effective crackdown on shared accounts, the number of new users is expected to further increase. At the same time, the price increase strategy will effectively alleviate the pressure on ARM. Therefore, it is expected that the company's revenue will exceed expectations.

The company's operating profit margin is steadily expanding, and the expected cash flow for the full year of 2023 is expected to increase to $6.5 billion. The company expects an operating profit margin of 20% in 2023, reducing content spending due to strikes, thus pushing FCF to $6.5 billion. By 2024, the company expects cash content spending to reach $17 billion, and operating profit margins to expand to 22%-23%.

In terms of valuation, based on calculations, it is estimated that the free cash flow in 2025 corresponds to a current stock price of 27.4x, and the net profit in 2025 corresponds to a current stock price of 24.5x. The current stock price has risen to a reasonable valuation level and has basically digested the Q4 performance growth in advance.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment