Netflix Q4 2023 Earnings Preview: Enhanced Revenue From Advertising Strategy and Sharing Crackdown

As $Netflix (NFLX.US)$approaches its fourth-quarter earnings report on January 23rd, the spotlight is on its burgeoning advertising revenue. Here's what to expect.

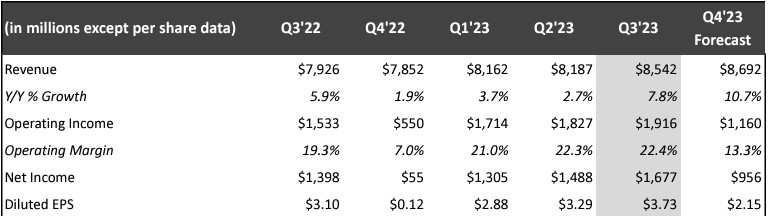

Consensus Estimates

● Netflix is expected to post quarterly earnings of $2.22 per share in Q4 of 2023, which represents a year-over-year change of +1751.92%.

It should be noted that Netflix experienced a shortfall in its EPS for Q4 of 2022, primarily due to losses associated with its euro-denominated debt. This loss was a consequence of the U.S. dollar's depreciation against the euro and is not reflective of the company's operational performance.

● Revenues are expected to be $8.71 billion, up 10.93% from the year-ago quarter.

● The launch of Netflix's ad-supported tier has been a game-changer, prompting Oppenheimer analysts to set a bullish price target of $600 — leading the charge on Wall Street. The average price target for Netflix is $505.85, which implies 5.32% upside from its latest closing price.

Subscription growth

Netflix's subscriber numbers have exceeded expectations in Q3, with 8.76 million new customers, bolstered by compelling content and effective measures against password sharing.

The pace of growth "suggests plenty of room for [subscription] growth in 2024," Oppenheimer analyst Jason Helfstein said in a note Jan. 12. He raised his fourth-quarter estimates for net additions to more than 10 million from 9 million, and for 2024 additions to more than 24 million from 21 million-plus.

Ad tier

Piper Sandler analyst Matt Farrell notes the digital advertising sector's resilience, forecasting an 8.7% growth in Q4 and continued acceleration. This positive trend aligns with Netflix's own ad tier membership, which saw a 70% increase in Q3 and accounted for 30% of all new sign-ups across its 12 "ads countries".

Netflix's president of advertising, Amy Reinhard, announced on January 10 that the company's advertising-based plan has now surpassed 23 million monthly active users around the globe. The figure follows the streaming service's report from just over two months ago, which stated that their ad tier had more than 15 million monthly active users worldwide.

This growth trajectory suggests that Netflix could soon eclipse Disney+ in ad revenue, despite $Disney (DIS.US)$'s existing advertising infrastructure. Insider Intelligence forecasts that Netflix will overtake Disney+ in ad revenues next year, amassing $1.03 billion versus Disney's $911.9 million.

Nielsen data underscores Netflix's dominance in the U.S. television market, capturing 7.4% of viewing time and only trailing behind YouTube (9%). This performance is particularly notable when compared to other streaming rivals such as Amazon Prime Video (3.4%) and Disney+ (1.9%), showcasing Netflix's strong positioning in the competitive landscape.

Margin challenges

Netflix is not without its challenges. The company anticipates a decrease in its operating margin for the fourth quarter. Even after reaching a high of 22.4% in Q3, escalating content costs coupled with a plateauing global Average Revenue per Membership (ARM) suggest a potential shift in profitability starting from the fourth quarter of 2023.

Citigroup has adjusted its rating for Netflix from "Buy" to "Hold," driven by apprehensions about diminishing margins. They foresee Netflix's spending on content to surge to $20.4 billion by 2025, casting doubt on the company's short-term profit outlook. Consequently, projections indicate a possible decline in Netflix's operating margin to 13% in Q4, down significantly from 22% in the preceding quarter.

Source: MarketWatch, Insider Intelligence, Seeking Alpha, Variety

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

ERobb : lol whatever