Japan's gold medal rush! 5 recommended Paris Olympics stocks! Can double bagger be aimed for with rapid market decline?

The Tokyo Olympics, held in Paris, France from July 26th to August 11th, are buzzing with the success of the Japanese athletes who are continuing to win gold medals. Therefore...Now is the perfect time to target Olympic-related stocks, as the stock prices of Japanese companies have plummeted.Pick up

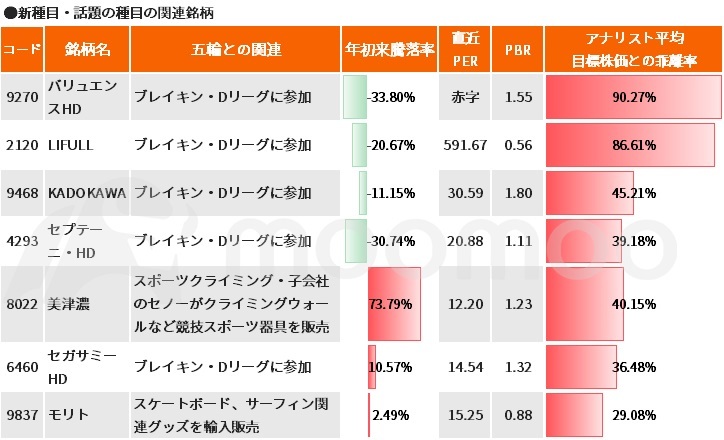

After the sharp decline in stock priceThe stock that has fallen to about half of the analyst's target priceHey,Even though the stock price has increased 1.7 times since the beginning of the year, it is still 40% away from the average target price of analystsThere are also stocks that are doing it.

The only event adopted for the first time at the Paris Olympics, also known as break danceBreaking". At the opening ceremony, Shigekix, a player of breaking, was selected as the flag bearer of the Japanese team, and it is expected to win medals."Medal acquisition is expected.If medal acquisition becomes a catalyst for attracting attention even after the tournament, companies that own teams in the domestic professional dance league "D.LEAGUE" started in 21 and open dance schools may also benefit.

In addition, skateboarding and sport climbing, which were adopted from the previous 21 Tokyo Games, are also popular events.In particular, skateboarding has attracted attention as Japanese athletes have won gold medals in both men's and women's events following the Tokyo Games.Like the above three eventsFollowing the Tokyo Games, Japanese athletes have won gold medals in both men's and women's skateboarding events.and have attracted attention.Urban sports is seeing an increasing number of participants, and with the expansion of the related market, a rise in related stocks can also be expected.That's it.

◆ $Valuence Holdings (9270.JP)$:Analysts see more than a 90% upside potential in the target stock price.

Ranked second domestically in the reuse market of second-hand luxury goods.At stores like 'Nanboya', they purchase used items and conduct sales primarily through their own auctions, as well as wholesale and retail operations. As of the end of May 2024, they operate 138 domestic purchase stores and 44 overseas stores, with strengthened partnerships with financial institutions, department stores, and others.

For the fiscal year ending August 2024, performance was revised downward from the initial forecast of increased revenue and profit due to higher selling and administrative expenses, new store openings, and increased upfront investments in web marketing. The revenue is expected to increase by 8.2% to 82.4 billion yen compared to the previous year, with an operating loss of 0.6 billion yen and a net loss of 1.89 billion yen.

The dance team operated by Valuens Japan, a subsidiary, will participate in the D-League in 2022. In January 2024, a dance academy will be opened.

One analyst's target stock price is 1800 yen, which is 90.3% higher than the closing price on the 2nd day.The stock price target is 1800 yen, which is 90.3% higher than the closing price on the 2nd day.。

Ranked second domestically in the reuse market of second-hand luxury goods.At stores like 'Nanboya', they purchase used items and conduct sales primarily through their own auctions, as well as wholesale and retail operations. As of the end of May 2024, they operate 138 domestic purchase stores and 44 overseas stores, with strengthened partnerships with financial institutions, department stores, and others.

For the fiscal year ending August 2024, performance was revised downward from the initial forecast of increased revenue and profit due to higher selling and administrative expenses, new store openings, and increased upfront investments in web marketing. The revenue is expected to increase by 8.2% to 82.4 billion yen compared to the previous year, with an operating loss of 0.6 billion yen and a net loss of 1.89 billion yen.

The dance team operated by Valuens Japan, a subsidiary, will participate in the D-League in 2022. In January 2024, a dance academy will be opened.

One analyst's target stock price is 1800 yen, which is 90.3% higher than the closing price on the 2nd day.The stock price target is 1800 yen, which is 90.3% higher than the closing price on the 2nd day.。

◆ $Mizuno (8022.JP)$:Although it has risen by more than 70% since the beginning of the year, there is still about a 40% increase potential.

A leading specialist in sports equipment, including sportswear, sports shoes, and baseball/golf-related products. It is a long-established company with a history of over 100 years. It also engages in the construction and operation of sports facilities.

24年3月期は国内に加えてアジア・オセアニアでも売り上げを伸ばし、売上、利益とも過去最高を更新。25年3月期は売上高が前年度比8.8%増の250 billion円、営業利益が10.0%増の19 billion円、純利益が4.8%増の15 billion円で、いずれも過去最高額の更新を見込んでいる。

2012年に買収した子会社のセノーはクライミングウォールのほか、体操・バスケットボール・バレーボールなど競技スポーツ器具を製造販売している。

year初から株価は7割以上上昇しているが、アナリスト2人のThe average target stock price is 40.2% higher than the closing price on the 2nd.。

A leading specialist in sports equipment, including sportswear, sports shoes, and baseball/golf-related products. It is a long-established company with a history of over 100 years. It also engages in the construction and operation of sports facilities.

24年3月期は国内に加えてアジア・オセアニアでも売り上げを伸ばし、売上、利益とも過去最高を更新。25年3月期は売上高が前年度比8.8%増の250 billion円、営業利益が10.0%増の19 billion円、純利益が4.8%増の15 billion円で、いずれも過去最高額の更新を見込んでいる。

2012年に買収した子会社のセノーはクライミングウォールのほか、体操・バスケットボール・バレーボールなど競技スポーツ器具を製造販売している。

year初から株価は7割以上上昇しているが、アナリスト2人のThe average target stock price is 40.2% higher than the closing price on the 2nd.。

◆ $Sega Sammy Holdings (6460.JP)$:This fiscal year, a special profit of approximately 8.5 billion yen is expected to be recorded, and the overall evaluation by analysts is "bullish".

It is a holding company that was established through the integration of Sammie, a major manufacturer and distributor of pachinko and pachislot machines, and Sega, a game software development company. It holds a stake in the Korean integrated resort company "Paradise Sega Sammy" under the equity method.

In the fiscal year ending in March 2024, despite an increase in revenue and operating profit, net profit was lower than the previous year due to losses related to the restructuring of the European business. In the fiscal year ending in March 2025, it is expected that revenue will decrease by 4.9% to 445 billion yen compared to the previous year, and operating profit will decrease by 20.8% to 45 billion yen, due to factors such as the sale of Phoenix Resort, which operates "Seagaia" in Miyazaki City.Approximately 8.5 billion yen of special profit will be recorded due to the sale.It is expected that net profit will increase by 18.0% to 39 billion yen.

Participated in the D League since its inception in 2021. In July 2024, it announced that it was offered as a return gift to hometown tax payers in Shinagawa Ward, Tokyo, where the head office is located.They have announced that dance lessons by a dance team have been adopted as a gift for those who have made local tax payments in Shinagawa Ward, Tokyo.They have announced that dance lessons by a dance team have been adopted as a gift for those who have made local tax payments in Shinagawa Ward, Tokyo.

The stock price has risen more than 10% since the beginning of the year.The comprehensive evaluation of 10 analysts is "bullish", and there is a potential increase of 36.5% to the average target stock price.There is.

It is a holding company that was established through the integration of Sammie, a major manufacturer and distributor of pachinko and pachislot machines, and Sega, a game software development company. It holds a stake in the Korean integrated resort company "Paradise Sega Sammy" under the equity method.

In the fiscal year ending in March 2024, despite an increase in revenue and operating profit, net profit was lower than the previous year due to losses related to the restructuring of the European business. In the fiscal year ending in March 2025, it is expected that revenue will decrease by 4.9% to 445 billion yen compared to the previous year, and operating profit will decrease by 20.8% to 45 billion yen, due to factors such as the sale of Phoenix Resort, which operates "Seagaia" in Miyazaki City.Approximately 8.5 billion yen of special profit will be recorded due to the sale.It is expected that net profit will increase by 18.0% to 39 billion yen.

Participated in the D League since its inception in 2021. In July 2024, it announced that it was offered as a return gift to hometown tax payers in Shinagawa Ward, Tokyo, where the head office is located.They have announced that dance lessons by a dance team have been adopted as a gift for those who have made local tax payments in Shinagawa Ward, Tokyo.They have announced that dance lessons by a dance team have been adopted as a gift for those who have made local tax payments in Shinagawa Ward, Tokyo.

The stock price has risen more than 10% since the beginning of the year.The comprehensive evaluation of 10 analysts is "bullish", and there is a potential increase of 36.5% to the average target stock price.There is.

◆ $Morito (9837.JP)$:Value stocks with a PBR below 1, despite achieving their highest-ever earnings, have a high market share in niche areas.

A trading company specializing in fashion accessories such as hooks and Velcro. The company holds the top position in Japan for metal hooks and is ranked among the world's best. In addition to apparel, they also offer products for the consumer industry materials and automotive interior components. They are pursuing a strategy of acquiring a high market share in niche areas.

In the fiscal year ending November 2023, the company achieved its highest-ever revenue and operating profit.For the fiscal year ending November 2024, they are expecting a 5.1% increase in revenue to 51 billion yen compared to the previous year, a 5.5% increase in operating profit to 2.6 billion yen, and a 3.7% increase in net profit to 2.3 billion yen.They anticipate achieving their highest-ever earnings in the fiscal year ending November 2024.They are projecting an annual dividend of 58 yen for the fiscal year ending November 2024.The annual dividend yield based on the closing price on the second day is 4.4%.becomes.

A subsidiary acquired in 2018, Manouverline, imports and sells skateboards and surfing-related items from the United States and Australia.

According to Morningstar's fair value stock price, it is about 30% higher than the closing price on the 2nd.The PBR at the closing price on the 2nd is 0.880 times.The stock value of this brand with a strong sense of stability that has maintained a stable performance even in the event of oil shocks, the Lehman shock, and the spread of the new coronavirus infection is showing a sense of value.

A trading company specializing in fashion accessories such as hooks and Velcro. The company holds the top position in Japan for metal hooks and is ranked among the world's best. In addition to apparel, they also offer products for the consumer industry materials and automotive interior components. They are pursuing a strategy of acquiring a high market share in niche areas.

In the fiscal year ending November 2023, the company achieved its highest-ever revenue and operating profit.For the fiscal year ending November 2024, they are expecting a 5.1% increase in revenue to 51 billion yen compared to the previous year, a 5.5% increase in operating profit to 2.6 billion yen, and a 3.7% increase in net profit to 2.3 billion yen.They anticipate achieving their highest-ever earnings in the fiscal year ending November 2024.They are projecting an annual dividend of 58 yen for the fiscal year ending November 2024.The annual dividend yield based on the closing price on the second day is 4.4%.becomes.

A subsidiary acquired in 2018, Manouverline, imports and sells skateboards and surfing-related items from the United States and Australia.

According to Morningstar's fair value stock price, it is about 30% higher than the closing price on the 2nd.The PBR at the closing price on the 2nd is 0.880 times.The stock value of this brand with a strong sense of stability that has maintained a stable performance even in the event of oil shocks, the Lehman shock, and the spread of the new coronavirus infection is showing a sense of value.

The rise in stock prices of sporting goods manufacturers during the Olympic Games can be said to be a 'conventional pattern', but it may be an opportunity to buy on dips due to the recent sharp decline in the market.

◆ $ASICS (7936.JP)$:The stock price has doubled since the beginning of the year! Progressing with a double-digit increase from the highest previous period settlement.

As a leading sports shoe company, it holds a prominent position among the world's major sporting goods manufacturers. It also has a high level of recognition overseas, including the "Onitsuka Tiger" brand.Approximately 80% of the sales come from overseas.In the fiscal year ending in December 2023, sales and profits reached an all-time high with a double-digit increase, driven by a strong performance in Asia including Japan.

The company is expecting further revenue and profit growth in the fiscal year ending in December 2024.。The company also plans to increase revenue and profit for the fiscal year ending in December 2024.The company is expecting sales of 590 billion yen, a 3.4% increase from the previous fiscal year, operating profit of 58 billion yen, a 7.0% increase, and net profit of 36 billion yen, a 2.1% increase.In the first quarter (January to March), both sales and profits have increased by double digits.The exchange rate during the period is assumed to be 1 dollar = 140 yen.

Since the beginning of the year, the stock price has soared to about double.Despite this, the comprehensive assessment by 7 analysts maintains a "bullish" outlook, with an average target stock price still having room for a 17.6% increase from the closing price on the 2nd day.There is still a 17.6% upside potential from the closing price on the 2nd day.There is still a 17.6% upside potential from the closing price on the 2nd day.

As a leading sports shoe company, it holds a prominent position among the world's major sporting goods manufacturers. It also has a high level of recognition overseas, including the "Onitsuka Tiger" brand.Approximately 80% of the sales come from overseas.In the fiscal year ending in December 2023, sales and profits reached an all-time high with a double-digit increase, driven by a strong performance in Asia including Japan.

The company is expecting further revenue and profit growth in the fiscal year ending in December 2024.。The company also plans to increase revenue and profit for the fiscal year ending in December 2024.The company is expecting sales of 590 billion yen, a 3.4% increase from the previous fiscal year, operating profit of 58 billion yen, a 7.0% increase, and net profit of 36 billion yen, a 2.1% increase.In the first quarter (January to March), both sales and profits have increased by double digits.The exchange rate during the period is assumed to be 1 dollar = 140 yen.

Since the beginning of the year, the stock price has soared to about double.Despite this, the comprehensive assessment by 7 analysts maintains a "bullish" outlook, with an average target stock price still having room for a 17.6% increase from the closing price on the 2nd day.There is still a 17.6% upside potential from the closing price on the 2nd day.There is still a 17.6% upside potential from the closing price on the 2nd day.

When athletes receive attention by winning gold medals, among other things, and have more opportunities to be exposed in the media, it is not insignificant in terms of advertising effects for the affiliated companies, including after the tournament.

At this point, the affiliated companies of athletes who have won gold medals and those who are expected to win medals can expect a rise in stock prices.

In this tournament, Japanese companies account for three out of the 15 "Worldwide Partners" which are positioned as the top sponsors. While it was difficult to conduct extensive advertising activities in the previous Tokyo Games due to the self-restraint mood caused by the COVID-19 pandemic, this time, sponsor effects can be expected.

moomoo News Mark

Source: Websites of respective companies, Olympic official website, moomoo

Source: Websites of respective companies, Olympic official website, moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment