NVIDIA's earnings report approaches: how Seller Report can help you aim for stable returns

This week, $NVIDIA (NVDA.US)$ is set to release its earnings report. Although the implied volatility (IV) of NVIDIA has somewhat declined since the "Black Monday" on August 5th, the IV remains at a high level due to the upcoming earnings release![]() .

.

Since higher IVs lead to higher option premiums, many investors are considering using option seller strategies to capture the time value of the options![]() .

.

However, some investors might have concerns: if NVIDIA's performance does not meet expectations, some short-term selling strategies like short straddle and short strangle could face significant risks due to increased stock price volatility![]() .

.

In this situation, let's see how professional investors handle it. They use seller strategies to consistently earn option premiums![]() .

.

Let me reveal the mystery of this strategy to you: the cash-secured put strategy.

I. What is cash-secured put?

The cash-secured put strategy involves selling put options while holding enough cash as collateral.

Many structured products, like Snowball and FCN (Fixed Coupon Note), utilize the cash-secured put option strategy. These products anchor to a target asset, and as long as its price doesn't fall to the strike price, they provide a fixed income.

In practice, it is difficult for these products' target assets to plunge to a price level that triggers the strike price (generally 50%-80% of the initial price), but they can offer a high fixed return (such as an annualized 12%). Thus, they are popular among many professional investors.

However, the entry threshold for these structured products is also very high. It usually requires several hundred thousand dollars, which is very expensive for retail investors.

In fact, you can also achieve a similar effect through the cash-secured put strategy with sufficient margin.

By selling long-term deep out-of-the-money (OTM) put options, while earning more option premiums, the risk of being exercised is reduced.

Moomoo recently launched a new feature: Option Seller Report. This tool will greatly assist you in using the cash-secured put strategy to achieve similar effects.

First, let’s understand how the cash-secured put strategy makes money.

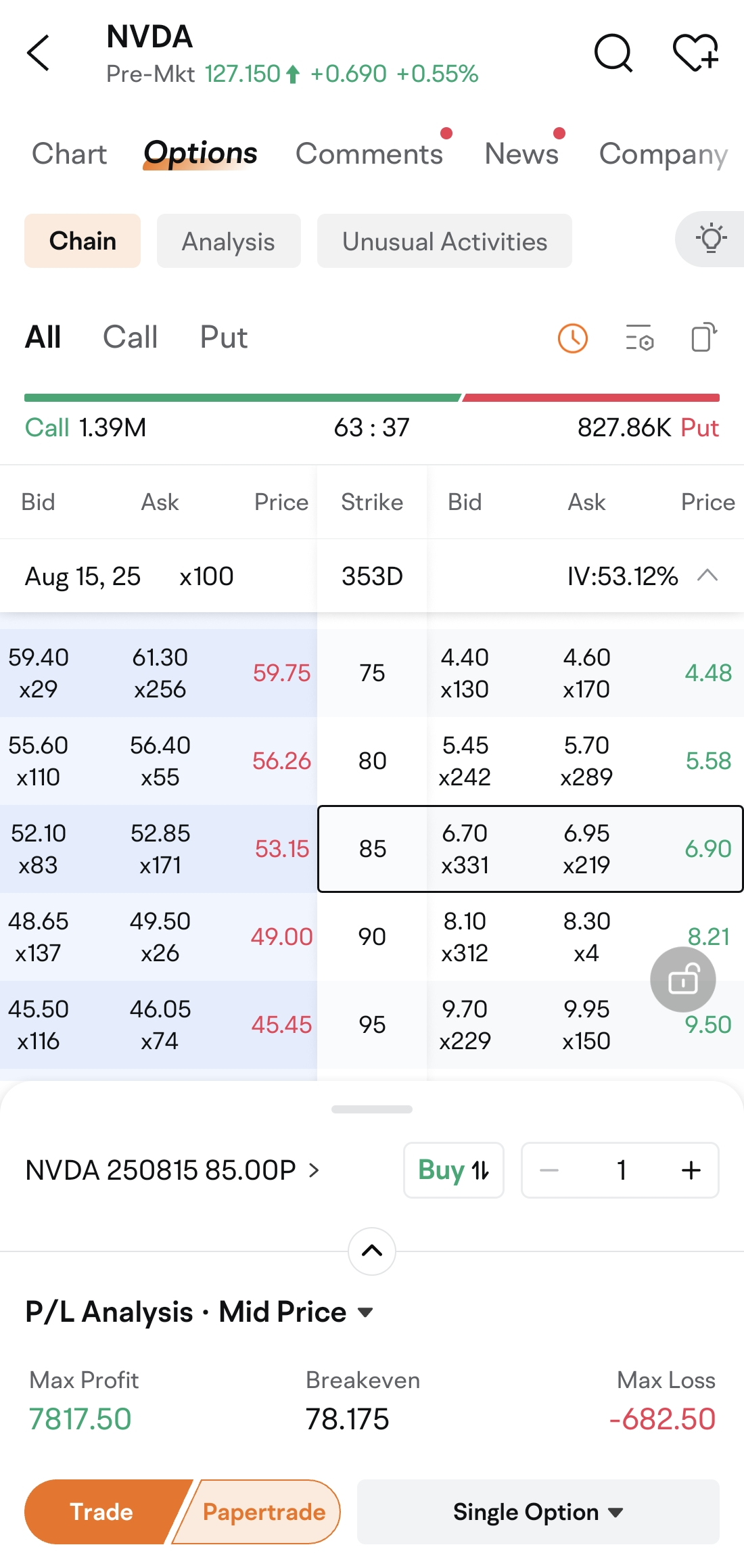

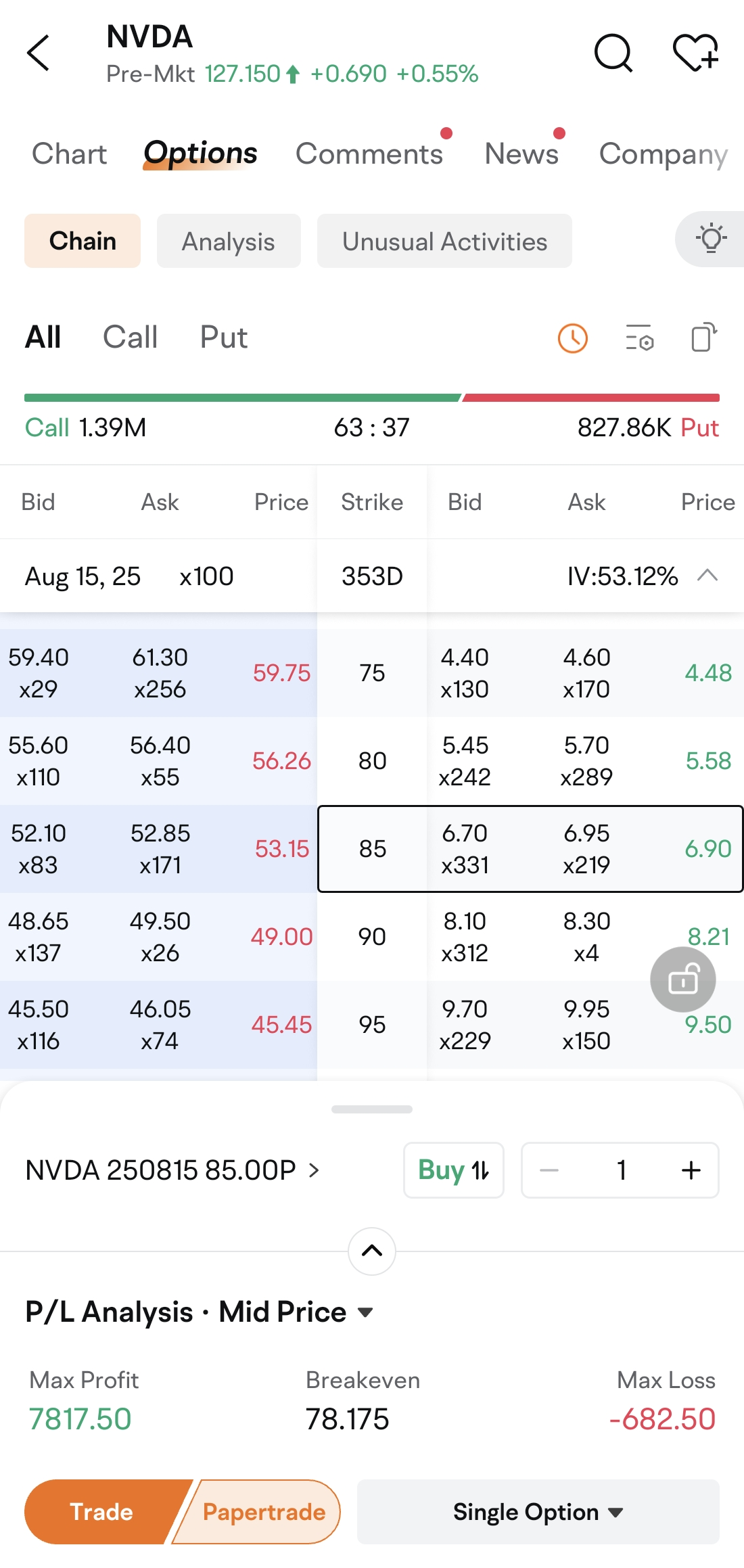

Taking NVIDIA's option as an example, when the stock price is $126.46, we sell an NVDA put expiring on August 15, 2025 (about 353 days later) for $6.82 per share, with a strike price of $85. Why sell an option with such a distant expiration date? We'll discuss that later.

As the option sellers, we need $85 * 100 (contract multiplier) = $8500 in cash as collateral in case the put option is exercised.

Don't forget that when selling the option, we immediately receive $6.82 * 100 = $682 in option premium, so we only need to pay $8500 - $682 = $7818 ($78.18 per share) in cash to meet the margin requirement.

The margin requirement for the cash-secured put strategy is much more friendly than the entry threshold of several hundred thousand dollars.

In extreme cases, if the stock price further declines after we are assigned the shares, we may face significant capital loss.

However, since we are selling deep OTM options, the stock price needs to drop 85 (strike price) / 126.46 (initial stock price) -1 = -32.78% to trigger the strike price.

The deep out-of-the-money strike price gives the underlying stock ample room to decline, enabling us to more reliably collect the full option premium.

If the stock subsequently surges, we can also close the put short position at a lower price, reclaiming the collateral early to pursue better investment opportunities.

Through this example, it is not difficult to see that selling long-term deep out-of-the-money options for relatively satisfactory fixed returns with lower risk is a reason for the popularity of the cash-secured put strategy.

Additionally, please note that when using this strategy, choose underlying stocks that are expected to perform well in the long run. This way, even if the put is exercised, we can buy a long-favored stock at a lower price, which is also acceptable to us.

II. Find more investment in Option Seller Report

Some of you might think: Can I also apply this strategy to other options, such as those with different underlying stocks, expiration dates, or strike prices, to find a more “satisfactory” investment opportunity?

Absolutely! We can use the Options Seller Report, where we can find opportunities to "collect interest", just like in the NVDA case above.

The advantage of using the Option Seller Report is that we can avoid repeatedly clicking into different stocks' option chains and save time from manually calculating and comparing metrics like ROI.

By filtering the indicators we are interested in within the Options Seller Report, we can find the investment opportunities that suit us best from many options.

I also found the NVDA 250815 $85 put from the case above. The Seller Report contains more information about selling this option.

If you're seeking higher ROI, simply select Cash Secured Put in the top left corner and sort by Annualized ROI to find options seller opportunities with higher annualized yields.

In practice, investing often involves balancing risk and return. If we aim to control the time span and in-the-money risk at levels similar to those of the NVDA 250815 $85 put while pursuing higher returns, we can click on the top right corner to filter by the Days to Expiration and OTM%.

Sometimes, a higher OTM% does not necessarily mean a higher probability of staying OTM, as higher volatility of the underlying stock could also lead to a higher risk of the option moving in-the-money (ITM). Besides being able to filter by implied volatility, the Seller Report also provides big data analysis of each option's probability of staying OTM, which we can use to assist in making investment decisions.

By clicking on the option card, you can enter the details page to view more information. Compared to the previously sold NVDA put, this option has a higher OTM% yet offers a higher theoretical annualized yield rate. Once the option target is confirmed, click on Trade to go directly to the trading interface to sell the option.

Currently, the Seller Report supports two basic options strategies: cash-secured puts and covered calls.

Click to learn more: Options Seller Report: Quickly Find High-ROI Options

That concludes today's discussion![]() .

.

I want to remind you that while selling deep out-of-the-money options carries lower risk compared to at-the-money options, being an option seller still involves significant risks, and one must proceed with caution.

For the cash-secured put strategy, if you're concerned about the option's in-the-money risk or are not prepared to potentially buy the underlying stock at a lower price, please be cautious when selling puts.

Also, always monitor your margin status. If the cash reserved as collateral for selling puts is insufficient, you could face a margin call, leading to unnecessary losses. Therefore, ensure your margin is adequately maintained.

If you have other thoughts about the Options Seller Report, feel free to share and discuss them in the comments section.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

HaloHarleeHarmonyHar : bullshit

Coach Donnie : $NVIDIA (NVDA.US)$ Morgan Stanley says Hopper/Blackwell demand is strong

- Nvidia’s Blackwell chips are now entering volume production, with demand from major customers driving significant growth potential for the company

- The Hopper H200 chips are seeing increased demand from smaller cloud service providers and sovereign AI projects

- Blackwell chips are expected to see 450,000 units produced in the fourth quarter of 2024, translating into a potential revenue opportunity exceeding $10 billion for Nvidia

- While Nvidia is still resolving some technical challenges with its GB200 server racks, these issues are part of the normal debugging process for new product launches

- Hon Hai, Nvidia’s assembly partner, is reportedly on track to begin shipments of the GB200 server rack by late Q4 2024

#CoachDonnie