Netflix Options Market Attracts Deep-Pocketed Investors, Benzinga Reports

Deep-pocketed investors have adopted a bullish approach towards $Netflix (NFLX.US)$, Benzinga reported, citing 19 extraordinary options activities linked to the stock of the streaming giant.

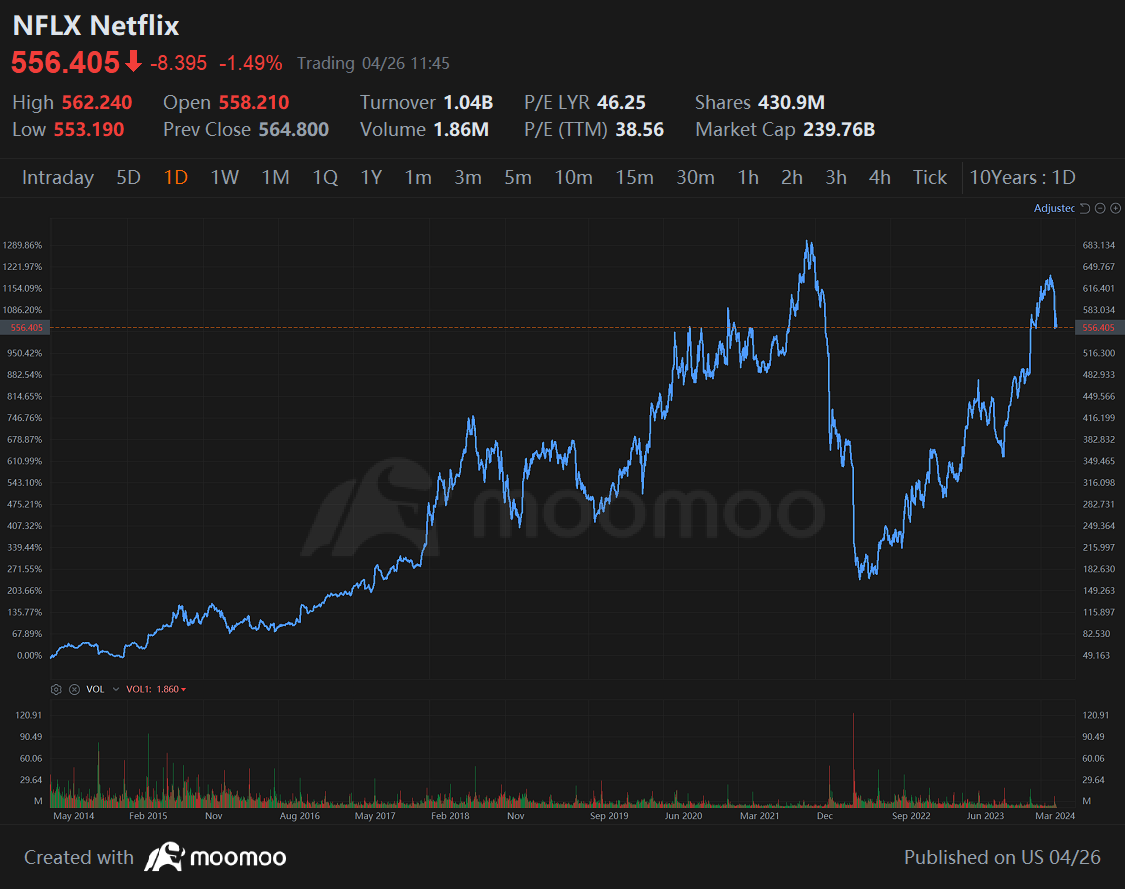

About 36% of the heavyweight investors behind the trades were leaning bullish and 36% bearish, according to the report. Of the options trades cited, six were puts, totaling $431,148, and 13 were calls, amounting to $544,308. Trading volumes and open interest data signal the major market movers were betting on the Netflix stock trading in a price band between $270 and $645 over the last three months. Shares were down 1.6% at $556.10 at 11:44 a.m. in New York. Read the full report for more details here: Options Corner: Netflix Options Market Attracts Deep-Pocketed Investors

About 36% of the heavyweight investors behind the trades were leaning bullish and 36% bearish, according to the report. Of the options trades cited, six were puts, totaling $431,148, and 13 were calls, amounting to $544,308. Trading volumes and open interest data signal the major market movers were betting on the Netflix stock trading in a price band between $270 and $645 over the last three months. Shares were down 1.6% at $556.10 at 11:44 a.m. in New York. Read the full report for more details here: Options Corner: Netflix Options Market Attracts Deep-Pocketed Investors

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors readCharacteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Svetlana Polishuk : absolutely