North America Midstream and Refining Preview | Diesel economics strengthening and improvement innatural gas sentiment

Core Points:

Domestic refining activity is improving as demand for diesel increases and inventory levels remain low.

The global product supply outlook includes new hydrotreating units at Kuwait's al-Zour refinery and an expected increase in China's oil product export quotas.

There are positive developments in the natural gas market, with a potential increase in production in late 2023/early 2024 driven by visible demand and producer inquiries for work in the Haynesville.

Body Text:

Domestic refining tailwinds soldier on, partly offset by incremental global product supply. From the 2Q23 earnings cycle, operators cited positive developments related to resilient underlying demand coupled with increased market share following pandemic related closures. Looking at 3Q23, US diesel margin expansion has accelerated recently across regions. With the backdrop of persistently low inventories (Figure 77), fundamental activity is improving with the American Trucking Association’s Tonnage Index having increased for 2 consecutive months (seasonally adjusted) from the recent low of 112.7 in April to 116.5 in June. In addition, a seasonal uplift from agricultural demand come harvest season will be additive, as will heating demand in the winter. In terms of the global product supply outlook, Kuwait brought online the third and final hydrotreating unit at its 615 kbpd al-Zour refinery as of early August. The first of al-Zour’s three 205 kbpd CDUs came online in November 2022, the second in late March, and the third was online as of the beginning of July. Al-Zour is expected to be fully operational by the end of 3Q. In China, diesel export arb remains economic (Figure 91) and a third export quota for 10 mt (81 mmbbls) of oil products is expected to be issued in August. Total quotas for 2023 could be as high as 50 mt vs. 28 mt from the first two quotas this year and up from 37.25 mt in 20221 .

E&P and oil services commentary suggest less producer pessimism on natural gas, with the Henry Hub forward curve still in steep contango plus continual visibility in incremental LNG export demand pull in 2024+. Continuing earlier conversations regarding the pullback in natural gas prices for much of 2023 and the outlook from here, US gas rig counts seem to be finding a bottom (128 in the past two weeks from >160 level in March/April). While Haynesville producers continue to exhibit disciplined behavior, temporarily pausing or deferring activity, the deceleration in the rate of rig count declines is a positive signal worth monitoring along with some optimism that HH prices are no longer in free fall.

Although it may be too early to call a definitive trend, we wouldn’t be surprised to see additional tailwinds in the production outlook come late 2023/early 2024. Land driller ICD (not covered) cited “inquiries for work in the Haynesville picking up over the past couple of weeks” as of its 2Q23 earnings call on 8/3/23. The Henry Hub forward curve structure signals an incentive to incrementally produce next year and beyond, coupled with visible demand pull from additional LNG export out of the USGC beginning with the Golden Pass LNG Train 1 projected to come online in 2H24. Near-term, we think the ramp-up of Gulf Coast export projects will be positive for DTM given the positioning of its LEAP Project, with the Phase 1 pipeline expansion potentially coming online in 3Q23 before official ISD of 4Q23. Looking ahead to 2024, we think DTM has positioned itself for a good set-up for Haynesville growth in 2024 given the timing of the rest of its projects (both Phase 2 and 3) expected to come underway in 1Q24 and 3Q24, respectively. As Haynesville DUC inventory grows ahead of 2024/2025, offering gas volume growth torque to match the ramp in liquefaction capacity, we think this will also be positive for other gas-levered names in our coverage including WMB.

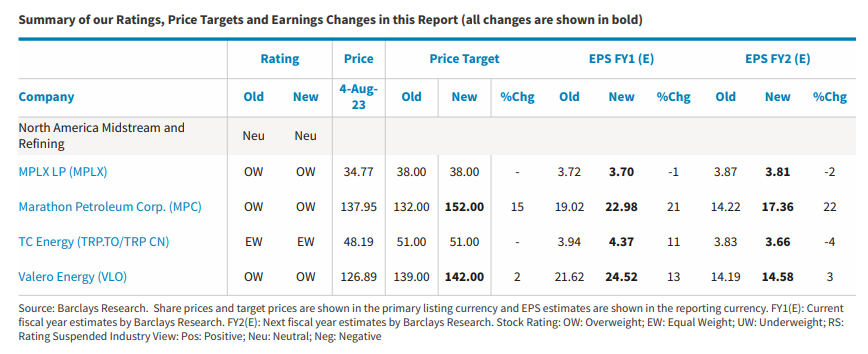

Estimate updates: We are revising our estimates for MPC, MPLX, TRP, and VLO to factor in updated commodity prices and recent announcements. We are updating our PTs for MPC to $152 from $132 previously and VLO $142 from $139 previously. Our MPLX and TRP PTs are unchanged at $38 and C$51.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment