Netflix Earnings Preview: Ad Business May Be Undervalued, Q2 2024 Results Expected to Exceed Expectations

$Netflix (NFLX.US)$ is a global leading streaming company that offers subscription streaming services. It is scheduled to release its Q2 2024 financial report after the market closes on July 18, Eastern Time.

According to Bloomberg consensus estimates, Netflix's Q2 2024 revenue is expected to be $9.523 billion, representing a year-over-year increase of 16.33%. Diluted EPS is projected to be $4.74, reflecting a year-over-year growth of 43.93%.

1. Pioneer in the Streaming Industry

Netflix is a leading global provider of streaming services, with over 270 million paid subscribers in more than 200 countries. With its rich original content and powerful recommendation algorithm, Netflix holds a significant position in the streaming market. The company consistently invests in original series, movies, and documentaries such as "Stranger Things" and "The Crown," further solidifying its market leadership.

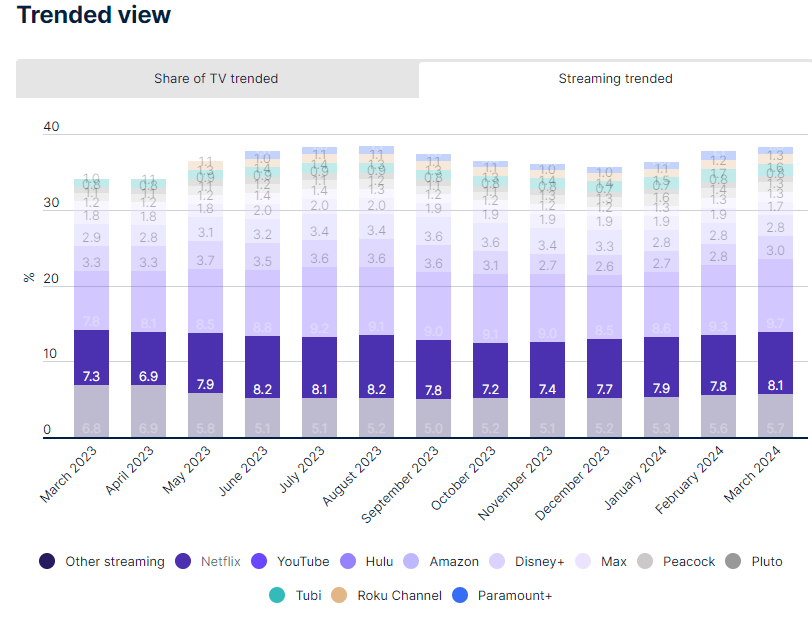

Competitive Landscape: In 2007, Netflix started to transition from the DVD rental service sector to streaming. Subsequently, other tech and entertainment giants also entered the field after 2019. Platforms like Hulu, Disney+, HBO Max, and Apple TV+ have all launched, creating a highly competitive market environment. Despite this, Netflix still holds an 8.1% share of the streaming segment (as of March 2024, with a total viewing time share of 38.5%). This indicates that Netflix's market share in the streaming sector is second only to YouTube, while other platforms like Prime Video, Disney+, and Max each hold shares of less than 3%.

Despite facing intense competition, Netflix continues to maintain its leading position in the streaming industry through its global presence and innovative strategies. The company is currently actively exploring new areas such as advertising services, physical entertainment, and sports event broadcasting to sustain future growth.

2. Performance Indicators: Number of Paying Subscribers and ARPU

As a company providing streaming services, nearly all of Netflix's revenue comes from SVOD (Subscription Video on Demand) services. Users pay a monthly subscription fee to gain the right to watch contents on the Netflix platform. According to Bloomberg data, starting from Q4 2023, the revenue from streaming subscription services has accounted for approximately 100.0% of Netflix's total revenue.

Additionally, Netflix has recently begun introducing advertisements into its streaming platform. This segment of the business is expected to account for around 4% of the total streaming subscription revenue in Q2 2024.

Given that nearly all of Netflix's revenue comes from user subscriptions, the number of subscribers and the Total Avg. Monthly Revenue per Paying Subscriber (ARPU) have become key indicators for measuring Netflix's performance growth. These metrics also serve as crucial bases for forecasting Netflix's Q2 2024 performance.

3. New Subscriptions Expected to Slow in Q2 2024, But Ad-Supported Services May Drive Subscription Growth

Currently, Netflix has 269 million paying subscribers globally, with its primary customer base concentrated in the U.S. and Canada, totaling 84 million users.

While there is still room for growth, the enormous current subscription base (for comparison, the U.S. population in 2022 was 333 million, and the Canadian population was 38 million) makes further growth challenging. Coupled with recent inflation and high interest rates in the U.S., users' willingness to pay may decrease. Additionally, major streaming platforms, including Netflix, have been continuously increasing subscription fees to offset the rising content delivery costs and maintain profitability amidst fierce competition in the streaming industry.

As a result, both Netflix and other platforms have launched ad-supported subscription services. These services have lower subscription fees and are suitable for users who do not mind ad interruptions or are price-sensitive. In the first quarter, Netflix gained 9.33 million new users through these newly introduced ad-supported subscription services and by reforming the account-sharing payment system.

Given that the action of crackdown on account sharing is unlikely to sustain such robust growth in new subscriptions, the growth rate of new users in the second quarter is not expected to remain equally strong. However, the ad business has brought considerable new subscription growth. Company data reveals that the MAUs (Monthly Active Users) for ad-supported services have now reached approximately 40 million, nearly doubling from 23 million in January 2024. Corroborating this, Sensor Tower data shows that the number of downloads of the Netflix app in the second quarter was similar to that of the same period last year. This fully demonstrates the excellent customer acquisition capability of the ad business.

Additionally, Netflix has announced that it will stop publishing user subscription metrics starting from the first quarter of 2025. This reflects the company's desire for investors to focus more on overall business growth rather than just the net increase in subscription users. It also showcases the company's determination to advance its ad services, sports events, and physical entertainment sectors.

Market forecasts for net subscription user growth in Q2 2024 have slightly declined, but due to the rise of ad-supported services, the number of new subscriptions may exceed expectations. According to Bloomberg consensus estimates, Netflix is expected to add 4.702 million new paying subscribers in Q2 2024, down 20.19% year-over-year. The total number of paying subscribers at the end of the quarter is expected to reach 273 million, reflecting a 1.4% increase from the previous quarter.

4. ARPU Expected to Remain Relatively Stable

A significant portion of the new subscribers in Q2 2024 are opting for the lower-priced ad-supported subscription service. This may impact the subscription profit per user and the ARPU (Average Revenue Per User) value. However, considering the substantial growth and ARPU brought by the ad business, the erosion of subscription revenue by the lower-priced ad-supported service is expected to be offset by the ARPU generated from the ad business. As ad business monetization improves and scales up, the monthly ad ARPU is likely to gradually increase.

The ad business has significant profit potential, but it currently does not generate substantial revenue. According to Bloomberg consensus estimates, ad revenue in Q2 2024 is expected to generate $389 million, accounting for approximately 4% of streaming revenue.

Even though the consensus expectations for the ad business revenue are not optimistic, Netflix is increasing its investment in sports content, such as NFL (National Football League) and WWE (World Wrestling Entertainment) events. In terms of ad technology, Netflix is opening its advertising resources to third parties such as Google, Magnite, and The Trade Desk to sustain internal ad tech investments and leverage programmatic partnerships. Therefore, the revenue prospects of the ad business are generally considered promising, and its revenue in Q2 2024 is expected to exceed expectations.

Additionally, Netflix's price increases for subscription services and effective measures against account sharing also help stabilize ARPU. In Q4 2023, Netflix raised prices for various subscription services in the U.S., France, and the U.K. by 11%-22%. In Q1 2024, prices were also increased in Singapore, New Zealand, and other peripheral markets. Recently, Netflix users in Australia have also been required to pay higher prices to maintain their subscriptions. Meanwhile, the action of crackdown on account sharing has effectively reduced shared accounts, which contributes to an increase in ARPU.

Considering these factors, the ARPU in Q2 2024 is expected to maintain its previous level. According to Bloomberg consensus estimates, Netflix's total average monthly revenue per paying subscriber in Q2 2024 is expected to be about $11.70, representing a year-over-year increase of 1.33% and a quarter-over-quarter decrease of 0.7%.

5. Profit Expected to Continue Rising Year-over-Year, Covering Increased Costs and Expenditures

Given the intense competition in the streaming industry, Netflix must increase its investments in content production and operational services to maintain its leading position in the sector.

Additionally, Netflix is planning to venture into physical entertainment. The company plans to open Netflix stores in Dallas and Pennsylvania in 2025, each covering over 100,000 square feet. These stores will feature various shopping opportunities, restaurants, and experiential activities related to its major series, which will undoubtedly require substantial investment.

Due to these factors, Q2 2024 costs and expenditures are expected to rise compared to the same period last year. However, Netflix's excellent cost control and improved operational capabilities have led to a decrease in the expense ratio. According to Bloomberg consensus estimates, total operating expenses for Q2 2024 are expected to be $6.969 billion, a year-over-year increase of 9.57%, with the expense ratio at 72.97%, down 6.07% year-over-year.

The expected decline in the expense ratio clearly indicates more efficient management and operations at Netflix. Furthermore, the company's ongoing price increases, the introduction of ad-supported services, and optimized pricing strategies (such as offering different subscription tiers) support higher gross margins for Netflix.

Therefore, one can remain optimistic about Netflix's profitability in Q2 2024. According to Bloomberg consensus estimates, gross profit for Q2 2024 is expected to be $4.3 billion, reflecting a year-over-year growth of 23.87%, with a gross margin of 45.89%, an increase of approximately 3 percentage points from the same period last year. Net profit is projected to be $2.082 billion, growing 40.02% year-over-year, with a net margin of 20.24%, representing an 11.40% year-over-year increase.

6. Optimistic Performance Expectations: What Should Investors Do?

Overall Outlook: Netflix continues to maintain its leading position in the streaming platform industry. In the long term, Netflix's efforts in physical entertainment and advertising are expected to generate significant revenue starting in 2025 and beyond. In the short term, Netflix's returns are also promising: analysis suggests that Q2 2024 performance should be optimistic and may exceed mainstream market forecasts.

Shareholder Returns: Since going public, Netflix has not paid dividends and has rarely undertaken stock splits (the last split occurred in 2015, and there has never been a reverse split in its history). The company's stock buyback activity is relatively stable, with the latest repurchase occurring in March 2024, amounting to $1.731 billion. Over the past year, the total amount of shares repurchased was approximately $7.232 billion, accounting for 2.55% of the company's current market value, with a certain number of shares repurchased at the end of each quarter. This indicates that the upward momentum of Netflix’s stock price largely stems from its performance growth and is also influenced by stock repurchases. Since Netflix does not pay dividends, shareholder returns can basically be judged by referring to stock repurchases.

Valuation: Currently, Netflix's P/E ratio is 45.49x, with a forward P/E ratio for the next 12 months estimated at 33.81x, suggesting that the valuation is within a reasonable range.

Considering Netflix's expected good operational performance and the optimistic direction of its key performance indicators, the company's Q2 2024 results are worth anticipating. The stock price is likely to see a modest increase following the release of financial reports that meet or exceed mainstream market forecasts. As a reference, Bloomberg consensus estimates project Netflix's Q2 2024 revenue to be $9.523 billion, a year-over-year increase of 16.33%; net profit is expected to be $2.082 billion, a year-over-year increase of 40.02%; diluted EPS is projected to be $4.74, a year-over-year increase of 43.93%.

Based on the above expectations, the following strategies are recommended for investors:

1. For investors holding the stock: If you wish to make profits, you can sell a certain number of call options to realize some gains and earn premiums; if you are seeking long-term returns, you can continue to hold.

2. For investors not holding the stock: Directly buying call options and selling put options can yield corresponding profits when the stock price rises.

Additionally, the company will hold a conference call following the release of the financial report, during which important guidance on future performance and development directions will be provided. It is advisable for investors to pay attention to this event.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment