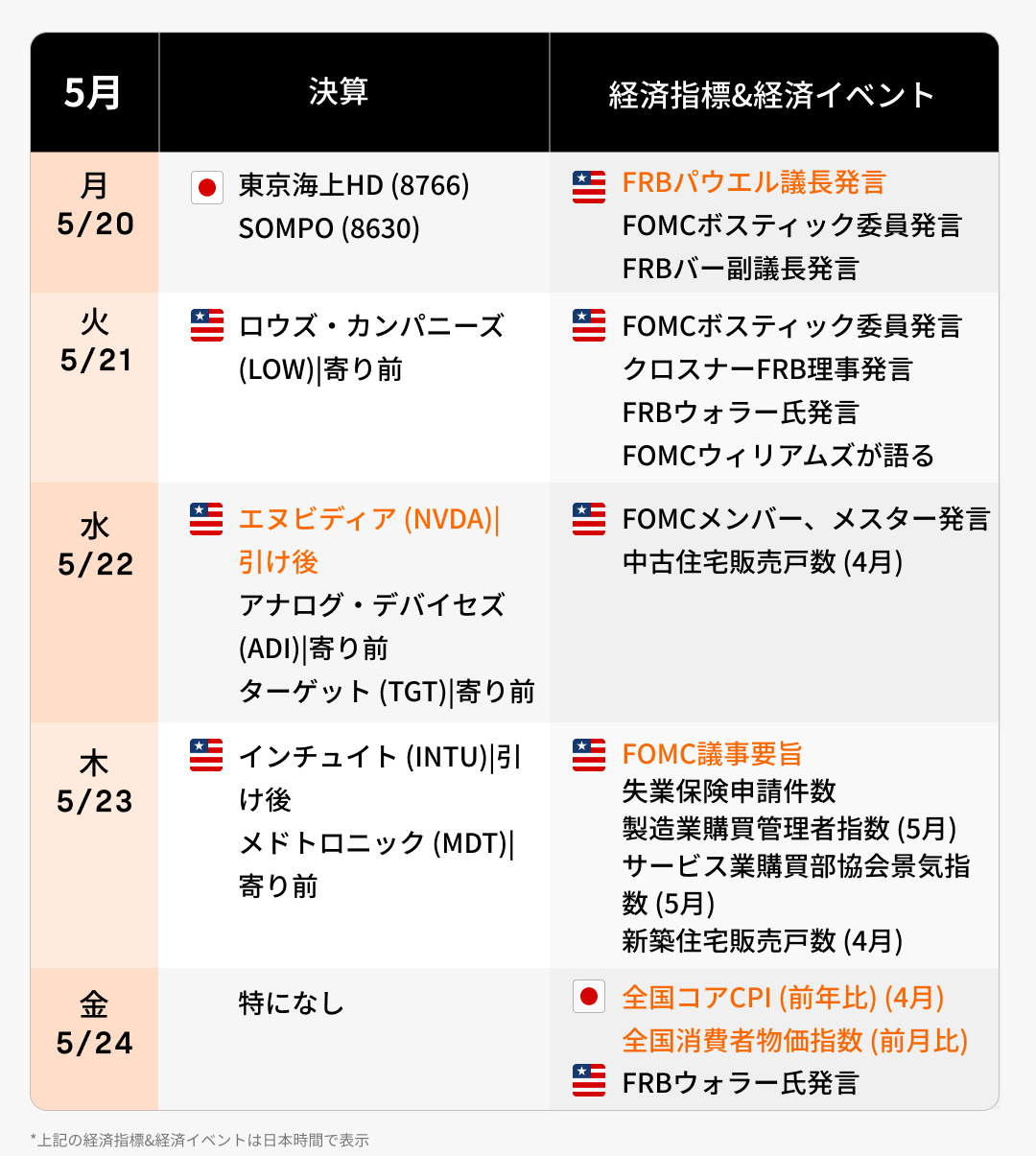

This week's financial results and economic calendar (5/20 to 5/24) depending on NVIDIA's financial results! “AI Festival” again?

Are Japanese stocks doing well this week? Rice that is getting a lot of attention in the market $NVIDIA (NVDA.US)$Ahead of the announcement of financial results on the 22nd, the wait-and-see mood is likely to expand in the first half of the week. Triggered by financial statements, etc. showing the expansion of demand for artificial intelligence (AI), etc.There is a possibility that the impact will spread to related stocks around the worldThere is. Meanwhile, as observations of lower US interest rates increase, interest is also being drawn to trends in long-term US interest rates.

Currently, while the Dow Average and Nasdaq Index hit their highest values, the Nikkei Average has been in an adjustment phase for close to 2 months. Depending on NVIDIA's financial results, it is possible that the upward trend will intensify all at once. Since demand for generative AI is strong, market expectations for NVIDIA financial results are high. If financial results are good, semiconductor-related stocks will be bought, and the Nikkei Average is expected to test the 39,000 yen range. Conversely, it is possible that the trend will fall again. That positive content was evaluated in NVIDIA's financial results for February, and amid strong semiconductor stocks, the Nikkei AverageThe highest value was updated for the first time in 34 yearsI ran up to.

Multiple organizations say NVIDIA's first quarter financial results and second quarter guidanceExpected to significantly exceed expectationsDoing it. According to Goldman Sachs, NVIDIA's stock price has risen 81% this year, but there is still plenty of room for growth. NVIDIA's target stock price was raised from 1000 dollars to 1100 dollars.

The foreign exchange market this week is likely to unfold while determining the positions of both the central banks of Japan and the United States on monetary policy. On the 21st, the Bank of Japan will hold a workshop on “multifaceted reviews” to look back on untraditional monetary policies spanning a quarter century. The theme is “the economic and price situation and monetary policy over the past 25 years,” and I don't know if future monetary policy will be mentioned, but there is also a possibility that it will be taken as hawkish if there are any objections to mitigation policies up until now. Also, the National Consumer Price Index (CPI) for April is scheduled to be announced on the 24th. If it is shown that the CPI maintains a high price level, it is likely that expectations that the Bank of Japan's policy changes will be brought ahead of schedule, and yen will be bought, and it is likely to be a tailwind for financial stocks.

this week,There will be many lectures by senior US Federal Reserve officialsIt has been done, and interest rates were cut earlyIt's hard to expect positive statements. If the depreciation of the yen progresses again, it will boost expectations that the Bank of Japan will raise interest rates. Also, the minutes of the US FOMC meeting were announced on the 22nd,Exploring the future of US monetary policyFurthermore, it seems that it will attract attention. Long-term US interest rates are likely to rise if people are once again aware of the prolongation of tight monetary policies. Meanwhile, long-term US interest rates are on a downward trend in response to a slowdown in growth in the US Consumer Price Index (CPI). At the market”The focus is on whether 10-year US bond yields will split 4%So, if the downward trend becomes more clearIt seems to support high-tech stocksIt was pointed out.”

1. The Nikkei Average rebounded for the first time in 2 weeks, and vigilance against prolonged US financial tightening recedes drastically

2. Buffett's secret investments revealed! Apple sells more than 100 million shares in the first quarter, and HP sells the full amount

3. Major institutional investors' portfolios revealed to the public! NVIDIA is still popular! Tesla is “abandoned”

4. Chairman Powell indicates the possibility that US interest rates will remain at a high level for a longer period

5. US core CPI falls to a low level for the first time in almost 3 years, retail sales fall below expectations, one step towards September interest rate cuts

6. The three major US indices once again hit record highs! “The stock market has already plateaued and will remain flat until the end of '24,” Goldman said

7. Meme stock investment fever stalled, Game Stop and AMC lost a total market value of 7 billion dollars

The Nikkei Average rebounded last week to 38,787.38 yen, 558.27 yen (1.46%) higher than the previous weekend, for the first time in 2 weeks. There were many announcements of high-profile economic indicators in the US, but 10-year bond yields declined drastically in response to the producer price index (PPI), consumer price index (CPI), and retail sales in April. Vigilance against prolonged monetary tightening has receded drastically.

Rice led by Mr. Buffett, the “god of investment” $Berkshire Hathaway-A (BRK.A.US)$The latest portfolio has been released, and mysterious brands that made the outfield curious have also been revealed. Is Warren Buffett from the United StatesIt has drastically withdrawn from the high-tech sector and increased investment in energy and insuranceDoing it. According to submitted documents, in the first quarter of this year, the company purchased 1 new stock, purchased 3 additional stocks, reduced holdings of 5 stocks, and sold 1 stock in full. Berkshire's position concentration is still high, with the top 10 stocks accounting for 91.19% of the total.

Major US institutional investors announced their US stock holdings and position sizes for the first quarter of this year. According to a report by the world's top 10 hedge funds,Technology stocks are still the target of intensive buyingIt is. Of the world's top 10 hedge fundsAbout half have overbought NVIDIA,Bridgewater and AQR largely overbought NVIDIA and related stocks in the first quarter. In addition to NVIDIA, major hedge funds $Amazon (AMZN.US)$, google, $Apple (AAPL.US)$They are also focusing on buying. On the other hand, $Tesla (TSLA.US)$There are no companies that own a large amount ofHalf sold Tesla and related brandsI'm focusing on it.

Chairman Powell was extremely optimistic about the US economy at the debate on the 14th, saying “growth of 2% or more will continue.” The view was that although employment was strong, the labor market would move towards equilibrium and inflation would also decline. If the Goldilocks (optimal temperature) economy, which is neither too cold nor too hot, comes, it will be a favorable environment that neither the stock market could hope for. Meanwhile, the US monetary authorities expressed the view that they should be patient and that it is necessary to wait for evidence that inflation is continuously slowing down, and emphasized the need to maintain policy interest rates at a high level over a longer period of time.

It was announced on the 15thUS Consumer Price Index (CPI) for AprilIsThe slowdown is mostly as expectedIt became. There are signs of falling into the momentum of the inflation rate, which has shown strength beyond expectations since the beginning of the year. Core CPI excluding energy and food is in line with market expectations,The rate of increase was small since 2021/4. Other than that, US retail sales fell short of market expectationsObservations of interest rate cuts by the end of the year have intensified.

In response to CPI and US retail sales data,All 3 major indices hit their all-time highs on the 15thI did it. The Dow Average reached the 40,000 dollar mark on the 16th. Since entering '24, the closing price of the S&P 500 is the 23rd time, the Dow is the 18th, and the NASDAQ Composite Index is the 8th time. SQQQ, which has an inverse correlation with the NASDAQ market, was also on the 15th,Cut through $10. This is usually an important psychological and technical milestone, and may trigger market interest and trading activity. However, David Kostin of Goldman Sachs said that the S&P 500 IndexThere is a possibility that it will remain flat until the end of this yearI said there was one. He said the S&P 500 index has already reached Goldman's year-end target of 5200. There is a possibility that interest rate cuts will change this situation, but the company's indicators do not show any further increase from current levels.

It “took the world by storm” as a meme stock $GameStop (GME.US)$Ya $AMC Entertainment (AMC.US)$The stock price skyrocketed on the 13th. What is the game stop110% higher at one pointWhat is the movie theater chain AMC102% higher at one pointIt became. The upward trend continued on the 14th, and each60% higher, 31.98% higherand it skyrocketed. However, stock prices for both stocks stalled on the 15th. On the 16th, Game Stop and AMC Entertainment Holdings continued to drop drastically, and the meme stock investment fever that took the market by storm calmed down. Of the total market value of approximately 11 billion dollars obtained from rising stock pricesAbout 7 billion dollars disappeared.

Source: MINKABU, Bloomberg, Investing, Traders Web, Reuters, Nihon Keizai Shimbun

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

ドラッケンメラー : Even if NVIDIA is doing well, it crashed due to lack of guidance and 10 pelica (lol)

182583152 : What will happen to NVIDIA stocks? Is NVIDIA stock still going up

182076928鬼平 : Your schedule for the end of this week is pretty hectic, isn't it?