Netflix Options Volume Jump After Stellar Earnings Sent Shares to Record

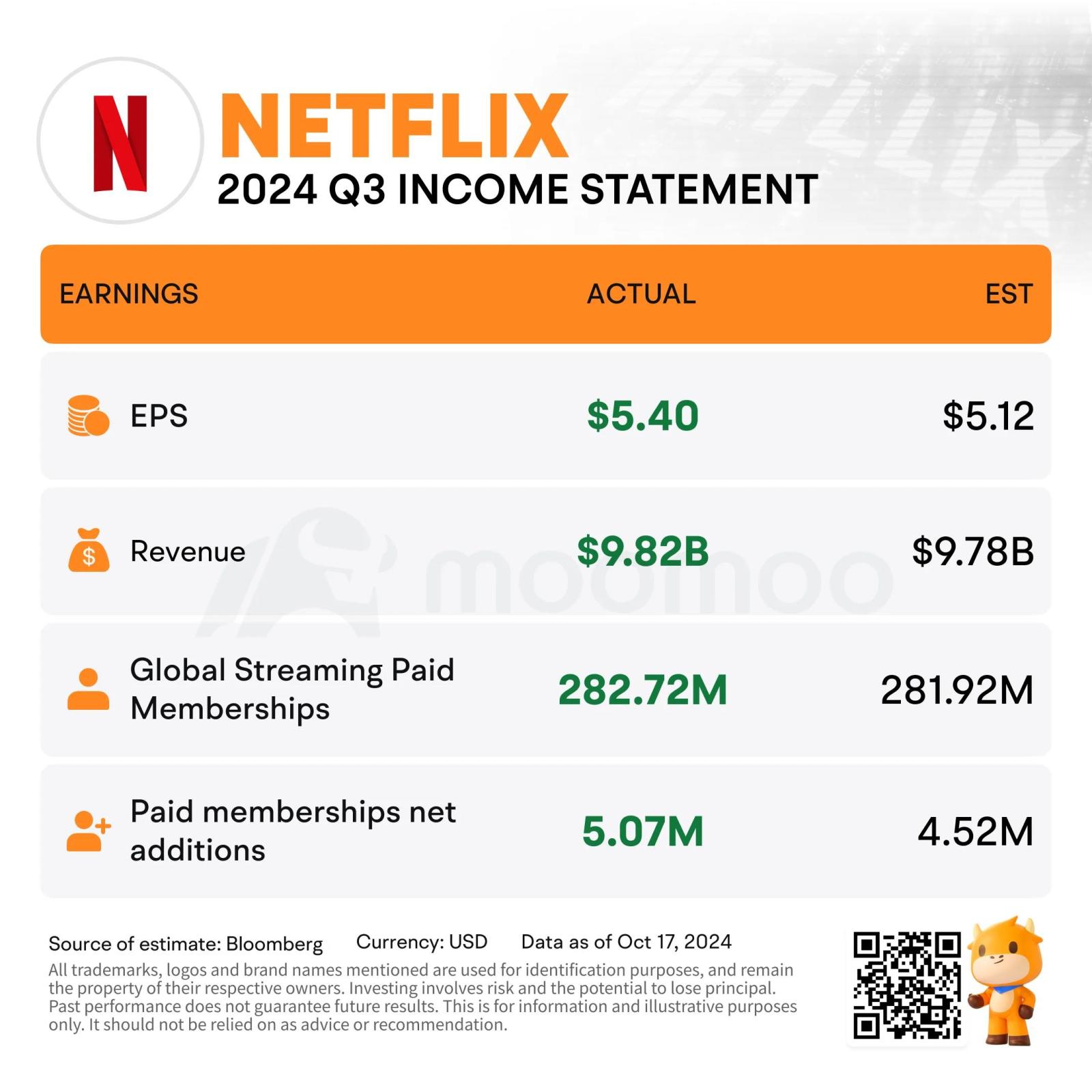

$Netflix (NFLX.US)$'s options volume jumped to the highest since at least April as shares climbed to a record after the global streaming giant reported earnings and revenue that surpassed analysts' estimates and added more subscribers than expected.

The stock climbed as much as 11% to an intra-day record of $763.41 Friday. By 12:38 p.m. in New York, the stock was at $757.44, still on course for an all-time closing high.

The share price rally pushed many put options out of the money, including the contract that gives the holder the right to sell the stock at $750 before the market closes today. That specific put option was the second most active contract tied to Netflix, with volume reaching 17,390, more than 113 times open interest.

Analysts, on average, raised their price target for the stock to $753.98 by Friday, from $730.89 yesterday, estimates compiled by Bloomberg show. Among the analysts who raised their forecast was JPMorgan's Doug Anmuth.

"We believe NFLX is a key beneficiary and driver of the ongoing disruption of linear TV, with content performing well globally and driving a virtuous circle of strong subscriber growth, more revenue and growing profit," Anmuth said in a note to clients. He raised his price target on the stock to $850, from $750.

Put options with that $750 strike price expiring next week are also seeing a sell-off, which could signal optimism over Friday's rally.

For 2025, Netflix sees revenue to reach $43 billion to $44 billion. The midpoint of that range is higher than the $43.4 billion expected by analysts, according to Bloomberg data. Operating margin is forecast to reach 28%, better than the 27% outlook for this year and the 27.9% analysts were predicting for the company.

"We're excited to finish the year strong with a great Q4 slate, including Squid Game S2, the Jake Paul/Mike Tyson fight and two NFL games on Christmas Day," the company said in its shareholder letter Thursday.

Among the string of hits on the streaming platform in the third quarter were new TV series including The Perfect Couple, Nobody Wants This, and Tokyo Swindlers, according with returning favorites such as Emily in Paris and Cobra Kai, the company said.

"We were impressed at how much further margins expanded beyond the huge rise already this year," Morningstar analyst Matthew Dolgin said in a note Friday, even as he continued to view the stock as overvalued. "Netflix also offered an initial sales and margin outlook for 2025 that portends less of a deceleration than we anticipated following a blockbuster 2024."

Amid the rally, Netflix shares are now trading at almost 42 times earnings, pricier than rival $Disney (DIS.US)$'s 24.7 times, and the broader the $S&P 500 Index (.SPX.US)$'s 25 times.

While Dolgin raised his price target for Netflix to $550, from $500, that still implies downside potential from the current stock price of $754.33.

While Dolgin raised his price target for Netflix to $550, from $500, that still implies downside potential from the current stock price of $754.33.

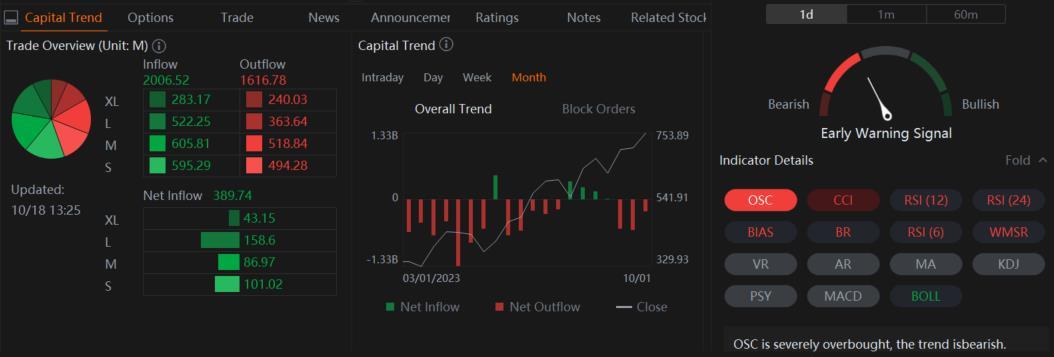

Amid the stock rally, Eight of the 15 technical indicators are flashing early warning signals that Netflix could now be considered overbought, and the trend may be turning bearish.

That's not stopping the bulls. So far today, inflows outpaced outflows by $391.34 million. If sustained over the next trading days, that could wipe out the third monthly outflows from Netflix, according to capital trend data tracked by moomoo.

Do you think Netflix can sustain the share price rally? Share your thoughts in the comment section and if you have a price forecast, please vote.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

# Netflix shares surged to a record after earnings beat. Can the rally be sustained?

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Supermengg : Ok

RyanT2021 : ok

Adrianlim90 : 1

72644268 : Hello there Any death protection like insurance

104476495 : h

nick weng : ok

103561146 : hi

Adrianlim90 : 1

103613928 : Ok

WaitYuhh : forsure over