Nike Bulls Pile Onto Options Market After CEO Change Announcement

$Nike (NKE.US)$ bulls are piling onto the options market Friday amid investor enthusiasm after the athletic footwear and apparel maker brought back a retired executive to lead the rebound of the company that has lost almost 22% of its market value this year.

Shares of the company rallied 6.45% to $86.19 at 12:56 p.m. in New York after the company said the previous day that retired executive Elliott Hill will succeed John Donahoe as president and chief executive officer effective Oct. 14. Before his retirement in 2020, Hill was the president for Nike's consumer and marketplace. Nike also said Hill helped grew the business to more than $39 billion.

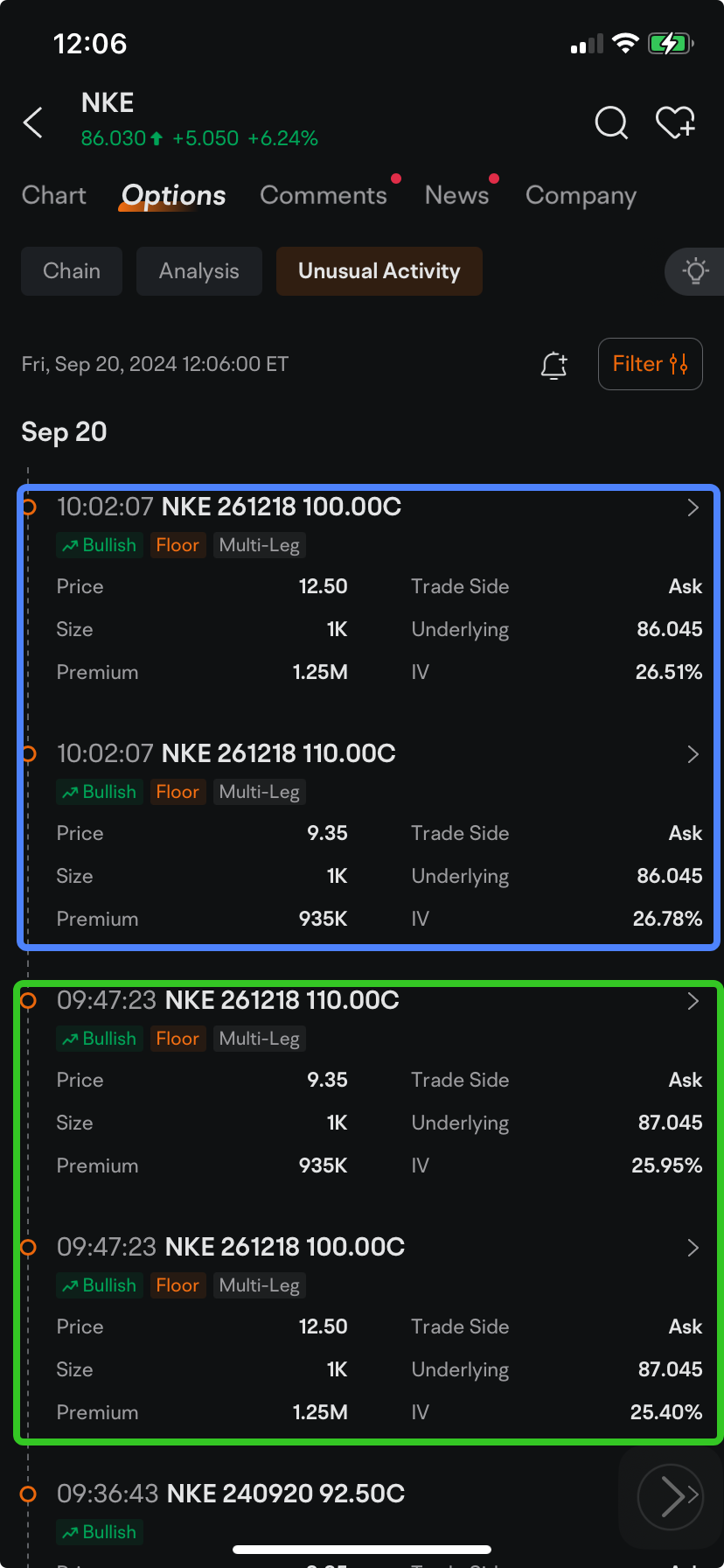

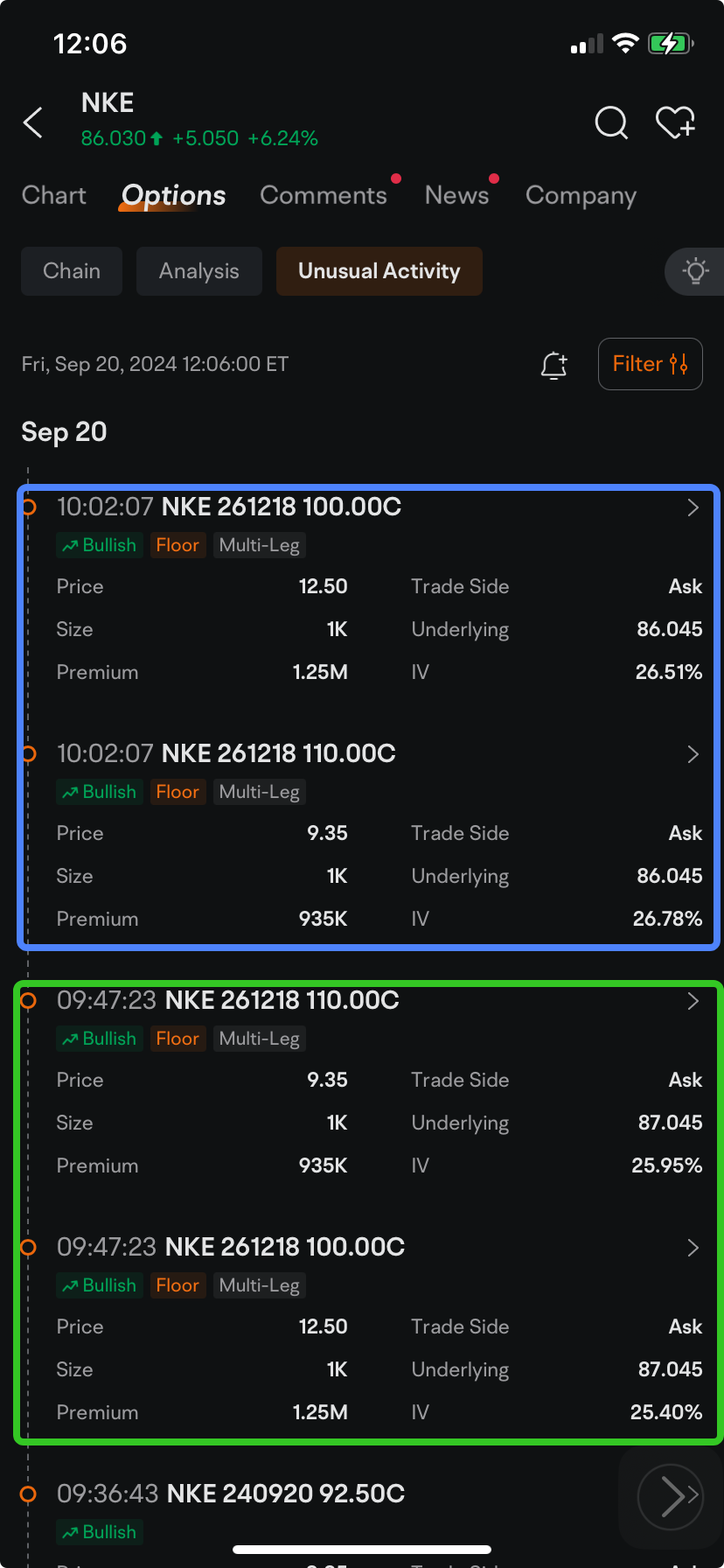

Before noon on Thursday, nine bullish unusual trades and two bearish positions were posted. Four of the bullish transactions were from multi-leg trades. The first was recorded at 9:47:23 a.m. Friday with premiums totaling $2.19 million. In that transaction an active buyer paid a $1.25 million premium for call options that give the holder the right to purchase 100,000 Nike shares at $100 by Dec. 18, 2026. The other transaction had the active buyer paying a premium of $935,00 for call options covering a combined 100,000 shares with a strike price of $110, also expiring on the same day.

A second multi-leg transaction was posted at 10:02:07 a.m. for call options that are also expiring in 819 days with the same volume, strike price and premiums as the first one, according to exchange data tracked by moomoo.

Although the surge in Nike shares began in after-hours trading Thursday, when the CEO change was announced, a block trade of 2.3 million shares at $88 just seconds after the market opened Friday may have helped fuel the rally. Those shares were worth $202.2 million, according to Bloomberg.

The $88 price tag for that block trade is higher than the average fill price of $86.47 as of 12:37 p.m., according to exchange data tracked by moomoo.

While Barclays analyst Adrienne Yih reportedly said that Hill's appointment as Nike CEO "will help reignite a company-wide focus on production innovation, Williams Trading analyst Sam Poser tempered the expectations. It will take about 15 to 18 months until a true product and brand evolution can be realized, Bloomberg News quoted Poser as saying.

Amid the share price rally, technical indicators tracked by moomoo are flashing a warning signal. Ten of the 15 gauges are showing the stock could now be overbought and the trend may be turning bearish. Two were neutral and the remaining three, including the moving average convergence divergence (MACD) were showing positive signs.

The increase in the share price pushed the MACD line above the signal line, an event known as golden cross, which is viewed by many who study charts as a signal of potential uptrend.

The increase in the share price pushed the MACD line above the signal line, an event known as golden cross, which is viewed by many who study charts as a signal of potential uptrend.

Got any thoughts on that 2.3 million-share block trade or anything on Nike, please share them in the comment section. And if you have a price forecast for the stock, please vote below.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

103238951 : good..

n0drip : Woah Phil Knight stepping down didn’t see this coming

ambitious Coyote_958 : 75 or lower Nike ain’t gonna go back to it’s glory days

Nike ain’t gonna go back to it’s glory days

102181510 : o.k

101606705 : ok

Alice Lim choo : good

104476495 : h

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

BONEHEAD20 : If NIKE doesnt get focused on functionslity that includes the art trend, the middle schoolers, high schoolers , and college newbies will start buying from SHEIN and TEMO

Tracey Wilson892 : Too much competition, … it’s feels old, kind of like new balance used to feel, but eventually makes a come back 10 yrs later. Jmo

View more comments...