Nvidia Options Positioned for a Staggering $180 Billion Post-Earnings Valuation Shift

Can the U.S. market continue its triumph? Some now believe it depends on today's $NVIDIA (NVDA.US)$earnings report. The earnings could potentially result in an impact on market value of about $200 billion, based on options positioning.

According to statistics provided by Bloomberg, the prices of short-term options and puts suggest nearly 11% movement in the chipmaker's shares on Thursday, the day following its earnings report. That would cause approximatly $180 billion swing in Nvidia's market value, one of the biggest single-session swings ever recorded. However, it would still lag behind records set by Meta Platforms Inc., which holds the records for the biggest one-day decrease and the largest single-session gain.

Driven by artificial intelligence mania, NVIDIA shares rallied nearly 240% last year and have advanced more than 40% so far this year, contributing to about 25% of the S&P 500's total gains.

"Big moves have left some concerned with valuations and fearful of adding to or establishing positions here, but at the same time they are fearful of missing out in the event of another leg higher," said Christopher Jacobson of Susquehanna International Group. "So many are turning to upside calls as a limited-risk alternative."

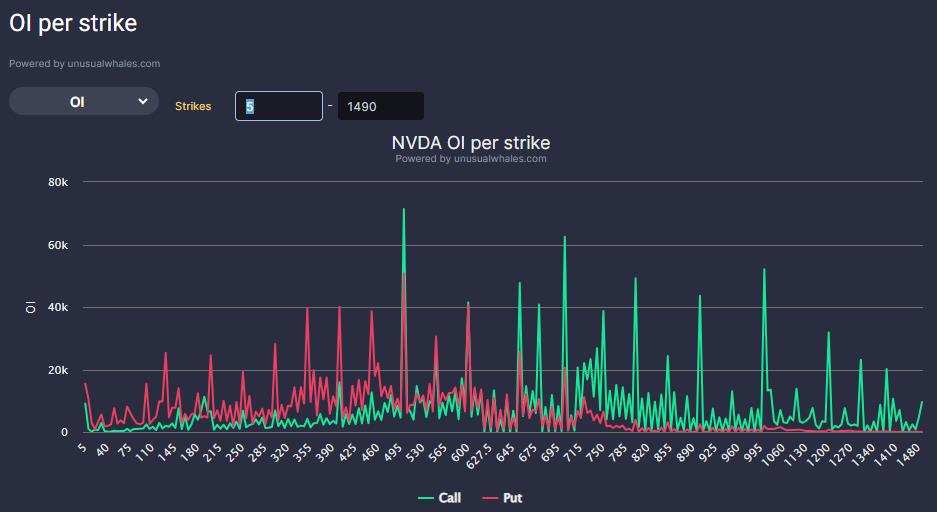

The largest open interest is in calls between $1010-$1,380, some of which will expire at the end of this week. To reach that price, the stock would need to rise a whopping 39% or more from last Friday's close.

The options market showed a 25% chance that Nvidia shares would break out of the $620 to $850 range, which is down 15% or up 17% from its Friday close, according to data compiled by Susquehanna.

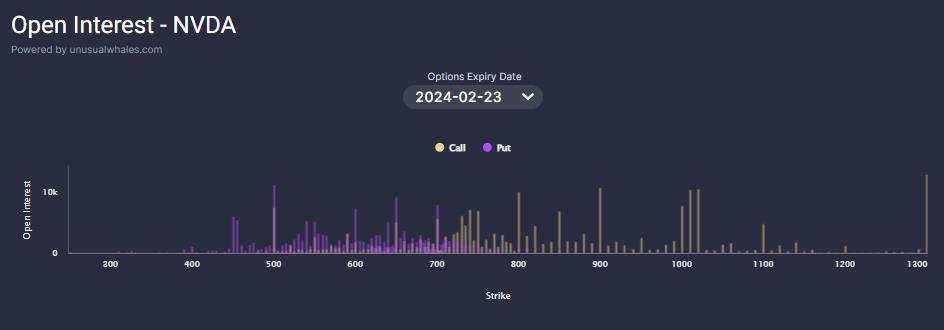

The Nvidia stock options market shows a call option wall at $715, $800, and $995, as well as the put option walls at $495 and $600, reflecting concentrated trading interest.

Options trading in NVIDIA has heated up dramatically in recent months, with traders buying NVIDIA calls, which carry a much higher premium than puts, suggesting that the market is betting on further gains in NVIDIA shares.

The volume of NVIDIA options traded last week was about $500 billion, more than all other constituents in the Russell 3000, according to Piper Sandler.

Source: Bloomberg, Unusual Whale, Market Chameleon

Disclaimer:

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

safri_moomoor : yes