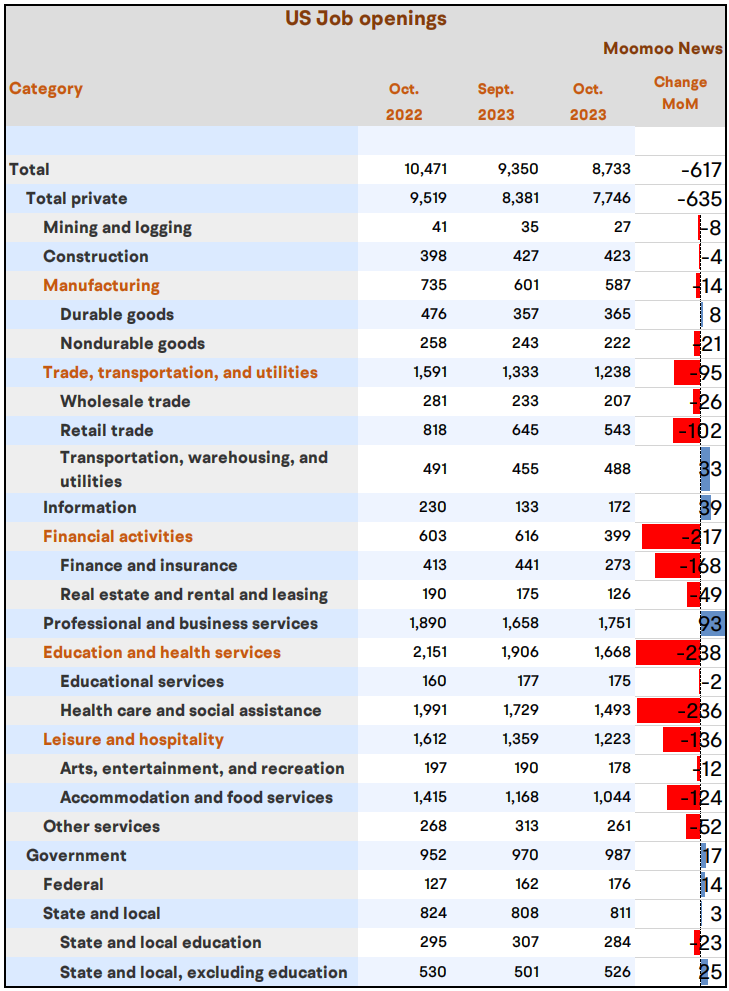

The JOLTs report released on Tuesday showed that the number of job openings dropped significantly to 8.73 million, marking the lowest level since March 2021 and falling below the market consensus of 9.3 million. During the month, job openings decreased in health care and social assistance (-236,000), finance and insurance (-168,000), and real estate and rental and leasing (-49,000). On the other hand, job openings increased in information (+39,000).

Lang Lang : https://security.moomoo.com/security/auth-email/?clientver=13.43.13708&ca_cid=104583181&main_broker=WzEwMTdd&user_id_type=3&data_ticket=7ffb056fbaa9d17abd76264b079e638f&channel=4&clientlang=2&clienttype=53&user_main_broker=WzBd&is_visitor=0&skintype=1#/