Nvidia, Semis, and Tech Market Pulls Back Before Bellweather Earnings

Good morning, traders. Happy Wednesday, August 28th. The market is pulling back crookedly before Nvidia earnings after closing tonight. We will work as fast as possible in the News Room to bring you Nvidia's results as soon as they drop; tune in live for the earnings call tonight. Analysts tracked by Bloomberg expect adjusted earnings of $0.65/share on revenue of $28.86B; we will update you on the estimates and numbers throughout the day.

My name is Kevin Travers; here are stories about the U.S. stock market today.

$Super Micro Computer (SMCI.US)$ fell 24% after the company announced that it would delay its Form 10-K filing for the full year 2024, which was due this week. The firm plans to file a Notification of Late Filing on August 30, 2024.

$Chewy (CHWY.US)$ rallied more than 15% Wednesday after Q2 earnings surpassed market expectations. The online seller of pet goods saw the value of sales per customer rise, attributed to a climb in net sales per customer. The firm reported adjusted earnings of 24 cents a share, over the 2C expected by analysts.

$PDD Holdings (PDD.US)$ was falling for a third day, down 7%. Yesterday, I wrote about the stock's volatility and how it sent it to the top of the market ranked by options volume. The stock fell 28% on Monday and 4% on Tuesday. The retail firm reported a bleak outlook and even said the firm's high revenue growth and profit are at an end.

$Berkshire Hathaway-B (BRK.B.US)$ climbed past a 1$ trillion valuation Wednesday after the stock rose. The firm sold $Bank of America (BAC.US)$ stock Wednesday, and Berkshire's cash on hand pile might now reach over $300B in value.

$Crude Oil Futures(MAY5) (CLmain.US)$ fell slightly after a small drop in oil supply this week. Within industries tracked by moomoo, Semiconductors fell 3%, lead by $Arm Holdings (ARM.US)$ -7%, $Micron Technology (MU.US)$ -5% and Nvidia falling 4% as the cash cow sector prepares for its uiltimate seasonal litmus test.

$Bitcoin (BTC.CC)$ hovered below $58k, Gold pulled back to $2500/USD. $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ and the $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ both fell.

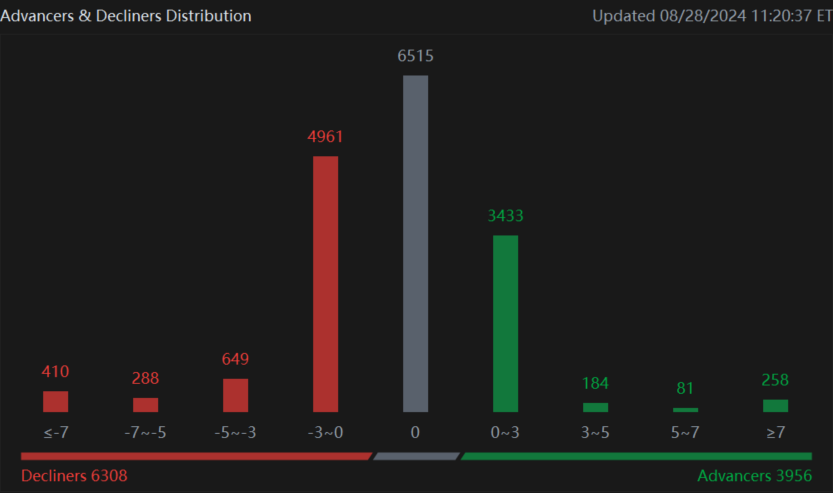

The market overall slipped into decline Wednesday, and traders held their breath. Just past am ET the $S&P 500 Index (.SPX.US)$ traded -0.66%, the $Dow Jones Industrial Average (.DJI.US)$ fell 0.07%, and the $Nasdaq Composite Index (.IXIC.US)$ fell 1.44%.

Every sector on the S&P 500 was in the green Friday after the Fed news, but since reaching a hair length of records, prices have stayed put in the past two trading sessions. Powell did not specify the timeline of these rate cuts, but he said he was confident the economy was on the way to 2% inflation. "The time has come to adjust, and the direction is clear," Powell said.

This week in macro, investors can look forward to more macroeconomic data that might inform how the FOMC will decide on rate cuts. CB Consumer Confidence came out Tuesday morning, showing a jump in expectations. Crude Oil Inventories came out Wednesday morning, showing a cut of 800k barrels compared to last week's drop of 4m.

Investors are awaiting a speech from FOMC member Bostic after 6 pm ET. Continuing and Initial Jobless claims will drop on Thursday alongside updated GDP numbers for the second quarter.

Friday will see the release of the July person Consumption Expenditure index (PCE), the Fed's favorite inflation measure. Last time, the PCE came in at 2.6% year over year, the lowest since 2021. Michigan consumer expectations and confidence will also drop on Friday.

Interested in Options? To see these stocks and more on the options page, click here. Want to learn more about options, check out moomoo education with this link. Click here to join our exclusive options chat with personal callouts from our resident expert, Invest with Sarge.

Yesterday, users were commenting on PDD, and how hard they were hit by this season earning reacitons.

Traders, what do you think, is the market in 2024 about following the herd? What you watching on the stock market today? What is the herd following? Let me know in the comments below!

Disclaimer: This content is for informational use only and is not a recommendation or endorsement of any particular investment or strategy. Indexes are unmanaged and cannot be directly invested into. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors' financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances, before making any investment decisions. Past performance does not indicate or guarantee future success. Moomoo makes no representation or warranty as to its adequacy, or timeliness for any particular purpose of the above content. The data and information provided has been obtained from sources considered to be reliable, but moomoo does not guarantee that the foregoing material is accurate or complete. See the link in the Moovers Community post for more information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

scott l branstetter : nvda going to the moon

72618801 : I hope so

Drew Manns scott l branstetter : $NVIDIA (NVDA.US)$ they beat all way around. delay in blackwell was intentional due to high demand for H1. They are raising gudeance. (#imsider)

104166257 : hi

103539497 : hi

LittleSoldier : Look I’m not one of those conspiracy dude’s, but anyone with a half a brain can easily see how this is being manipulated. Just a coincidence that the stocks tank right before the what we all know will be a great ER!! I fricken can’t wait for it to come out so I can be Not Surprised. Duh!!

can easily see how this is being manipulated. Just a coincidence that the stocks tank right before the what we all know will be a great ER!! I fricken can’t wait for it to come out so I can be Not Surprised. Duh!!

It’s like fricken Magic No the escalation in the wars, No Earthquakes. No president Shot today!!

Errrrr!!!!!!!

Kevin Travers OP LittleSoldier : Interesting point. I agree that markets are mighty volatile, but how do you feel about Nvidia with less than an hour to go?

Spicy Pepper : POW!!! To the moon Alice!!!!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

LittleSoldier Kevin Travers OP : Been ready to fly should have been a all day affair no we have to wait cause we’re little fish,

104476495 : h

View more comments...