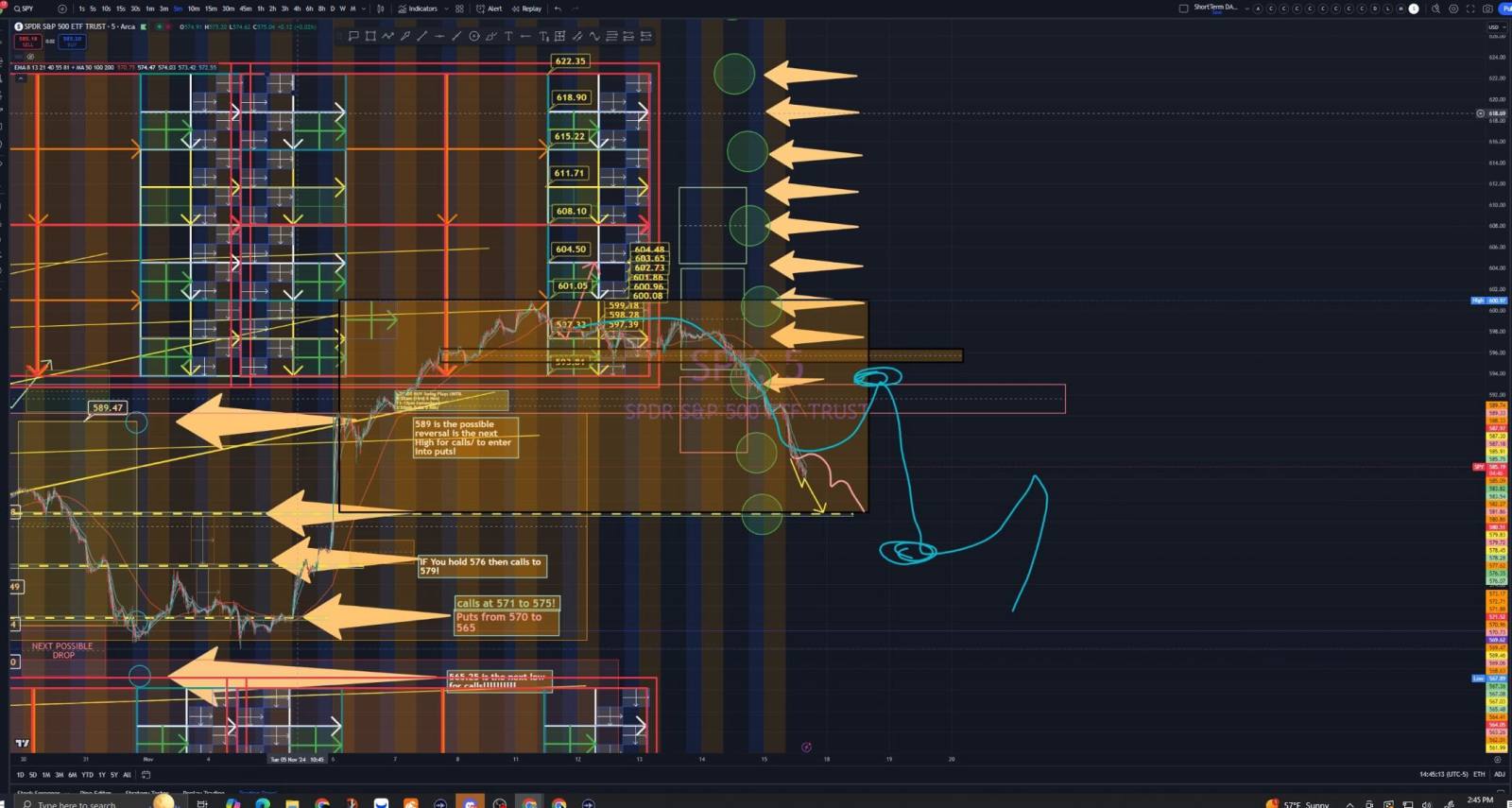

- Buy December $600 - $620 strike

- price calls for spy 50-200$ I got 3

- Or for Jan expiration that's fine as well Make sure you buy this

- The reason why l'm not telling you to go too far out is because we're already near the peak on what spy can run to so theoretically only the short-term options a month out to two months out would actually be valuable because for the last seven months we've been running up you see

- also technically options that are three months out to seven months out are still up, even though we fell the last 2 days so we barely fell we would need another week to two weeks of falling to buy expirations 6+ months out so that’s why I’m saying to buy a month out-two months out Max

- We want to sell these at the end of November or when SPY hits $604-$620

- The next time to average down would be at $580 & then once again at $575

- Anything above $594 you should be playing extra calls on the 1-2 weeks scale

(not monthly)

- Anything below $594 to $604 you should be playing put on the 1-6+ monthly scale depending on your strike price and how far you got out for it’s expiration

- And then once again from $610 - $620 but this time 3-9 month out for the options

- Anything below $575. You should be playing extra puts to $565 on the two week scale. (Not monthly)

- And then once you hit 565 that’s gonna be your next massive level to play the calls to 590 or 600 This could be done on the 1-6 month scale

- Below 565 you wanna play puts to $555 on the two weeks scale

Sylos OP : Bought more Closer dated options! Posted this on my socials!

Daniel Ambriz : I'm in this with ya!!!

Sylos OP : 100% to 1000% play potentially

$SPDR S&P 500 ETF (SPY.US)$

Peter Ramos : This guy doesn’t miss, oh man please post more