Stifel analysts downgraded the stock to hold, noting that the company's latest guidance cut, its second in about six months, is undercutting the credibility of its management, adding more uncertainty to the outlook, Wall Street Journal reported. Morgan Stanley analyst Alex Straton also lowered her rating on the stock to equal weight, as she expects to see earnings volatility in the near term, according to another WSJ report.

RetireInStyle : for those who r interested, it is abt time to capture some now.

White_Shadow : just see the facts about Nike as detailed by Morningstar, great tool for detailed analysis hooked up by MooMoo cause it's cool AF. Nike is a great company with strong fundamentals and a loyal customer base, a global leader in retail athletic equipment & apparel, great stock with recent price correction creating a excellent buying opportunity.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

74379264 :

74379264 : $SPDR® S&P 500 ETF (SPY.AU)$

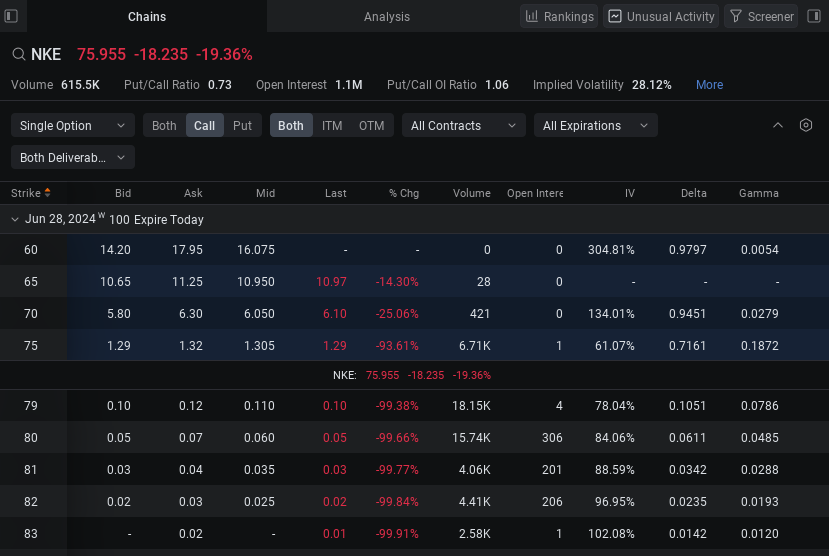

Snow Yo : Nike August Calls are gonna PRINT

KrispyCumnPie : It's a great buying opportunity, price at the pandemic level. The dip is an overreaction.