YOU GUYS WERE RIGHT 😱 ABOUT NVDA 🤦🏽♂️

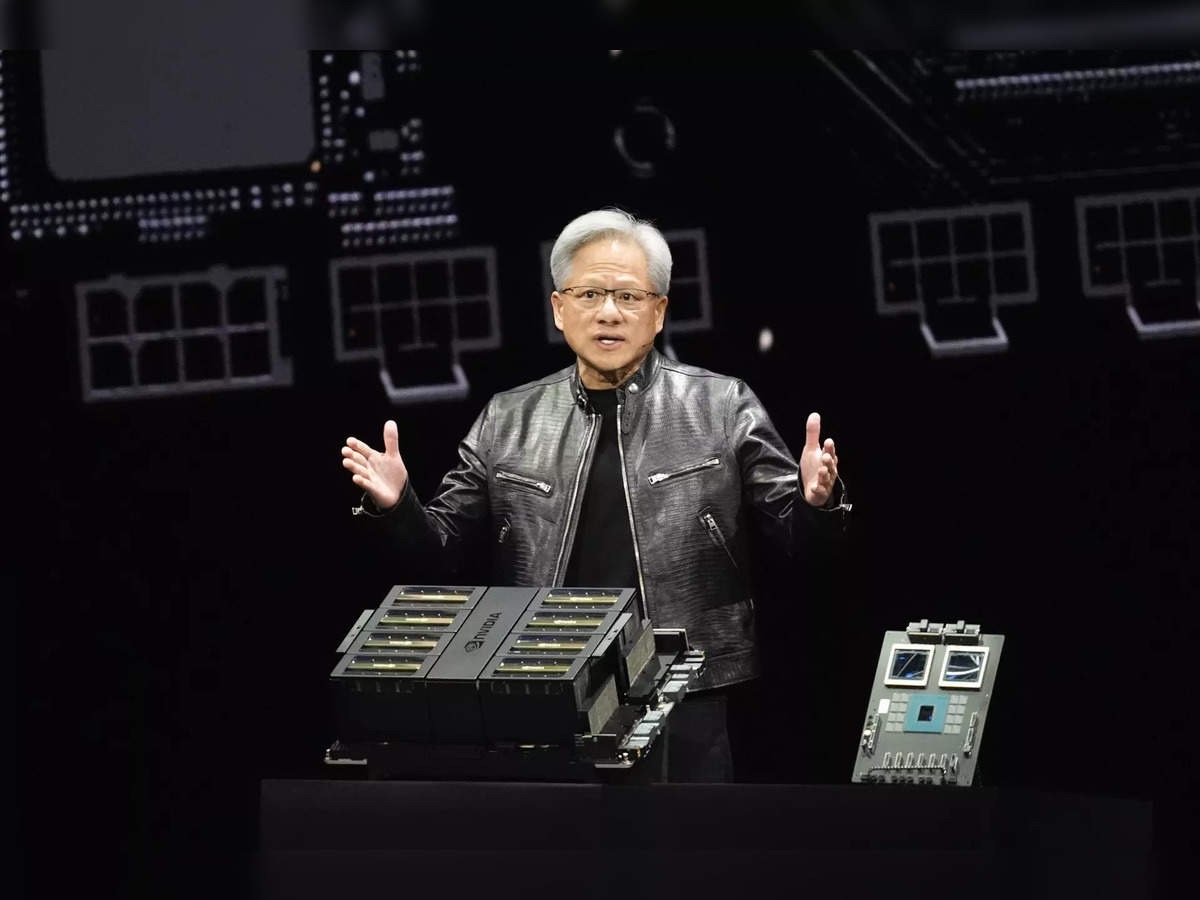

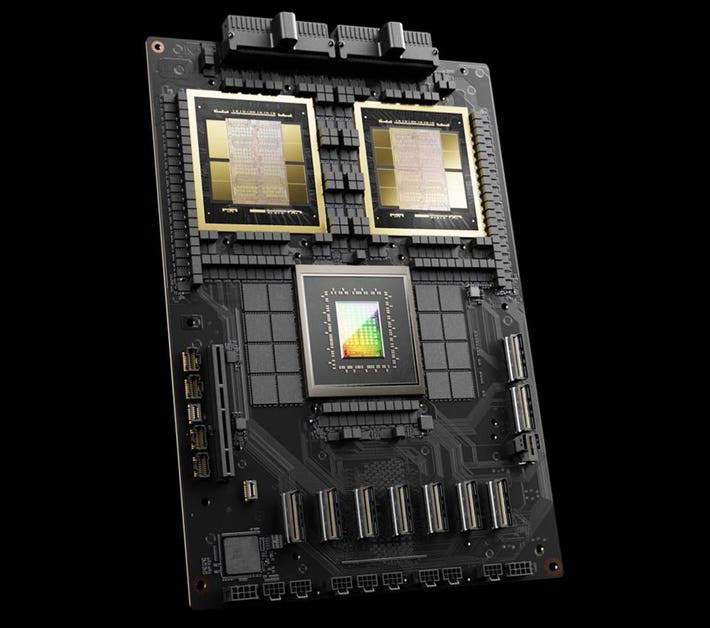

$NVIDIA (NVDA.US)$ Nvidia GB 200 Grace Blackwell Superchip. 🤤 💰 150 is not an if, but a when. ⬆️

Morgan Stanley says Hopper/Blackwell demand is strong

- Nvidia’s Blackwell chips are now entering volume production, with demand from major customers driving significant growth potential for the company

- The Hopper H200 chips are seeing increased demand from smaller cloud service providers and sovereign AI projects

- Blackwell chips are expected to see 450,000 units produced in the fourth quarter of 2024, translating into a potential revenue opportunity exceeding $10 billion for Nvidia

- While Nvidia is still resolving some technical challenges with its GB200 server racks, these issues are part of the normal debugging process for new product launches

- Hon Hai, Nvidia’s assembly partner, is reportedly on track to begin shipments of the GB200 server rack by late Q4 2024

- The Hopper H200 chips are seeing increased demand from smaller cloud service providers and sovereign AI projects

- Blackwell chips are expected to see 450,000 units produced in the fourth quarter of 2024, translating into a potential revenue opportunity exceeding $10 billion for Nvidia

- While Nvidia is still resolving some technical challenges with its GB200 server racks, these issues are part of the normal debugging process for new product launches

- Hon Hai, Nvidia’s assembly partner, is reportedly on track to begin shipments of the GB200 server rack by late Q4 2024

#NVidia #CoachDonnie

Why is $NVIDIA (NVDA.US)$ on track to reach a new record high closing price⁉️

• $Alphabet-A (GOOGL.US)$ ordered 400K GB200 chips valued at $10B.

• $Microsoft (MSFT.US)$ purchased 60K GB200 chips worth $2B.

• $Meta Platforms (META.US)$ acquired 360K GB200 chips for $8B.

Demand for Nvidia's Blackwell chip is absolutely INSANE 🤩

• $Alphabet-A (GOOGL.US)$ ordered 400K GB200 chips valued at $10B.

• $Microsoft (MSFT.US)$ purchased 60K GB200 chips worth $2B.

• $Meta Platforms (META.US)$ acquired 360K GB200 chips for $8B.

Demand for Nvidia's Blackwell chip is absolutely INSANE 🤩

Blackwell is Nvidia's next-gen chip going into scale production this quarter. Many investors were concerned about pushouts. But instead, production is on track, and demand is off the charts.

Blackwell comes in a single configuration (contains two GPUs), which can go into existing data centers, or in large configurations like the GB200 NVL72, which packs 72 Blackwell chips (equivalent to 144 H100s).

Blackwell comes in a single configuration (contains two GPUs), which can go into existing data centers, or in large configurations like the GB200 NVL72, which packs 72 Blackwell chips (equivalent to 144 H100s).

One of these "chips" sells for ~$3M and contains ~2 miles of cables costing $100K just in cabling alone.

What we learned...

Earlier this month, Foxconn's CEO said that demand for Blackwell is "crazy" - adding a new facility in Mexico to satisfy Blackwell orders.

These comments came right after Nvidia's CEO, Jensen Huang, stated that production is on track and demand for Blackwell is "insane."

In addition, an important event took place two weeks ago — the Open Compute Project (OCP)— where data center companies showcased their latest and greatest products. The key takeaway from this event was that everyone wants the GB200 NVL72. Positive for content, margins, and the rest of the value chain.

Microsoft (NASDAQ:MSFT) announced that Azure is the first cloud service to run the Blackwell system GB200 and reportedly increased its orders from 300–500 racks (mainly NVL36) to about 1,400–1,500 racks (about 70% NVL72), 5x increase. Subsequent Microsoft orders will primarily focus on NVL72. While this is unconfirmed, it is in-line with what we heard at OCP.

On the volume side, TSMC (NYSE:TSM) just reported earnings and implied that they are doubling their packaging capacity from 40K/month to 80-100K/month exiting '25. In terms of GPU capacity, this implies that Blackwell should be exiting the year at 2M units/quarter.

And here is the best part, according to comments from the CEO, Blackwell is now "sold out"!

This is great news for Nvidia but also very positive for the rest of the value chain, including networking plays: connectors, cables, switches, interconnects, etc.

Nvidia, the GB200 NVL 72 is important because it is margin accretive as it contains many Nvidia networking products).

While Hopper (the prior generation GPU) took Nvidia 's Data Center revenues from $20B to >$100B, Blackwell has the potential to take it above $200B.

NVIDIA is being added to the Dow Jones Industrial Average.

NVIDIA ($NVDA) was trading at a P/E ratio of 64 with a stock price of $15 in 2021. In 2024, NVIDIA is still at a P/E of 64, but the stock price has risen to $142.

This highlights how a stock can appear expensive based on valuation metrics like P/E, yet still not be overvalued if the company’s growth potential justifies the price.

Looking back, it’s clear that NVIDIA was not overvalued at $15 in 2021, despite its high P/E ratio. Since then, it has increased tenfold, proving that while it seemed expensive, it was a valuable investment.

It required a vision to see beyond the numbers in 2021, to recognize NVIDIA’s potential and the impact its GPUs would have on the world.

i see a lot of upside

This highlights how a stock can appear expensive based on valuation metrics like P/E, yet still not be overvalued if the company’s growth potential justifies the price.

Looking back, it’s clear that NVIDIA was not overvalued at $15 in 2021, despite its high P/E ratio. Since then, it has increased tenfold, proving that while it seemed expensive, it was a valuable investment.

It required a vision to see beyond the numbers in 2021, to recognize NVIDIA’s potential and the impact its GPUs would have on the world.

i see a lot of upside

Extra Credit:

I see $NVIDIA (NVDA.US)$ is working behind the scenes on $Super Micro Computer (SMCI.US)$

Super Micro shares surge as AI boom drives 100,000 quarterly GPU shipments 🚚

(Reuters) -Super Micro Computer (SMCI.NaE) said on Monday it is currently shipping more than 100,000 graphics processors per quarter and unveiled a new suite of liquid cooling products, sending the AI server maker's shares up about 14% following a weeks-long slump.

A boom in generative artificial intelligence technology has bumped up demand for the hardware required to process the large amounts of data genAI uses, helping Super Micro, which makes servers featuring leading AI chips including Nvidia's (NVDA.NaE).

It "recently deployed more than 100,000 GPUs with liquid cooling solution (DLC) for some of the largest AI factories ever built," Super Micro said in a statement.

Super Micro is on track to add more than $3 billion to its market value if gains hold.

The company is acclaimed for its liquid cooling technology, which boasts greater power-saving than the air cooling techniques used in some data centers.

Nvidia's (NVDA.NaE) shares were up more than 4%.

Monday's rally provides a breath of relief to Super Micro's investors after the stock was slammed by mounting troubles, including Hindenburg Research disclosing a short position in the company in August. Short interest in Super Micro is just over 20% of its free float, worth about $3.59 billion, market research firm Ortex estimated.

"If this is related to short sellers trying to buy back shares or not is too early to tell at this point, but at the current price, short sellers are making short-term losses and may choose to close their positions," Ortex said, noting this could have added to the stock's gains on the day.

Super Micro's shares lost more than 9% of their value over the last two weeks, but are still up more than 66% this year, benefiting from Wall Street's booming, AI-linked "picks-and-shovels" trade.

The company also launched a new range of DLC products, which would enable the "highest GPU per rack density", with up to 96 of Nvidia's (NVDA.NaE) B200 chips per rack.

"Up to 40% energy savings for infrastructure and 80% space savings are a massive innovation for large, power-hungry AI deployments and could be a key differentiator to competitors," said Gadjo Sevilla, senior AI and tech analyst for eMarketer.

Super Micro shares surge as AI boom drives 100,000 quarterly GPU shipments 🚚

(Reuters) -Super Micro Computer (SMCI.NaE) said on Monday it is currently shipping more than 100,000 graphics processors per quarter and unveiled a new suite of liquid cooling products, sending the AI server maker's shares up about 14% following a weeks-long slump.

A boom in generative artificial intelligence technology has bumped up demand for the hardware required to process the large amounts of data genAI uses, helping Super Micro, which makes servers featuring leading AI chips including Nvidia's (NVDA.NaE).

It "recently deployed more than 100,000 GPUs with liquid cooling solution (DLC) for some of the largest AI factories ever built," Super Micro said in a statement.

Super Micro is on track to add more than $3 billion to its market value if gains hold.

The company is acclaimed for its liquid cooling technology, which boasts greater power-saving than the air cooling techniques used in some data centers.

Nvidia's (NVDA.NaE) shares were up more than 4%.

Monday's rally provides a breath of relief to Super Micro's investors after the stock was slammed by mounting troubles, including Hindenburg Research disclosing a short position in the company in August. Short interest in Super Micro is just over 20% of its free float, worth about $3.59 billion, market research firm Ortex estimated.

"If this is related to short sellers trying to buy back shares or not is too early to tell at this point, but at the current price, short sellers are making short-term losses and may choose to close their positions," Ortex said, noting this could have added to the stock's gains on the day.

Super Micro's shares lost more than 9% of their value over the last two weeks, but are still up more than 66% this year, benefiting from Wall Street's booming, AI-linked "picks-and-shovels" trade.

The company also launched a new range of DLC products, which would enable the "highest GPU per rack density", with up to 96 of Nvidia's (NVDA.NaE) B200 chips per rack.

"Up to 40% energy savings for infrastructure and 80% space savings are a massive innovation for large, power-hungry AI deployments and could be a key differentiator to competitors," said Gadjo Sevilla, senior AI and tech analyst for eMarketer.

• Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.

- Warren Buffett, Multi-Billionaire

• I like these ETFs for long term: SPLG FTEC VOO VGT FHLC FSKAX

• I like these stocks for long term NVDA MSFT META AMZN AAPL GOOGL CEG CVNA PLTR MSTR BRK.B LLY SMR LEU

• I like a few shorts as well but the majority is in ETFs and longs that have a 10-100% or more Return on Investment aka CAGR (Compound Annual Growth Rate) *

• ETFs and DCA help us to not get caught up in emotions as easily

When you have all or mostly individual stocks you’ve gotta be the expert and that’s extremely challenging for anyone especially year 1

ETFs help mitigate risk

DCA help develop discipline

#CoachDonnie

- Warren Buffett, Multi-Billionaire

• I like these ETFs for long term: SPLG FTEC VOO VGT FHLC FSKAX

• I like these stocks for long term NVDA MSFT META AMZN AAPL GOOGL CEG CVNA PLTR MSTR BRK.B LLY SMR LEU

• I like a few shorts as well but the majority is in ETFs and longs that have a 10-100% or more Return on Investment aka CAGR (Compound Annual Growth Rate) *

• ETFs and DCA help us to not get caught up in emotions as easily

When you have all or mostly individual stocks you’ve gotta be the expert and that’s extremely challenging for anyone especially year 1

ETFs help mitigate risk

DCA help develop discipline

#CoachDonnie

While $NVIDIA (NVDA.US)$ dominates semiconductor headlines during the AI boom, several other companies also hold monopolistic positions in the evolving digital economy -- here's a cheat sheet of the top 10 👇

1. $ASML Holding (ASML.US)$ | ASML Holding

• They hold a monopoly in lithography machines, which are essential for enabling the mass production of ultra-small, efficient chips crucial for AI applications. Their technology is foundational in pushing the boundaries of miniaturization and performance in semiconductor manufacturing.

2. $Taiwan Semiconductor (TSM.US)$ | Taiwan Semiconductor Manufacturing

• They remain the world’s largest dedicated independent semiconductor foundry, with unmatched capabilities in manufacturing advanced chips that are crucial for AI technologies. They are the only manufacturer with sufficiently advanced technology to produce the most sophisticated AI chips.

3. $KLA Corp (KLAC.US)$ | KLA Corporation

• They specialize in process control and yield management solutions. Their equipment and services are essential for the semiconductor manufacturing industry, ensuring the production of high-quality chip performance at micro and nano-levels, which is critical for the reliable operation of AI systems.

4. $Applied Materials (AMAT.US)$ | Applied Materials

• They excel in materials engineering solutions used to produce virtually every new chip and advanced display in the world. Their innovations in metal deposition and etch systems are essential for creating smaller, faster, and more reliable electronic devices needed in AI applications.

5. $Lam Research (LRCX.US)$ | Lam Research

• They are pivotal in the semiconductor fabrication process, providing advanced wafer fabrication equipment and services. Their technology is crucial for the production of highly sophisticated semiconductor devices, making them indispensable for manufacturers aiming to meet the increasing demands for more powerful and efficient AI chips.

6. $Micron Technology (MU.US)$ | Micron

• They are leaders in providing memory and storage solutions crucial for AI data processing. Their competitive advantage comes from their cutting-edge DRAM and NAND technologies, which significantly enhance the speed and capacity of AI systems.

7. $Broadcom (AVGO.US)$ | Broadcom

• Their range of semiconductor devices supports data center networking and broadband capabilities, crucial for AI ecosystems. Their broad product line and innovation in 5G technology position them as a key infrastructure provider in the rapidly expanding AI market.

8. $Qualcomm (QCOM.US)$ | Qualcomm

• They have a near-monopoly in mobile phone chips and is now integrating AI into its Snapdragon processors. This positions Qualcomm at the forefront of AI applications in mobile devices, enabling advanced features like natural language processing and on-device AI models.

9. $Marvell Technology (MRVL.US)$ | Marvell Technology

• Their technology excels in creating solutions that enhance data center performance and capacity, critical for AI data handling. Their specialized chipsets for cloud and enterprise applications position them as leaders in the data infrastructure market.

10. $Texas Instruments (TXN.US)$ | Texas Instruments

• They specialize in analog ICs and embedded processors, used extensively in automated applications and smart devices, pivotal for modern industrial applications.

1. $ASML Holding (ASML.US)$ | ASML Holding

• They hold a monopoly in lithography machines, which are essential for enabling the mass production of ultra-small, efficient chips crucial for AI applications. Their technology is foundational in pushing the boundaries of miniaturization and performance in semiconductor manufacturing.

2. $Taiwan Semiconductor (TSM.US)$ | Taiwan Semiconductor Manufacturing

• They remain the world’s largest dedicated independent semiconductor foundry, with unmatched capabilities in manufacturing advanced chips that are crucial for AI technologies. They are the only manufacturer with sufficiently advanced technology to produce the most sophisticated AI chips.

3. $KLA Corp (KLAC.US)$ | KLA Corporation

• They specialize in process control and yield management solutions. Their equipment and services are essential for the semiconductor manufacturing industry, ensuring the production of high-quality chip performance at micro and nano-levels, which is critical for the reliable operation of AI systems.

4. $Applied Materials (AMAT.US)$ | Applied Materials

• They excel in materials engineering solutions used to produce virtually every new chip and advanced display in the world. Their innovations in metal deposition and etch systems are essential for creating smaller, faster, and more reliable electronic devices needed in AI applications.

5. $Lam Research (LRCX.US)$ | Lam Research

• They are pivotal in the semiconductor fabrication process, providing advanced wafer fabrication equipment and services. Their technology is crucial for the production of highly sophisticated semiconductor devices, making them indispensable for manufacturers aiming to meet the increasing demands for more powerful and efficient AI chips.

6. $Micron Technology (MU.US)$ | Micron

• They are leaders in providing memory and storage solutions crucial for AI data processing. Their competitive advantage comes from their cutting-edge DRAM and NAND technologies, which significantly enhance the speed and capacity of AI systems.

7. $Broadcom (AVGO.US)$ | Broadcom

• Their range of semiconductor devices supports data center networking and broadband capabilities, crucial for AI ecosystems. Their broad product line and innovation in 5G technology position them as a key infrastructure provider in the rapidly expanding AI market.

8. $Qualcomm (QCOM.US)$ | Qualcomm

• They have a near-monopoly in mobile phone chips and is now integrating AI into its Snapdragon processors. This positions Qualcomm at the forefront of AI applications in mobile devices, enabling advanced features like natural language processing and on-device AI models.

9. $Marvell Technology (MRVL.US)$ | Marvell Technology

• Their technology excels in creating solutions that enhance data center performance and capacity, critical for AI data handling. Their specialized chipsets for cloud and enterprise applications position them as leaders in the data infrastructure market.

10. $Texas Instruments (TXN.US)$ | Texas Instruments

• They specialize in analog ICs and embedded processors, used extensively in automated applications and smart devices, pivotal for modern industrial applications.

* For ANY and all aforementioned/heretofore Stocks, ETFs, side hustles or other Assets/asset classes discussed here

Remember the following:

🚨 DISCLAIMER 🚨

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

I Share Because I Care. The aforementioned is for Informational Educational & Entertainment purposes ONLY, this is NOT investment advice.

You have to do what’s best for you and yours at the end of the day. There’s NO guarantees in Investing nor Asset Accumulation.

Reach out to your Financial Advisor, CPA and or CFP.

I am not a Financial Advisor, CFP nor CPA.

Remember the following:

🚨 DISCLAIMER 🚨

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

I Share Because I Care. The aforementioned is for Informational Educational & Entertainment purposes ONLY, this is NOT investment advice.

You have to do what’s best for you and yours at the end of the day. There’s NO guarantees in Investing nor Asset Accumulation.

Reach out to your Financial Advisor, CPA and or CFP.

I am not a Financial Advisor, CFP nor CPA.

NVIDIA Stock Could Touch $800 By 2030, BGG Executive Predicts 550% Upside Driven By AI Revolution And Web3 Transition

Benzinga 2:35 AM ET 9/30/2024

Former Boston Consulting Group executive Phil Panaro forecasts that NVIDIA Corp (NVDA.NaE) shares could reach $800 by 2030. This prediction suggests a potential 558.98% increase from its current price.

What Happened: Panaro attributes this anticipated growth to the ongoing artificial intelligence revolution and the shift from Web2 to Web3. He believes these technological advancements will significantly boost Nvidia’s market share and revenue.

In an interview with Schwab Network, Panaro mentioned that Nvidia’s revenue could multiply tenfold, from $60 billion to $600 billion by 2030. He also expects a “huge explosion” in Nvidia’s stock following the release of its next-gen AI chip, Blackwell, in 2025.

“That’s actually the best case for why it’s actually going to go up. Because if you look at all the other customers they’re not getting to, there’s 490 other Fortune 500 firms that haven’t really adopted AI to the fullest because they don’t understand it. You have all these cities and governments that are going to be redoing all their infrastructure from Web2 to Web3, and you then have the AI arms race, with countries and their militaries, which Nvidia (NVDA.NaE) hasn’t penetrated for the most part,” Panaro said.

Despite some skepticism from other strategists, Panaro remains confident in Nvidia’s potential. He emphasized that the firm’s growth is supported by the limited penetration of AI in various sectors, including corporate, municipal, and military applications.

Benzinga 2:35 AM ET 9/30/2024

Former Boston Consulting Group executive Phil Panaro forecasts that NVIDIA Corp (NVDA.NaE) shares could reach $800 by 2030. This prediction suggests a potential 558.98% increase from its current price.

What Happened: Panaro attributes this anticipated growth to the ongoing artificial intelligence revolution and the shift from Web2 to Web3. He believes these technological advancements will significantly boost Nvidia’s market share and revenue.

In an interview with Schwab Network, Panaro mentioned that Nvidia’s revenue could multiply tenfold, from $60 billion to $600 billion by 2030. He also expects a “huge explosion” in Nvidia’s stock following the release of its next-gen AI chip, Blackwell, in 2025.

“That’s actually the best case for why it’s actually going to go up. Because if you look at all the other customers they’re not getting to, there’s 490 other Fortune 500 firms that haven’t really adopted AI to the fullest because they don’t understand it. You have all these cities and governments that are going to be redoing all their infrastructure from Web2 to Web3, and you then have the AI arms race, with countries and their militaries, which Nvidia (NVDA.NaE) hasn’t penetrated for the most part,” Panaro said.

Despite some skepticism from other strategists, Panaro remains confident in Nvidia’s potential. He emphasized that the firm’s growth is supported by the limited penetration of AI in various sectors, including corporate, municipal, and military applications.

Why It Matters: Nvidia (NVDA.NaE) has consistently been at the forefront of technological innovation. CEO Jensen Huang has a unique approach to market exploration, focusing on “zero-billion-dollar markets,” which are untapped and potentially lucrative sectors. This strategy has significantly contributed to Nvidia’s growth, making it one of the most valuable companies globally.

Additionally, early tech investor James Anderson has predicted that Nvidia (NVDA.NaE) could achieve a market capitalization of nearly $50 trillion within the next decade. This optimistic outlook is driven by the increasing demand for AI chips, essential for advanced generative AI models. Nvidia’s shares have already surged by 168% this year, pushing its market value above $3 trillion.

However, there are concerns about overvaluation in the tech sector. Truist's Chief Strategist and CIO, Keith Lerner, recently downgraded the tech sector from overweight to neutral due to these concerns. Despite this, he remains optimistic about the long-term prospects of AI.

Furthermore, Elon Musk has aligned with Huang’s vision of a future where AI-powered personal assistants will become commonplace, akin to Star Wars’ R2-D2 or C-3PO. This vision underscores the transformative potential of AI in everyday life.

Additionally, early tech investor James Anderson has predicted that Nvidia (NVDA.NaE) could achieve a market capitalization of nearly $50 trillion within the next decade. This optimistic outlook is driven by the increasing demand for AI chips, essential for advanced generative AI models. Nvidia’s shares have already surged by 168% this year, pushing its market value above $3 trillion.

However, there are concerns about overvaluation in the tech sector. Truist's Chief Strategist and CIO, Keith Lerner, recently downgraded the tech sector from overweight to neutral due to these concerns. Despite this, he remains optimistic about the long-term prospects of AI.

Furthermore, Elon Musk has aligned with Huang’s vision of a future where AI-powered personal assistants will become commonplace, akin to Star Wars’ R2-D2 or C-3PO. This vision underscores the transformative potential of AI in everyday life.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Coach Donnie OP : Wealth is who you are not what you have…

Wealth has to be an inward realization before it becomes an outward manifestation.

#CoachDonnie

Junius Falcon : An elite tech choice that is also quite defensive in uncertain times. I am seeing a few hundreds dollars per share in years, if economy will still growth in a healthy way lol.

Coach Donnie OP Junius Falcon : Eventually it will be 300-500 then 500-1000 possibly

Junius Falcon Coach Donnie OP : Let's say 300 first then re-evaluate

Coach Donnie OP Junius Falcon : Say what YOU say I had NVDA and BTC years ago so the way I view things is different than most.

I had NVDA and BTC years ago so the way I view things is different than most.

Ultratech : consider that the new chips are a more expensive and better upgrade leaving the last generation obsolete and that as a result the returns on nvda will be same or better

Coach Donnie OP Ultratech : It’s that and much more

Coach Donnie OP : @Ultratech Morgan Stanley says Hopper/Blackwell demand is strong

- Nvidia’s Blackwell chips are now entering volume production, with demand from major customers driving significant growth potential for the company

- The Hopper H200 chips are seeing increased demand from smaller cloud service providers and sovereign AI projects

- Blackwell chips are expected to see 450,000 units produced in the fourth quarter of 2024, translating into a potential revenue opportunity exceeding $10 billion for Nvidia

- While Nvidia is still resolving some technical challenges with its GB200 server racks, these issues are part of the normal debugging process for new product launches

- Hon Hai, Nvidia’s assembly partner, is reportedly on track to begin shipments of the GB200 server rack by late Q4 2024

#NVidia #CoachDonnie

Coach Donnie OP : NVDA to the moon

Junius Falcon Ultratech : True, I remember something like 4x faster, but 2x the price. Really has to make up the sales a lot. Their CPU are not made for consumers, but maybe they will to go there eventually ...

View more comments...