IPO Series - Northeast Group Berhad - The Next UWC / SFP Tech ? Precision Engineering Components Manufacturer

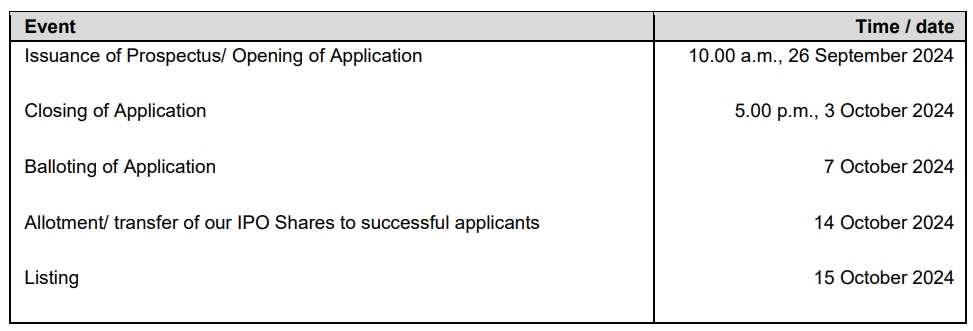

Figure 1: IPO timetable of Northeast Group Berhad

-Will be listed on the ACE Board

-Will be listed on the ACE Board

Full Video of Northeast Group Berhad (Chinese version): - YouTube

Info of IPO

Enlarged no. of shares upon listing: 740 million

IPO price: RM0.50

Market capitalization: RM370 million

Estimated funds to raise from Public Issue: RM84.49 million

PE ratio = 20.15x (based on FY2023)

Enlarged no. of shares upon listing: 740 million

IPO price: RM0.50

Market capitalization: RM370 million

Estimated funds to raise from Public Issue: RM84.49 million

PE ratio = 20.15x (based on FY2023)

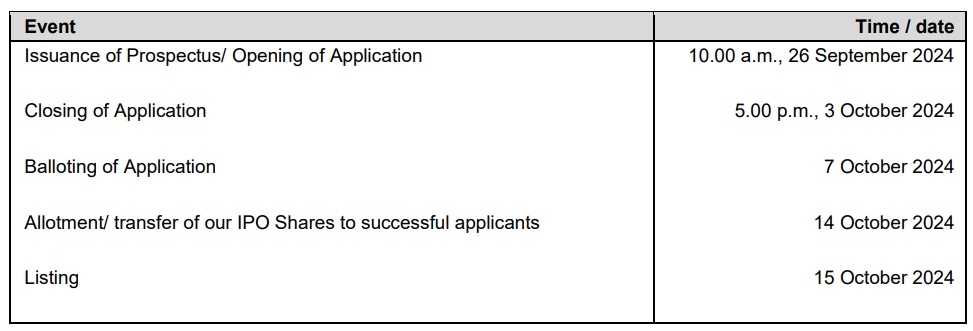

Business Model

Figure 2: Business model of Northeast Group Berhad

Source: Northeast Group Berhad IPO prospectus

Source: Northeast Group Berhad IPO prospectus

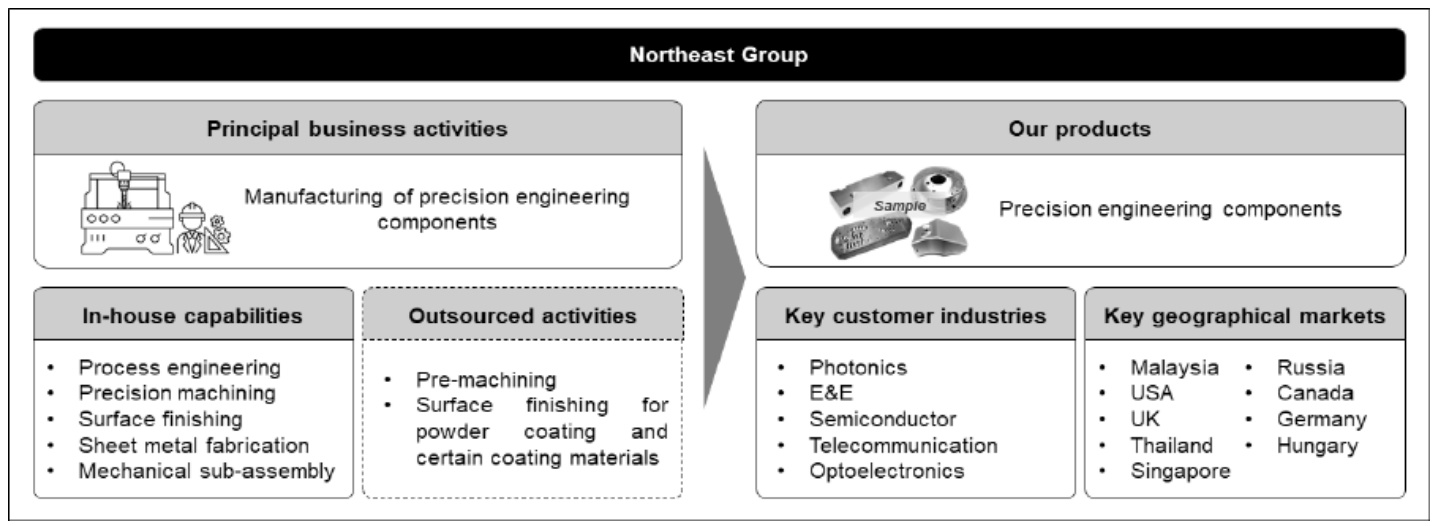

Precision Components

Figure 3: Application of precision engineering components

Source: Northeast Group Berhad IPO prospectus

Source: Northeast Group Berhad IPO prospectus

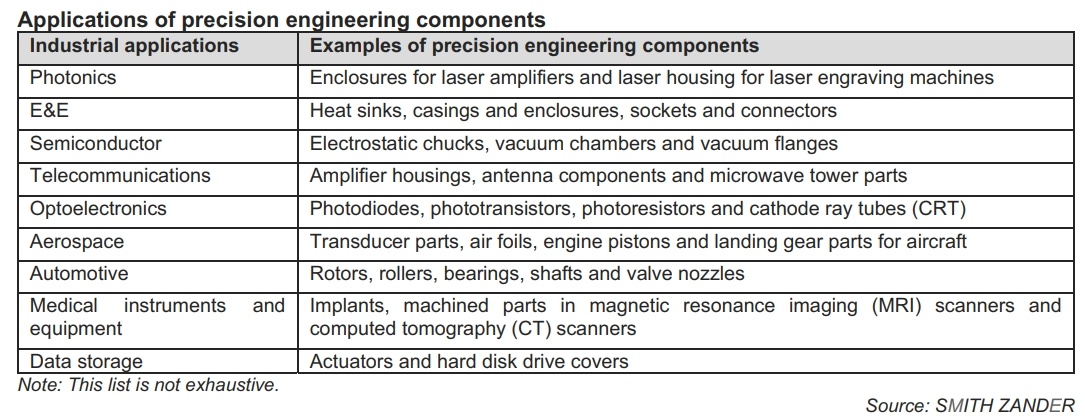

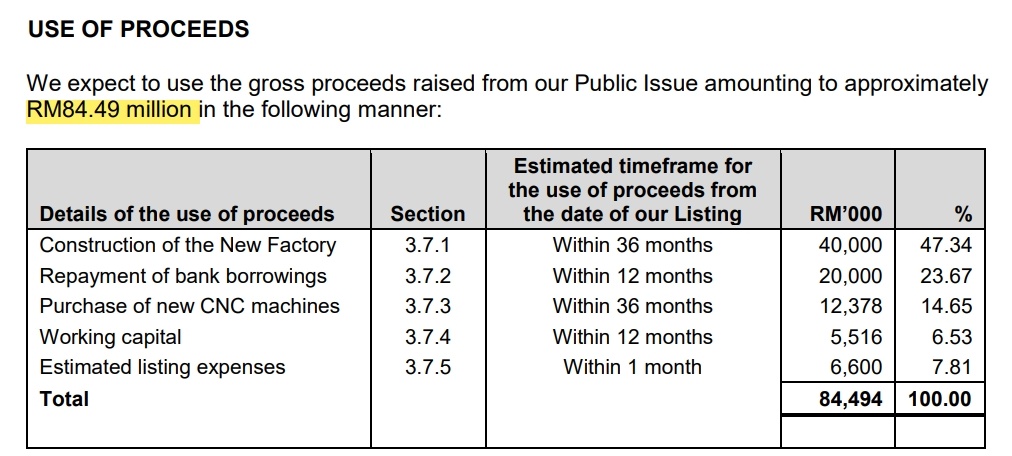

Utilisation of Proceeds

Figure 4: Utilisation of proceeds of Northeast Group Berhad

Source: Northeast Group Berhad IPO prospectus

Source: Northeast Group Berhad IPO prospectus

Dividend Policy

-The group does not have a dividend policy

-The group does not have a dividend policy

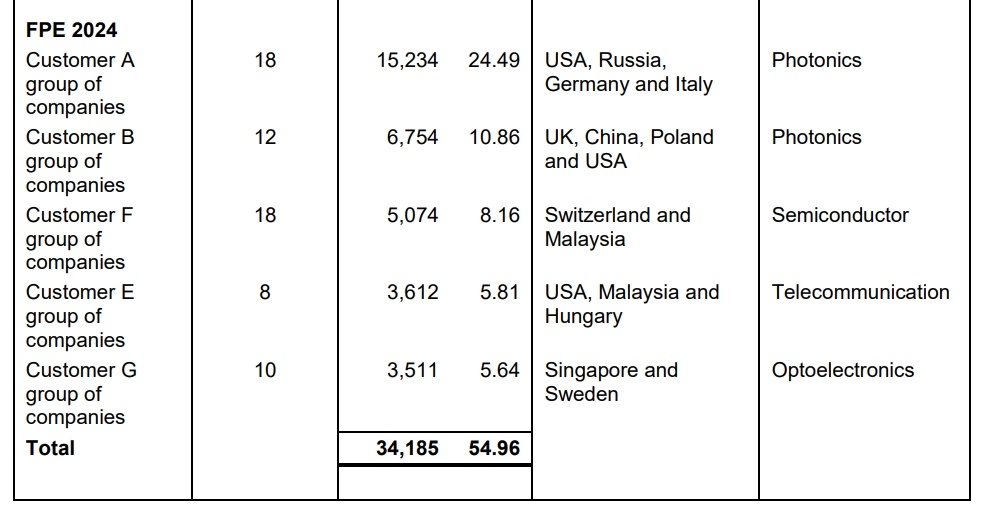

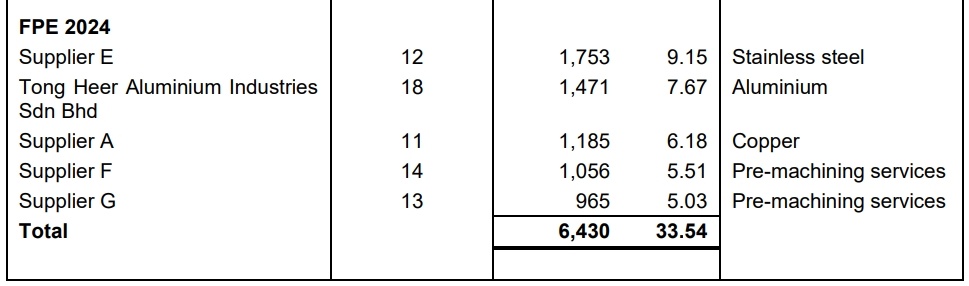

Major Customers and Major Suppliers

Figure 5: Major customers and suppliers of Northeast Group Berhad in FPE2024

Source: Northeast Group Berhad IPO prospectus

Source: Northeast Group Berhad IPO prospectus

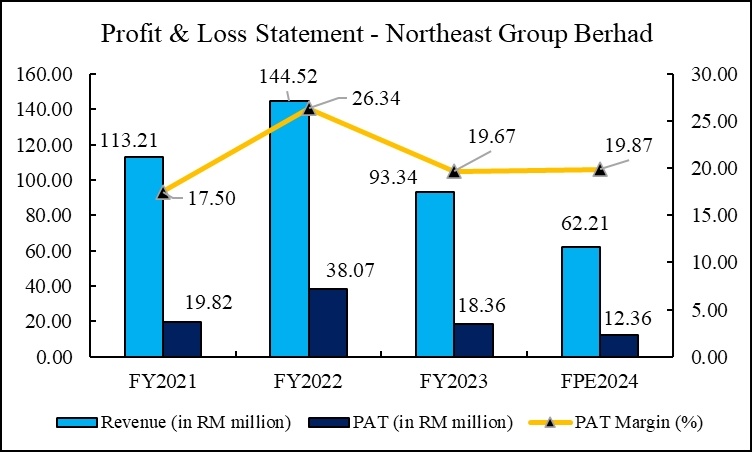

Financial Summary

Fiure 6: Profit & Loss statement of Northeast Group Berhad

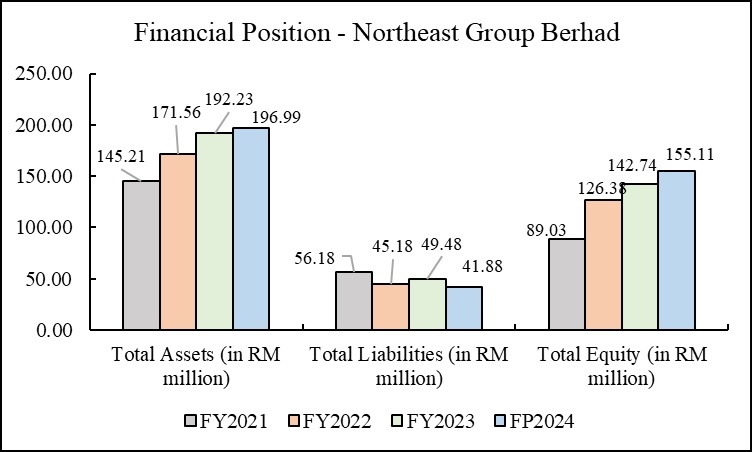

Figure 7: Financial position of Northeast Group Berhad

Financial overview, industry market, and personal opinion

-The group has recorded its highest PAT and PAT margin in FY2022, with RM38.07 million and 26.34% respectively. However, the group’s revenue is closely tied to the price movement of commodities, including aluminum and copper.

-The group business is similar to certain famous precision engineering components companies like UWC Berhad, SFP Tech, Coraza, etc., which outperformed during the listing day. The major revenue by currency is USD from FY2021 to FPE2024, which has potentially affected the group’s revenue due to the change in FOREX value.

-Global semiconductor demand is still in the recovery stage, and the recent hot topics like AI and data centers might boost the sentiment of these related companies.

-The group has recorded its highest PAT and PAT margin in FY2022, with RM38.07 million and 26.34% respectively. However, the group’s revenue is closely tied to the price movement of commodities, including aluminum and copper.

-The group business is similar to certain famous precision engineering components companies like UWC Berhad, SFP Tech, Coraza, etc., which outperformed during the listing day. The major revenue by currency is USD from FY2021 to FPE2024, which has potentially affected the group’s revenue due to the change in FOREX value.

-Global semiconductor demand is still in the recovery stage, and the recent hot topics like AI and data centers might boost the sentiment of these related companies.

Would you apply for this IPO? Share your thoughts in the comments section below.

Disclaimer: The above content is not an investment advisory service and does not purport to tell or suggest which securities or stocks customers should buy or sell for themselves. It should not be assumed that the methods, techniques, or indicators presented above will be profitable or will not result in losses. You should not rely solely on information when making any investment. Rather, you should use the information only as a starting point for doing additional independent research to allow you to form your own opinion regarding investments.

The details of the IPO prospectus can be accessed through

https://www.klsescreener.com/v2/announcements/view/7974397

https://www.klsescreener.com/v2/announcements/view/7974397

By: Jshen Ng

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment