Nvidia, Meta, Apple, and Microsoft Could Help This Stock-Split ETF Turn $200,000 Into $1 Million

$Ishares North American Tech Etf (IGM.US)$ holds 281 stocks, including top AI players like $NVIDIA (NVDA.US)$ , $Meta Platforms (META.US)$ , $Apple (AAPL.US)$ , and $Microsoft (MSFT.US)$ , and has outperformed the $S&P 500 Index (.SPX.US)$ with a 20.2% annual return over the last 10 years. The ETF’s recent 6-for-1 stock split makes it more accessible to investors, now priced around $92 per share.

With AI expected to add $15.7 trillion to the global economy by 2030, and 70% of executives believing AI will transform business value, this ETF provides diversified exposure to AI-driven growth. The ETF’s top holdings account for 34.3% of its portfolio and are driving its returns through innovations in AI platforms, LLMs, and AI chips.

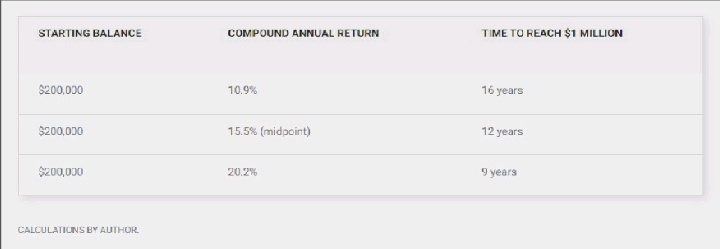

Even at a 10.9% historical annual return, the ETF could turn $200,000 into $1 million in about 16 years. The rapid AI adoption and stock growth of major tech companies offer strong potential, though the pace of growth may slow as these giants reach saturation in user bases.

The top four holdings in the iShares ETF account for 34.3% of the total value of its entire portfolio, and each of them has a dominant presence in AI:

The below table shows how long it could take the ETF to turn an investment of $200,000 into $1 million based on a range of returns:

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Ultratech : $Rydex Exchange Traded Fd Trust Guggenheim S&P 500 Top 50 Etf (XLG.US)$