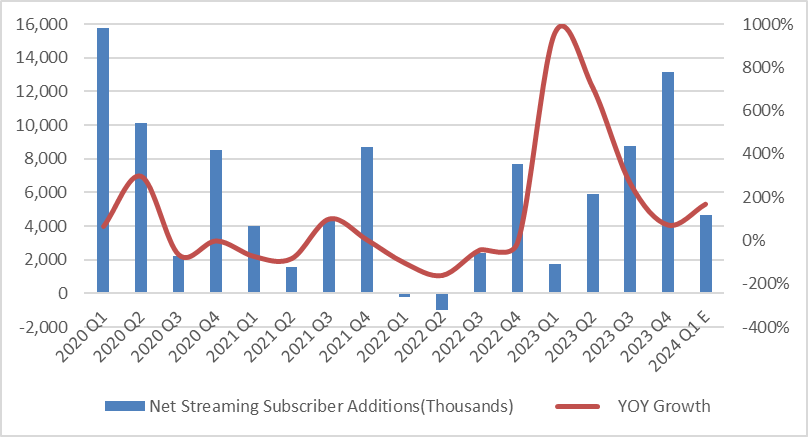

Data from early 2023 showed that Netflix had as many as 100 million shared accounts globally. Throughout the year, the company strengthened measures to combat this, adding approximately 29.53 million new subscription users, with Q1-Q4 seeing 1.75 million, 5.89 million, 8.76 million, and 13.12 million respectively, showing a clear quarter-over-quarter growth, with a significant portion stemming from the crackdown on shared accounts. At the same time, the number of users unsubscribing was minimal, with some shared accounts directly converting to full-paying subscribers, reflecting excellent user stickiness and a high retention rate.

Stock Buff : In your article, “According to the latest options data, the market is betting that Netflix's stock price may fluctuate ± 8.8% on the earnings day”. I would like to ask you what kind of options data did you get this conclusion based on?

Noah Johnson OP Stock Buff : Here I have quoted the data from Market Chameleon in an article from moomoo news![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Stock Buff Noah Johnson OP : Thank you for your answers.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)