Dell is expanding its AI Factory in collaboration with Nvidia, introducing new advancements in servers, edge solutions, workstations, and services to accelerate AI adoption and innovation. This partnership aims to simplify AI implementation for firms, allowing them to confidently adopt the next tech revolution.

lai lai6 : good

74472274 : What are the next stocks to buy for big profits

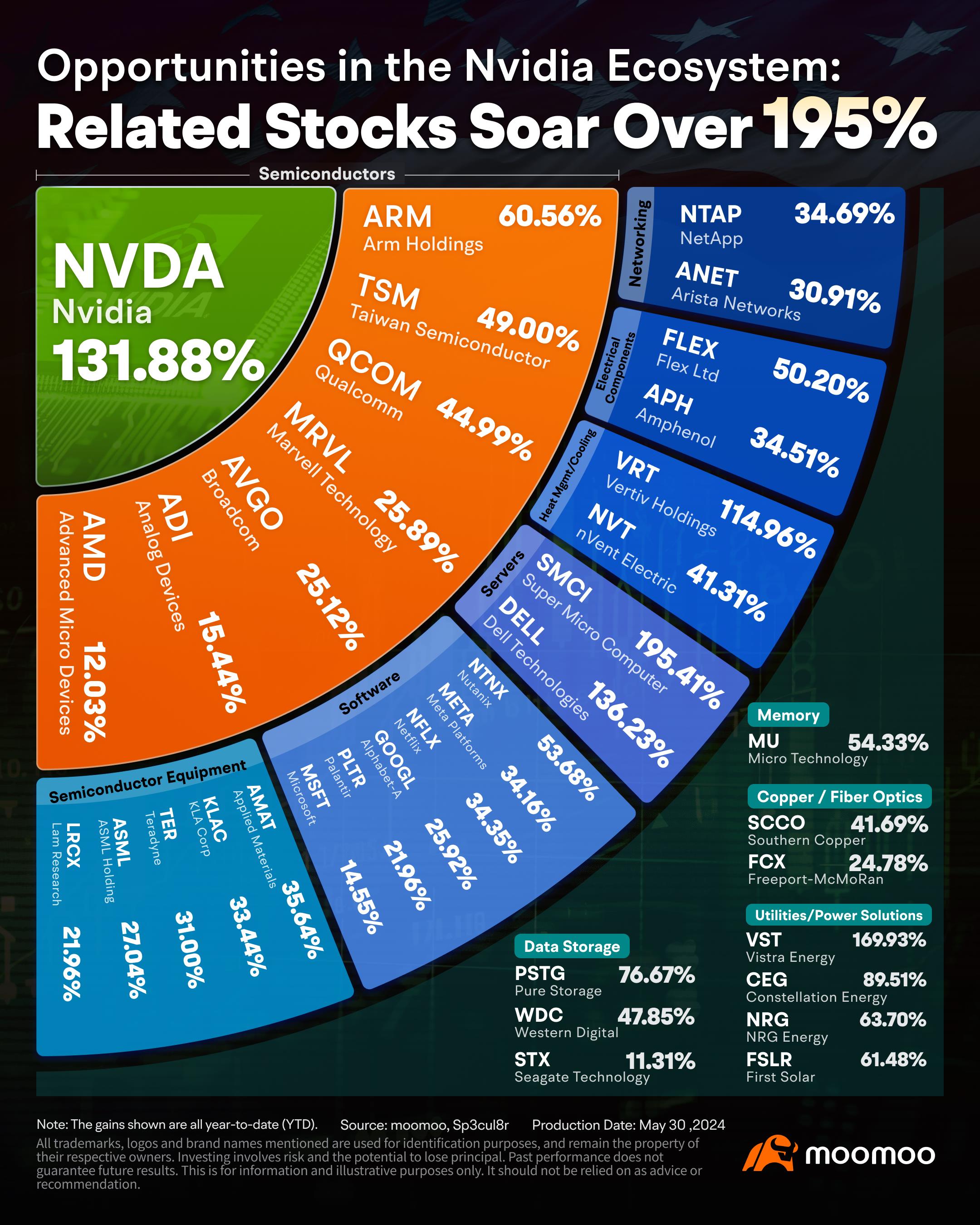

70897269 : Awesome chart showing the supply and support chain

Popeye the sailor : nice ! huge opportunity ahead

Sir Wildman : good stuff

HYGWE : where's Amazon?

PAUL BIN ANTHONY : very helpful

ᗦ↞◃ 70897269 : 7456789