NVDA post-market review chart analysis for Thursday, September 14: Deepening the Golden Pit

[Core Tip: 1. Pursuing the so-called long and empty double repair itself is a false proposition. 2. The short line is scrap copper and iron, and the long line is fine gold diamond. 3. A high price-earnings ratio is an important sign of high-performing blue-chip stocks. 4. Follow the trend, counter technology, and go against people's hearts. 5. Gambling is always a high cost. 6. You have to be able to endure some downward fluctuations. 7. Life isn't always bad. Seemingly difficult situations may nurture the seeds of hope. 8. The famous “unfathomability principle” discovered by the great Werner Heisenberg (Werner Heisenberg) in quantum mechanics also applies in the financial market. Trying to predict through technical analysis such as the so-called Elliott Wave Theory is a joke. There are only two methods that are possible: a. Multi-batch discrete random variable framed shotball shoveling transactions. b. Function-level limit approach to root out transactions.]

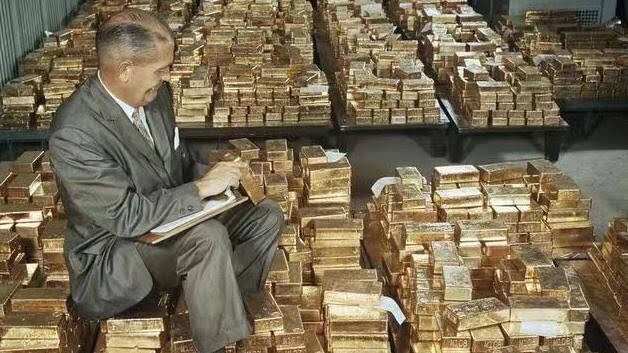

The classic expression of the Golden Pit:

1. The stock price is following a strong upward channel, and suddenly there is an unsubstantial sharp drop.

2. In the relatively low area of the stock price, there was a sudden sharp drop due to an unexpected non-long-term nature.

3. In a region where stock prices were relatively low, there was an unexpected sharp drop that the government did not want to see. After the Gold Pit appears, it's a good time to seize the opportunity.

1. The stock price is following a strong upward channel, and suddenly there is an unsubstantial sharp drop.

2. In the relatively low area of the stock price, there was a sudden sharp drop due to an unexpected non-long-term nature.

3. In a region where stock prices were relatively low, there was an unexpected sharp drop that the government did not want to see. After the Gold Pit appears, it's a good time to seize the opportunity.

The JC family's ironclad trading rules (I can't emphasize repetition too much):

Winning in the falling market; winning in amplitude; winning in boldness; winning in wisdom; winning in open-mindedness; winning in learning; winning in change; winning in adapting; winning in mathematics; winning in physics; winning in models; winning in function; winning in vibration; winning in quantification; winning in framework; winning in moderation; winning in probability; winning in technology; winning in psychology; winning in dexterity; winning in fickleness; winning in oscillation; winning in the long term; winning in investing: winning in mentality.

Losing to oneself; losing to oneself; losing to solidification; losing to abandoning oneself; losing to self-reliance; losing to being chasing high; losing to stagnation; losing unilaterally; losing in gambling; losing in protecting positions; losing in full positions; losing in financing; losing in reversal; losing in stewing stocks; losing in Yongdong; losing in gambling; losing in complaining; losing in excuses; losing in cursing; losing in dreaming; losing in plans; losing in prediction; losing on the short line; losing on the short line; losing on the short line; losing in the short line; losing in the short line; losing in the short line; losing in the short line; losing in the short line; losing on the line; losing in the short line; losing in the short line; losing on the line; losing in the short line; losing in the short line; losing on the line; losing in the short line; losing on the line; losing on the short line; losing on the line; losing on the short line; losing on the line; losing on the short line; losing in the short line; losing in the short line; losing on the line Hurry; losing in greed; losing in mentality.

98% of people will never be able to give up on ups and downs or predictions, and there are no plans of any kind that use a certain percentage of the battle sequence of treasury funds as a strong and strong backing, so 98% can only end in failure. Trading earns a living, not being a stock slave, not an opinion fight (JC does not participate in opinion fighting, has no interest.) Instead, the investment deal wins.

Alarm bells are ringing: The first and last chapters of the Book of Wisdom both read “There is no empty lunch in the world.” Don't expect to read other people's post-market review chart analysis; you can make money without effort on your own. Here, at this moment, all of JC's posts are private pre- and post-market personal statements, research and exploration. There is no passionate struggle of opinions, stock recommendations, and even less spiritual soup. They cannot be used as a basis for trading. The resulting trading profits and losses can only be borne by oneself. Regardless of profit or loss, all blame is taken by oneself.

We've never known each other in the first place, not to mention that even if you have financial skills, it's easy to be treated as a scammer in this money playing financial market. Therefore, JC would never use the research results as a vehicle to send money for free, because there's no need for this.

What are some so-called true friends in the financial markets? The road is in full swing. Everyone walks their own way, each does its own thing; if there is no desire, I won't eat your meal, I won't eat that kind of thing, I don't need to look at your face. I'm not afraid of anyone but Jesus Christ (who is God).

Disclaimer: This article is a private trading log, not opinions or individual stock recommendations. The blogger holds shares and may sell them at any time (including the same day and the next day). Also, the level of bloggers is average, and they often make mistakes (weak markets are more likely to make mistakes). I cut my actual trading level in half and then fold it in half.

Winning in the falling market; winning in amplitude; winning in boldness; winning in wisdom; winning in open-mindedness; winning in learning; winning in change; winning in adapting; winning in mathematics; winning in physics; winning in models; winning in function; winning in vibration; winning in quantification; winning in framework; winning in moderation; winning in probability; winning in technology; winning in psychology; winning in dexterity; winning in fickleness; winning in oscillation; winning in the long term; winning in investing: winning in mentality.

Losing to oneself; losing to oneself; losing to solidification; losing to abandoning oneself; losing to self-reliance; losing to being chasing high; losing to stagnation; losing unilaterally; losing in gambling; losing in protecting positions; losing in full positions; losing in financing; losing in reversal; losing in stewing stocks; losing in Yongdong; losing in gambling; losing in complaining; losing in excuses; losing in cursing; losing in dreaming; losing in plans; losing in prediction; losing on the short line; losing on the short line; losing on the short line; losing in the short line; losing in the short line; losing in the short line; losing in the short line; losing in the short line; losing on the line; losing in the short line; losing in the short line; losing on the line; losing in the short line; losing in the short line; losing on the line; losing in the short line; losing on the line; losing on the short line; losing on the line; losing on the short line; losing on the line; losing on the short line; losing in the short line; losing in the short line; losing on the line Hurry; losing in greed; losing in mentality.

98% of people will never be able to give up on ups and downs or predictions, and there are no plans of any kind that use a certain percentage of the battle sequence of treasury funds as a strong and strong backing, so 98% can only end in failure. Trading earns a living, not being a stock slave, not an opinion fight (JC does not participate in opinion fighting, has no interest.) Instead, the investment deal wins.

Alarm bells are ringing: The first and last chapters of the Book of Wisdom both read “There is no empty lunch in the world.” Don't expect to read other people's post-market review chart analysis; you can make money without effort on your own. Here, at this moment, all of JC's posts are private pre- and post-market personal statements, research and exploration. There is no passionate struggle of opinions, stock recommendations, and even less spiritual soup. They cannot be used as a basis for trading. The resulting trading profits and losses can only be borne by oneself. Regardless of profit or loss, all blame is taken by oneself.

We've never known each other in the first place, not to mention that even if you have financial skills, it's easy to be treated as a scammer in this money playing financial market. Therefore, JC would never use the research results as a vehicle to send money for free, because there's no need for this.

What are some so-called true friends in the financial markets? The road is in full swing. Everyone walks their own way, each does its own thing; if there is no desire, I won't eat your meal, I won't eat that kind of thing, I don't need to look at your face. I'm not afraid of anyone but Jesus Christ (who is God).

Disclaimer: This article is a private trading log, not opinions or individual stock recommendations. The blogger holds shares and may sell them at any time (including the same day and the next day). Also, the level of bloggers is average, and they often make mistakes (weak markets are more likely to make mistakes). I cut my actual trading level in half and then fold it in half.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment