NIO Widen Loss A Concern Despite May Deliveries Set Monthly Record

$NIO Inc (NIO.US)$ is expected to report the quarterly result on 06 June 2024 before market open for the period ending 31 March 2024.

It is expected to show a fall in quarterly revenue. NIO is expected to report a 2.3% decrease in revenue to $10.431 billion from $10.68 billion a year ago. The company's guidance on 05 March 2024, for the period ended 31 March, was for revenue between CNY10.50 billion and CNY11.09 billion.

Earnings per share is expected to be on a loss of CNY2.18 per share.

NIO Last Reported Earnings

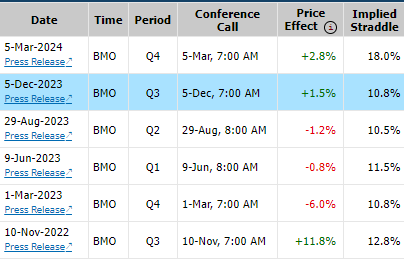

NIO last reported earnings on 05 March 2024 before the market opened (BMO). NIO shares gained +2.8% the day following the earnings announcement to close at 5.48. Following its earnings release, 91 days ago, NIO stock has drifted -4.9% lower. From the time it announced earnings, NIO traded in a range between 3.61 and 6.30. The last price (5.21) is closer to the higher end of range.

Implied straddle for upcoming earnings is 11.4%. As compared to the last quarter earnings, NIO loss is expected to widen and hence, I would expected a negative price effect post its quarterly earnings on 06 June.

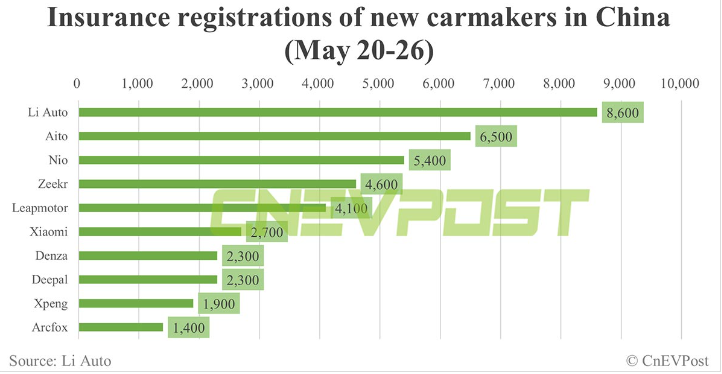

NIO Came In 3rd In Car Registration in China, Did Not Do Much to its stock price

Even though NIO came in with 5,400 insurance registrations for period of 20-26 May 2024, its stock price did not seem to improve.

We are still seeing NIO trading sideways even though it is currently above the 50-day period.

There have been pretty decent buying strength ahead of its quarter earnings tomorrow (06 June 2024), but will it really help NIO to push its stock price higher.

NIO need to solve the issue of revenue declining despite higher deliveries number, especially with competition building up.

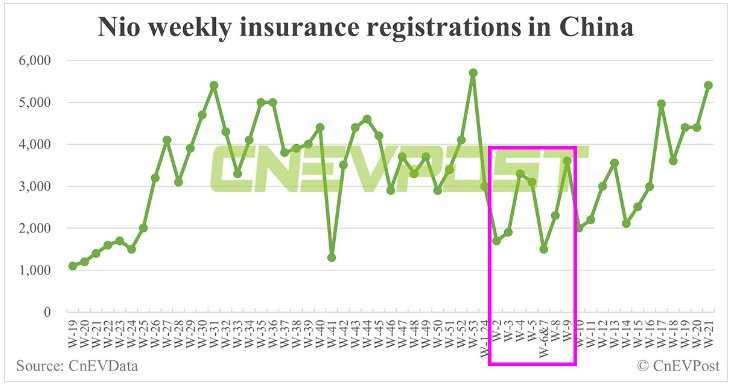

NIO Q1 Deliveries Lower Than Current Quarter

If we were to estimate how NIO earnings would be like, from the sales number, it looks like NIO revenue would be much lower than the previous quarter and also the same period in 2023.

As seen below the Q1 period seem to record pretty low sales based on the weekly insurance registrations. So what we need to look out would be the loss and how NIO revenue and expenses stands in its reporting.

Is NIO A Buy Now?

Based on what I have observed, I am expecting NIO to trade below $5 after its earnings, that would present a good opportunity to buy.

If you look at the chart below, the last buying opportunity was on 29 May 2024, where the price is around $4.78, so I would think NIO would make a dip to around that price between $4.60 to $4.75.

What do we buy now is because based on the insurance registration, the current quarter earnings would be much better, as seen from the registration number, so the next earnings report could see NIO stock price going up.

Summary

Based on the deliveries number NIO has given for May, it is significant for its next quarter earnings, but for the upcoming reporting quarter, we could be seeing a lower sales number from NIO, and hence, their loss could widen.

I am expecting NIO stock price to suffer a decline after its earnings.

Appreciate if you could share your thoughts in the comment section whether you think NIO stock price would decline after its upcoming earnings report?

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

TWP PaPa : Already stop looking at those analyst ....

....

TMW1986 : 1Q sure is bad. Confirm.