Will NIO stock continue in a bearish trend?

Fund Management Hong Kong, has lessened its stake in Nio by 4.3% in the 2nd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund sold a total of 55,257 shares during the period. I see a bearish trend for NIO from the company's profitability and macroeconomics points of view:

Company's profitability

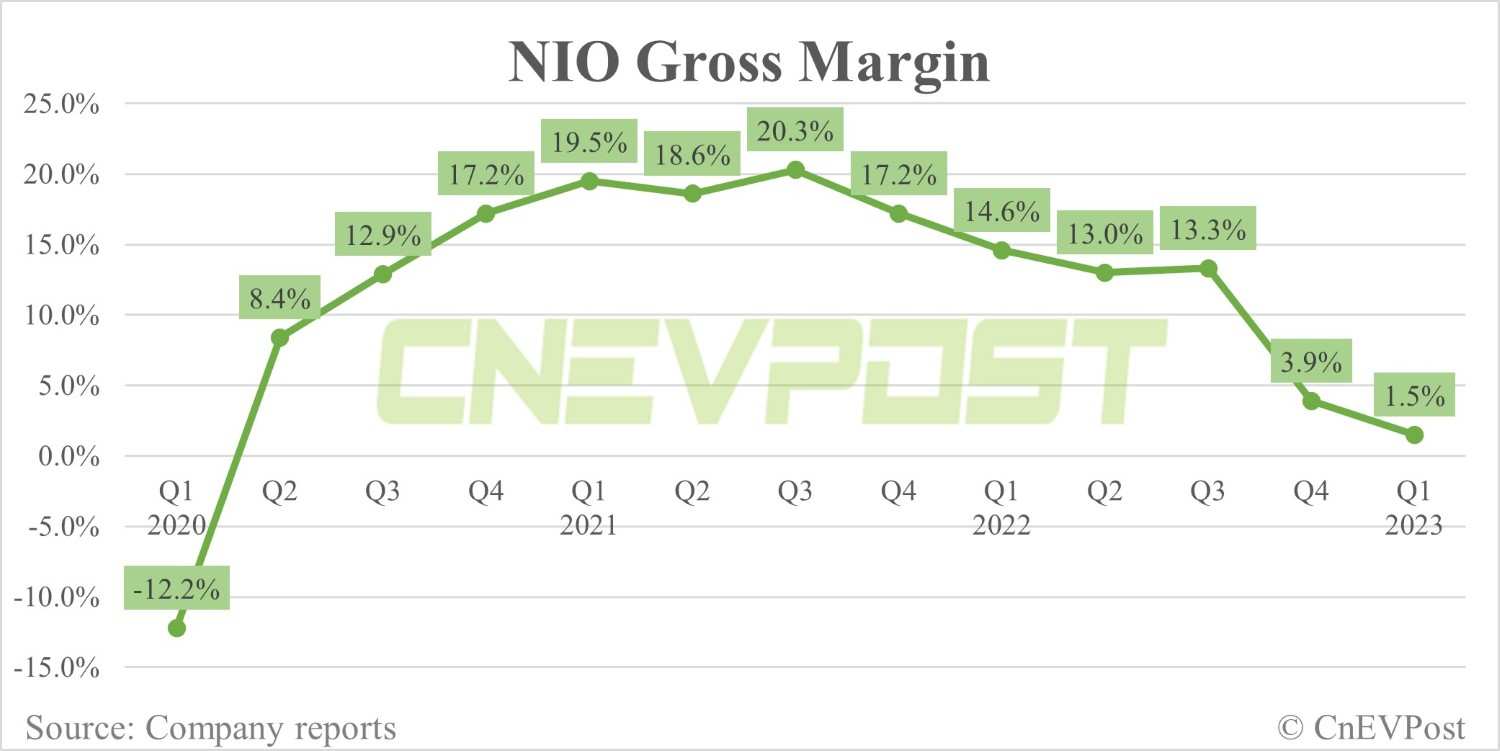

Although NIO reported an increase of in sales, there was a decline in other key financial metrics, like gross margin and net income. The gross margin fell to 10.4% for the whole year of 2022 compared to 18.9% for the previous year, and the net loss widened by 259.4% from the previous year to 14.43 billion.

Company's profitability

Although NIO reported an increase of in sales, there was a decline in other key financial metrics, like gross margin and net income. The gross margin fell to 10.4% for the whole year of 2022 compared to 18.9% for the previous year, and the net loss widened by 259.4% from the previous year to 14.43 billion.

Macroeconomics conditions

NIO weakness is over reliance on government subsidy and China EV market. The car sales are predominantly in China. The participation is EV price cutting make the situation worse. NIO may be innovative in its EV features but lack in reducing production cost. Most of the projects rolled out are burning cash with the latest smartphone. The only thing that save the company is injection of fund by CYVN Holdings.

NIO weakness is over reliance on government subsidy and China EV market. The car sales are predominantly in China. The participation is EV price cutting make the situation worse. NIO may be innovative in its EV features but lack in reducing production cost. Most of the projects rolled out are burning cash with the latest smartphone. The only thing that save the company is injection of fund by CYVN Holdings.

NIO is different fromTesla

Don't be misled by start-up figures because the market conditions in the past is different from now. Based on latest data under the same market conditions, there's a huge gap between the 2 companies' performance:

Tesla Q2 2023

EV sales 466,140 vehicles

Revenue USD 24,927 billion

Earnings per share +USD 0.91 (positive)

Gross margin 18.2%

NIO Q1 2023

EV sales 31,041 vehicles

Revenue USD 1,554.6 million

Earnings per share -USD 0.35 (negative)

Gross margin 1.5%

NIO Q2 2023

EV sales 23,520 vehicles

Don't be misled by start-up figures because the market conditions in the past is different from now. Based on latest data under the same market conditions, there's a huge gap between the 2 companies' performance:

Tesla Q2 2023

EV sales 466,140 vehicles

Revenue USD 24,927 billion

Earnings per share +USD 0.91 (positive)

Gross margin 18.2%

NIO Q1 2023

EV sales 31,041 vehicles

Revenue USD 1,554.6 million

Earnings per share -USD 0.35 (negative)

Gross margin 1.5%

NIO Q2 2023

EV sales 23,520 vehicles

Technical Analysis indicators like wedge pattern and moving average are often use by trader to forecast share prices and trend. But do beware that few unqualified traders may make confirmation bias mistakes in using such tools. Hence it is important to know their limitations.

Limitations in Wedge Pattern

A wedge is a technical analysis pattern used in financial markets, illustrating an asset's narrowing price movement over time. Here are the limitations you should take note:

1) Misinterpretation of Wedges

Wedge patterns can be subjective, and their identification may differ between traders. Differences in selecting highs and lows can lead to varying interpretations, resulting in differing trading decisions.

2) Dependence on Other Market Factors

While wedges can provide potent signals, their reliability is often influenced by other market factors such as economic news, company earnings, or changes in market sentiment. Therefore, traders should use wedges in conjunction with other technical analysis tools or fundamental analysis.

3) False Breakouts and Whipsaws

Wedge patterns can occasionally lead to false breakouts or whipsaws, where the price moves beyond a trend line but quickly reverse, leading to potential losses. It underscores the importance of setting stop losses and waiting for volume confirmation.

Example #1

Investopedia used daily Alphabet Inc. chart to explain a false breakout to the upside. The price moved above the prior high the day before earnings and a breakout even occurred on elevated volume. But when Earnings were released the following day the price gapped lower and the upside breakout failed - bearish downtrend or move side way continued.

Limitations in Wedge Pattern

A wedge is a technical analysis pattern used in financial markets, illustrating an asset's narrowing price movement over time. Here are the limitations you should take note:

1) Misinterpretation of Wedges

Wedge patterns can be subjective, and their identification may differ between traders. Differences in selecting highs and lows can lead to varying interpretations, resulting in differing trading decisions.

2) Dependence on Other Market Factors

While wedges can provide potent signals, their reliability is often influenced by other market factors such as economic news, company earnings, or changes in market sentiment. Therefore, traders should use wedges in conjunction with other technical analysis tools or fundamental analysis.

3) False Breakouts and Whipsaws

Wedge patterns can occasionally lead to false breakouts or whipsaws, where the price moves beyond a trend line but quickly reverse, leading to potential losses. It underscores the importance of setting stop losses and waiting for volume confirmation.

Example #1

Investopedia used daily Alphabet Inc. chart to explain a false breakout to the upside. The price moved above the prior high the day before earnings and a breakout even occurred on elevated volume. But when Earnings were released the following day the price gapped lower and the upside breakout failed - bearish downtrend or move side way continued.

Limitations in Moving Average

Moving averages are widely used technical indicators that help smooth out price data by creating a constantly updated average price. Here are the limitations you should take notes:

1) Lagging Nature of Moving Averages

Moving averages are lagging indicators, which means they are based on historical data and may not always accurately predict future price movements. Investors should be aware of this limitation and consider using additional technical indicators to improve their analysis.

2) Whipsaw Signals

Whipsaw signals refer to the false buy or sell signals generated by moving averages when the market is moving sideways or is highly volatile. To mitigate the impact of whipsaw signals, investors can use other technical indicators or adopt a longer time horizon for their moving averages.

3) Complementary Technical Indicators

While moving averages can provide valuable insights, they should not be used in isolation. Investors should consider using additional technical indicators to enhance their analysis and decision-making process.

Moving averages are widely used technical indicators that help smooth out price data by creating a constantly updated average price. Here are the limitations you should take notes:

1) Lagging Nature of Moving Averages

Moving averages are lagging indicators, which means they are based on historical data and may not always accurately predict future price movements. Investors should be aware of this limitation and consider using additional technical indicators to improve their analysis.

2) Whipsaw Signals

Whipsaw signals refer to the false buy or sell signals generated by moving averages when the market is moving sideways or is highly volatile. To mitigate the impact of whipsaw signals, investors can use other technical indicators or adopt a longer time horizon for their moving averages.

3) Complementary Technical Indicators

While moving averages can provide valuable insights, they should not be used in isolation. Investors should consider using additional technical indicators to enhance their analysis and decision-making process.

$BYD COMPANY (01211.HK)$ $BYD Co. (BYDDF.US)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Tesla (TSLA.US)$ $VOLKSWAGEN A G (VWAGY.US)$ $NIO Inc (NIO.US)$ $Li Auto (LI.US)$ $XPeng (XPEV.US)$ $General Motors (GM.US)$ $Ford Motor (F.US)$ $Rivian Automotive (RIVN.US)$ $MERCEDES-BENZ GROUP AG (MBGAF.US)$ $TOYOTA MOTOR CORP (TOYOF.US)$ $GEELY AUTO (00175.HK)$ $Lucid Group (LCID.US)$ $Stellantis NV (STLA.US)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

bullrider_21 : This discussion is about technical analysis. You are side-stepping instead by talking about limitations. Use technical analysis to justify why it's bearish.

ZnWC OP bullrider_21 : Thanks for contributing "comment".

ZnWC OP : I didn't side track. I give TA break up fail example. Knowing the limitations of TA chart is important to avoid confirmation bias mistakes.

ZnWC OP : Someone is misleading by comparing Nio with Tesla at different time - comparison should be made under the same market condition based on latest data.

bullrider_21 ZnWC OP : Someone is misleading by not comparing at the same stage not the same time. You should compare them before they are profitable. Now you are comparing when Nio is not profitable yet and Tesla which is already profitable.

ZnWC OP bullrider_21 : Thanks for contributing "comment".

ZnWC OP : There is no point repeating the same claim. It doesn't make sense comparing a month which the economy is booming with another which is bearish like the COVID-19 pandemic (which is misleading). Using the company as a start-up is an excuse. Hence setting the same market condition is a more accurate comparison.

bullrider_21 ZnWC OP : There is no point in using now. Tesla had gone through what Nio is going through now. Tesla is now profitable. Of course, when you compare the figures, Nio is bearish.

bullrider_21 ZnWC OP : Don't use now as an excuse. Now Tesla is profitable. Of course, the figures are bullish compared to Nio.

ZnWC OP bullrider_21 : Thanks for contributing "comment".

View more comments...