NVDA Earnings Preview: Grab rewards by guessing the opening price!

Hi mooers! ![]()

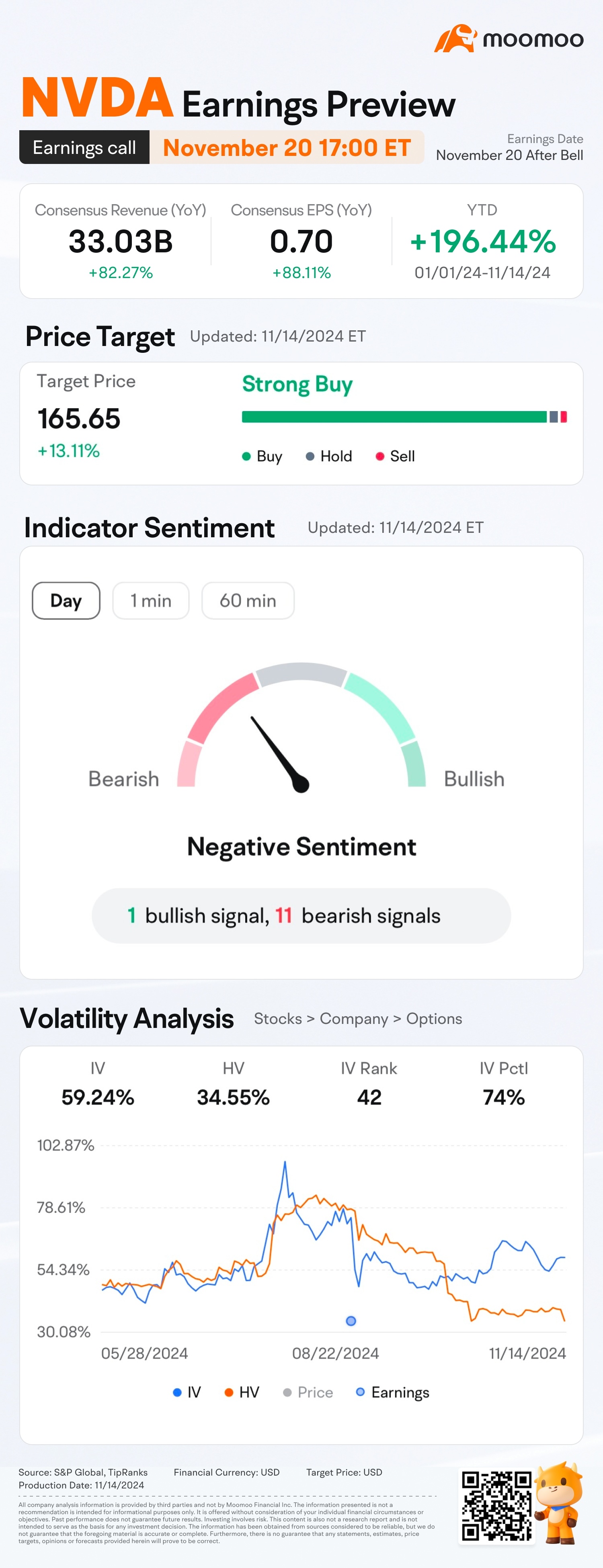

The world's most valuable company, $NVIDIA (NVDA.US)$, is set to release its Q3 FY2025 financial results on November 20 after the bell. Unlock insights with NVDA Earnings Hub>>

As of 14 November, share prices of $NVIDIA (NVDA.US)$ have increased +196.44% in this year.![]() It is now the world's most valuable company with a $3.6 trillion market cap

It is now the world's most valuable company with a $3.6 trillion market cap![]() .

.

As big tech companies like $Amazon (AMZN.US)$, $Alphabet-A (GOOGL.US)$ and $Meta Platforms (META.US)$ all poised to increase their AI investment, how would Nvidia be benefited? Would Nvidia CEO Jensen Huang give us more information about Blackwell processor and the future of generative AI? Subscribe to @Moo Live and book the conference call!

Since its Q2 FY2025 earnings, shares of $NVIDIA (NVDA.US)$ have increased 16.8%.![]() How will the market react to the upcoming results? Make your guess now!

How will the market react to the upcoming results? Make your guess now!

(Vote will close on 9:30 ET November 21)

● Exclusive 300 points: For the writer of the top post on analyzing NVDA's earnings prospects.

Read more >> Earnings season insights: understanding earnings reports to capture market opportunities

Note:

1. Rewards will be distributed within 5-7 working days after the result's announcement.

2. Rewards can be used to exchange gifts at the Rewards Club (moomoo app>> Me>> Redeem Points).

3. The selection is based on post quality, originality, and user engagement.

1. Rewards will be distributed within 5-7 working days after the result's announcement.

2. Rewards can be used to exchange gifts at the Rewards Club (moomoo app>> Me>> Redeem Points).

3. The selection is based on post quality, originality, and user engagement.

Disclaimer: This material is for informational use only and is not a recommendation of any investment and should not be used as the primary basis of any investment decisions. There is no assurance that any estimates or price targets mentioned will occur. Investing involves risks. Past performance is not indicative of future results. Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC. For AU users: AFSL 224663. All investments carry risks. Consider FSG before applying. Data and information displayed in these images are obtained from independent third-party sources. They do not constitute any financial advice, recommendation or solicitation to acquire or dispose financial products. All contents such as comments and links posted or shared by users of the community are the opinion of the respective authors only and do not reflect the opinions, views, or positions of Moomoo Financial Inc., Moomoo Technologies, any affiliates, or any employees of MFI, MTI or its affiliates. The reward selection shall be made upon moomoo's sole discretion and determination. Points may be redeemed only through the moomoo app and have no other value. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

NazRidh : Great stock

Forever Learning : 160.5

Lucas Cheah : $NVIDIA (NVDA.US)$ - Earnings Prospects

1. Leadership in AI and Data Centers

Nvidia is a dominant player in GPUs for AI applications and data centers. Demand for its A100 and H100 GPUs, crucial for training AI models, has surged as businesses and cloud providers expand AI capabilities, driving significant revenue growth in its data center segment.

2. Gaming Segment Recovery

Nvidia's gaming segment, powered by its GeForce GPUs, is benefiting from recovering demand and new product releases, such as the RTX 40 series. Increased interest in high-performance gaming and the metaverse could further support this segment’s earnings.

3. Expansion into Automotive

Nvidia’s Drive platform for autonomous vehicles is gaining traction, with partnerships from companies like Mercedes-Benz. As autonomous driving technology advances, Nvidia’s automotive segment has the potential to become a key growth driver.

4. High Valuation and Competitive Pressures

While Nvidia’s prospects are strong, its high valuation reflects high growth expectations. Additionally, competition from companies like AMD and upcoming AI-focused chipmakers may pressure market share and pricing in the future.

In summary, Nvidia’s earnings prospects are robust due to its leadership in AI, data centers, and gaming. Expansion into automotive further supports growth potential, though high valuation and competitive pressures remain key considerations.

104712493 : NVIDIA’s (NVDA) earnings are expected to be driven by the following key factors:

Leadership in AI and Data Centers: NVIDIA's dominance in AI hardware, particularly its GPUs like the H100, continues to fuel demand from data center operators and tech firms building AI models. AI adoption across industries is a significant growth driver.

Growth in Cloud Computing and Partnerships: Strong partnerships with major cloud providers (e.g., AWS, Microsoft Azure, Google Cloud) boost demand for NVIDIA’s products in scaling AI and machine learning workloads.

High-Performance Gaming: NVIDIA's GeForce GPUs remain a staple in the gaming industry, with growth supported by trends like e-sports, virtual reality, and next-gen game development.

Automotive and Edge AI Expansion: NVIDIA's innovations in autonomous driving technology and AI solutions for vehicles and edge computing are opening new revenue streams, particularly as the automotive sector embraces AI-driven advancements.

Software Ecosystem and Recurring Revenue: NVIDIA’s software offerings, such as CUDA and AI frameworks, create a robust ecosystem that drives recurring revenues, enhancing profitability over the long term.

Generative AI Boom: The explosion in generative AI applications (e.g., ChatGPT) has intensified demand for NVIDIA’s GPUs and AI platforms, making it a cornerstone supplier for enterprises investing in AI.

Focus on Innovation and R&D: Continuous innovation in GPU technology, AI solutions, and related software positions NVIDIA to maintain its competitive edge in rapidly evolving markets.

New93 : yay

71391098 : Outlook.

moneymaker1234 : going to beat earnings

70190156 : Bullish for the long term

Jason Nance : Above 165

SRK2024 : 170

View more comments...