NIO vs. XPeng: Guess the post-earnings market winner!

Hi mooers!![]()

Chinese EV companies, $XPeng (XPEV.US)$ and $NIO Inc (NIO.US)$ are both scheduled to release their Q3 earnings this week, with XPEV's earnings on November 19 before bell and NIO's earnings on November 20 before bell.

The two companies are competitors at the Chinese Electric Vehicle market. In October, $NIO Inc (NIO.US)$ reported 20,976 vehicles delivery. $XPeng (XPEV.US)$ delivered 23,917 vehicles in October, setting a new record for its monthly deliveries. As of November 15, $XPeng (XPEV.US)$'s market cap stands around $12.1 billion, while $NIO Inc (NIO.US)$'s market cap is about $9.38 billion.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the winner who makes the biggest %gains in intraday trading on the first day after their earnings respectively (e.g., If 50 mooers make a correct guess, each of them will get 100 points.)

(Vote will close at 14:00 ET on November 20)

● Exclusive 300 points: For the top comments on the two companies' earnings prospects under this post.

Analysts expects $XPeng (XPEV.US)$'s Q3 revenue to grow 18.30% YoY to $10.09B, while $NIO Inc (NIO.US)$'s Q3 consensus revenue is $19.10B, with 0.19% YoY growth. Curious about how the companies' performances compare with the market consensus? Moomoo's got the tools!

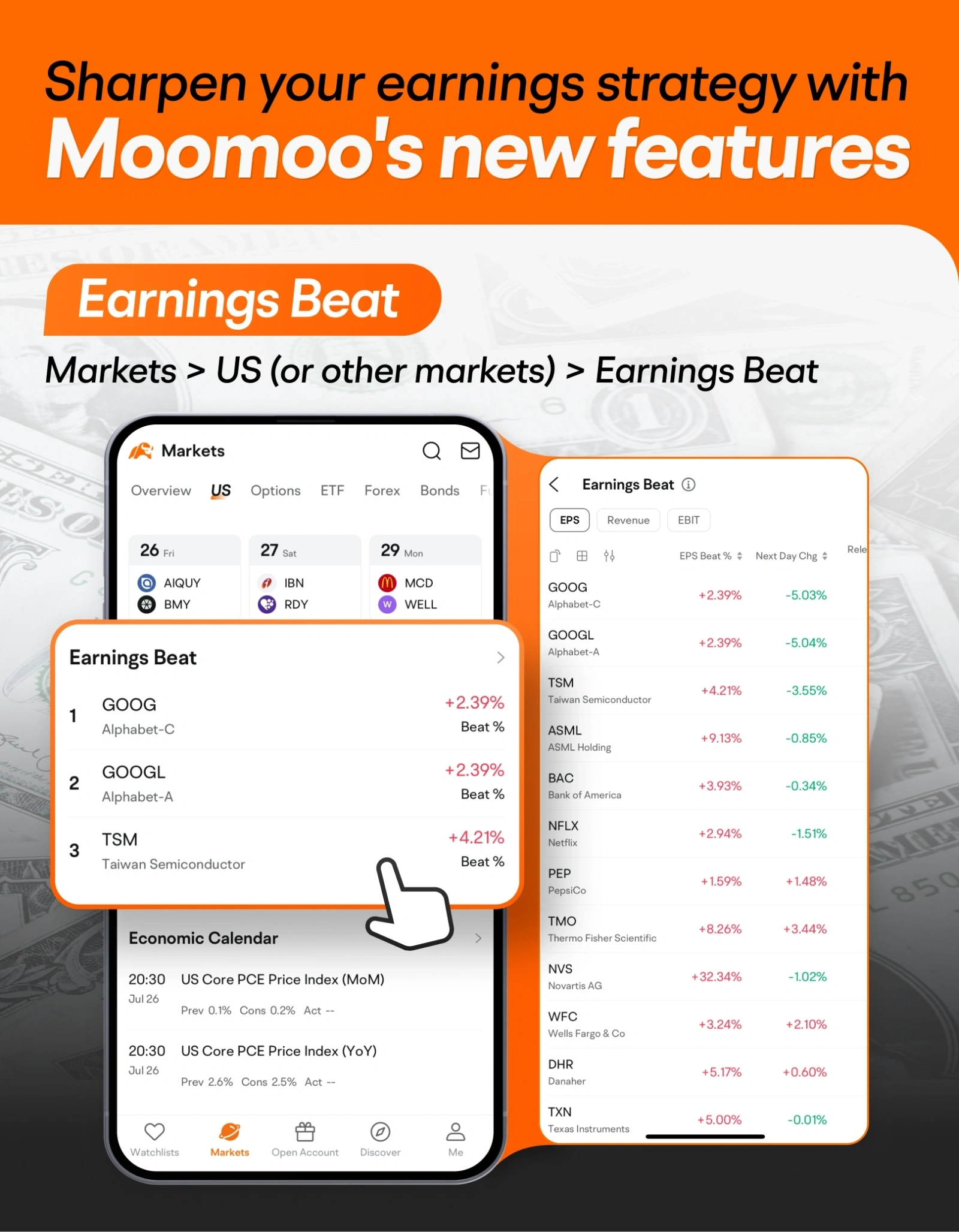

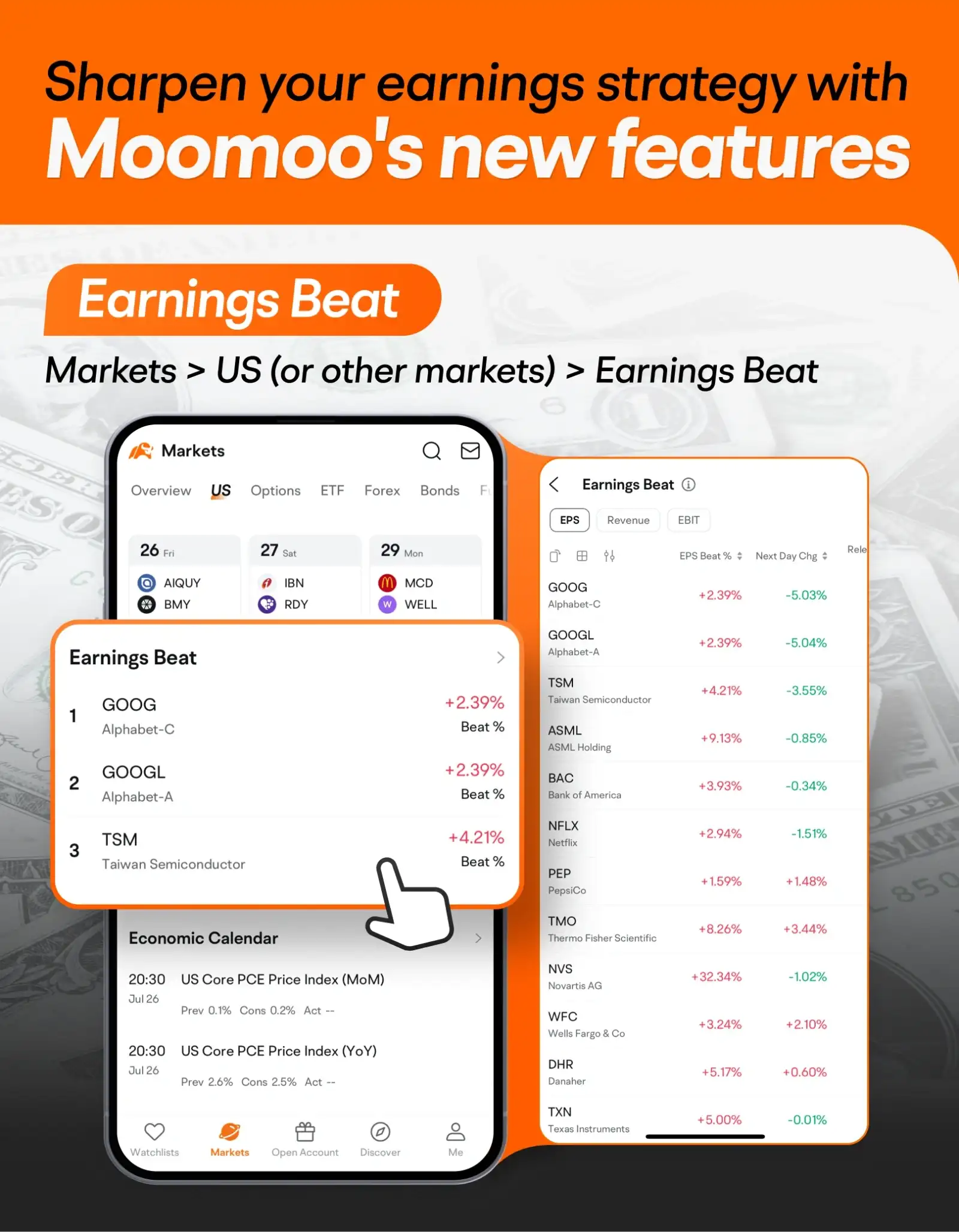

Check out the Earnings Beat feature!

Check out the Earnings Beat feature!

On the other hand, shares of $NIO Inc (NIO.US)$ have seen an increase of 1.81% since its Q2 earnings.

Read more >> Earnings season insights: understanding earnings reports to capture market opportunities

Note:

1. Rewards will be distributed within 5-7 working days after the result's announcement.

2. Rewards can be used to exchange gifts at the Rewards Club (moomoo app>> Me>> Redeem Points).

3. The selection is based on post quality, originality, and user engagement.

1. Rewards will be distributed within 5-7 working days after the result's announcement.

2. Rewards can be used to exchange gifts at the Rewards Club (moomoo app>> Me>> Redeem Points).

3. The selection is based on post quality, originality, and user engagement.

Disclaimer: This material is for informational use only and is not a recommendation of any investment and should not be used as the primary basis of any investment decisions. There is no assurance that any estimates or price targets mentioned will occur. Investing involves risks. Past performance is not indicative of future results. Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC. For AU users: AFSL 224663. All investments carry risks. Consider FSG before applying. Data and information displayed in these images are obtained from independent third-party sources. They do not constitute any financial advice, recommendation or solicitation to acquire or dispose financial products. All contents such as comments and links posted or shared by users of the community are the opinion of the respective authors only and do not reflect the opinions, views, or positions of Moomoo Financial Inc., Moomoo Technologies, any affiliates, or any employees of MFI, MTI or its affiliates. The reward selection shall be made upon moomoo's sole discretion and determination. Points may be redeemed only through the moomoo app and have no other value. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104712493 : 1. Revenue Growth and Sales Momentum

NIO has shown consistent growth in vehicle deliveries, driven by a strong product lineup that includes premium SUVs and sedans. Its Battery-as-a-Service (BaaS) model boosts recurring revenue and attracts cost-sensitive buyers.

Recent international expansion into Europe further diversifies revenue streams.

NIO operates in the premium EV market, which has higher margins compared to XPeng's mid-market focus.

XPeng focuses on mid-tier EVs and has shown significant growth, particularly with models like the P7 sedan and the G6 SUV.

Its competitive pricing strategy appeals to a broader customer base, which could drive volume sales.

XPeng is a leader in autonomous driving technology (XPILOT), which enhances the value of its vehicles and generates potential software revenue.

Advantage: NIO has higher margins due to its premium positioning, but XPeng could see faster growth in the mid-market segment due to broader affordability.

2. Profit Margins

NIO's premium positioning enables higher gross margins, but heavy investments in battery-swapping infrastructure and R&D pressure short-term profitability.

Margins improve as production scales, especially with increased exports.

XPeng's lower vehicle prices compress margins. It relies on scaling production and software-based revenue streams to improve profitability.

XPeng has been aggressive in cost reduction through platform development and localization.

Advantage: NIO has better margin potential in the premium segment, but XPeng’s cost-focused strategy could yield steady long-term profitability.

Dragon Fish : Everyone is picking Nio. Why? Bcos Nio price is at the bottom and Xpeng is at the high. If you use simple maths to count of course Nio will have a better percentage. This is common sense.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Cui Nyonya Kueh : I voted $XPeng (XPEV.US)$![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

73162089 : The prices of NIO cars are 50% higher than XPeng's. The number of cars sold by NIO is also much higher than XPeng during the Q3.

Lucas Cheah : Both $XPeng (XPEV.US)$ and $NIO Inc (NIO.US)$ are key players in China’s burgeoning electric vehicle (EV) market, with unique strengths and challenges shaping their earnings prospects. Here's a detailed analysis:

$XPeng (XPEV.US)$

1. Growth in Smart EV Technology:

XPeng’s focus on advanced autonomous driving features, such as its XPilot system, positions it as a leader in smart EV technology. For example, the company’s G6 SUV integrates cutting-edge software and hardware, appealing to tech-savvy consumers and differentiating it from competitors.

2. International Expansion:

XPeng is expanding into European markets like Norway, Sweden, and Denmark, where EV adoption is high. This diversification provides additional revenue streams beyond the domestic market.

$NIO Inc (NIO.US)$

1. Premium Positioning:

NIO targets the higher-end EV market, with vehicles like the ET7 sedan and ES8 SUV, offering luxury features and excellent build quality. Its innovative Battery-as-a-Service (BaaS) model reduces upfront costs for customers and generates recurring revenue.

2. Expansion Beyond China:

NIO is also focusing on international markets, particularly in Europe, where premium EVs are in demand. This complements its domestic growth strategy.

$XPeng (XPEV.US)$ offers potential for tech-focused growth, while $NIO Inc (NIO.US)$ provides stability with its luxury market and recurring revenue streams. Both companies are positioned for success in the EV market, but NIO’s premium pricing and diversified revenue model may offer more consistent earnings growth.

dman51212 : Bio

dman51212 dman51212 : Nio

72984164 : nay

New93 : yay

Randall Lamoureux : Nio has been poised for an upside for the better part of a year now. It needs it as investors aren’t buying and getting behind the company as they were once expecting large corporations and institutions to do and retail investors only experience the lows and big corporate sell offs for profits leaving us stuck with the bill.

View more comments...