Nvidia, Microsoft, Google Help Lift US Indexes Higher | Wall Street Today

US stocks struggled to eke out a gain, managing to turn higher in the last 15 minutes of trading, as investors weigh the impact of a weakening labor market on companies' ability to sustain earnings growth.

The $S&P 500 Index (.SPX.US)$ rose 0.15% to 5291.34, while the $Nasdaq Composite Index (.IXIC.US)$ gained 0.17% to 16857.05. The $Dow Jones Industrial Average (.DJI.US)$ rose 0.36% to 38711.29.

Decliners far outnumbered gainers 8011 to 5323, with banks, auto manufacturers and oil and gas companies slipping. $NVIDIA (NVDA.US)$, $Apple (AAPL.US)$, $Microsoft (MSFT.US)$, $Alphabet-A (GOOGL.US)$, and $Amazon (AMZN.US)$ defied the downturn pressure.

Decliners far outnumbered gainers 8011 to 5323, with banks, auto manufacturers and oil and gas companies slipping. $NVIDIA (NVDA.US)$, $Apple (AAPL.US)$, $Microsoft (MSFT.US)$, $Alphabet-A (GOOGL.US)$, and $Amazon (AMZN.US)$ defied the downturn pressure.

MACRO

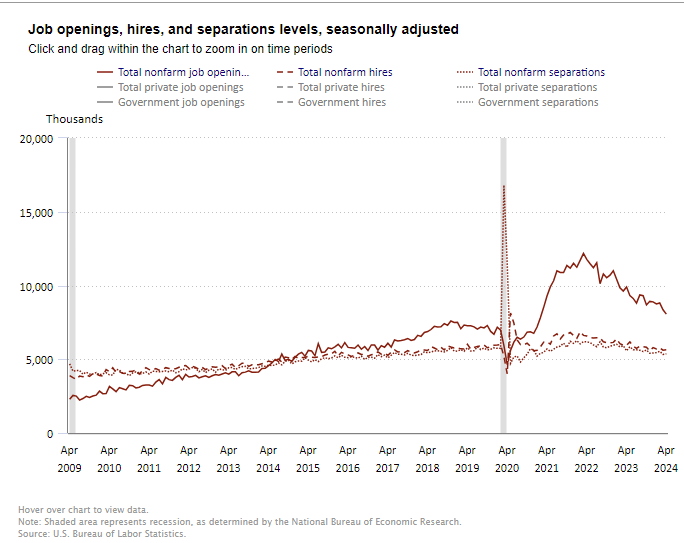

Job openings in the US fell in April to a two-year low and fewer people quit in what could be a sign of weakness in the labor market that could strengthen the case for the Federal Reserve to start cutting interest rates.

The number of job vacancies dropped by 1.8 million jobs to 8.1 million, the Bureau of Labor Statistics said in a news release. Those leaving their jobs reached 3.5 million, from 3.6 million a year earlier.

SECTORS

Crude oil fell to a new fourth-month low after the Organization of Petroleum Exporting Countries and its allies, known collectively as OPEC+ said it plans to roll back the voluntary production cuts starting in the fourth quarter. Those cuts previously helped support prices.

US Treasury yields declined, with the $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ slipping to 4.768%, from the previous close of 4.802% amid speculations that a weakening labor market could help convince the Fed to start cutting interest rates in the next few months.

Traders are now pricing in a 54.9% chance that rates will fall 25 basis points by September, up from 41.7% a week ago, according to the CME FedWatch tool.

Traders are now pricing in a 54.9% chance that rates will fall 25 basis points by September, up from 41.7% a week ago, according to the CME FedWatch tool.

MOVERS

$Carnival (CCL.US)$ rallied after the company said late Monday that it will sunset its P&O Cruises Australia brand and fold those operations into the Carnival Cruise Line, increasing guest capacity for the highest-returning brand in its global portfolio. $Norwegian Cruise (NCLH.US)$, $Royal Caribbean (RCL.US)$ also.

$Bath & Body Works (BBWI.US)$ was the biggest loser on the S&P 500, slumping almost 13% after the company forecast a 2% decline in sales for the second quarter.

$GameStop (GME.US)$ and $AMC Entertainment (AMC.US)$ fell after the Wall Street Journal reported that meme trader Keith Gill, also known as "Roaring Kitty" is facing increased scrutiny scrutiny from Massachusetts Secretary of State Bill Galvin over potential manipulation. E-Trade is also reportedly trying to decide whether to ban Gill from its trading platform, according to Benzinga.

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See thislinkfor more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Saul d Solache : thank you