2. Nvidia's September market forecast:

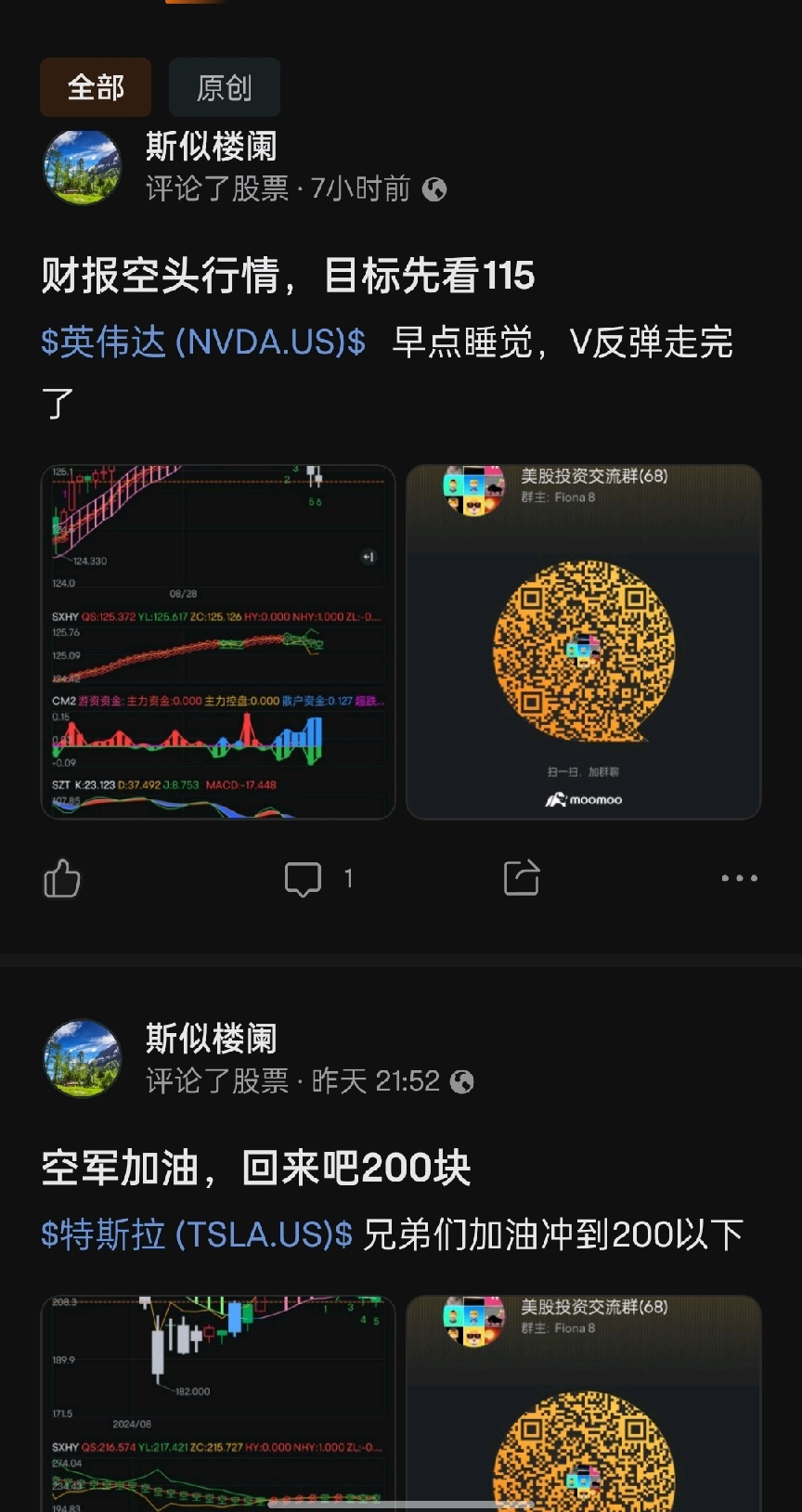

Currently, with the release of the earnings report, Nvidia's earnings report is better than expected but lower than the market's expectations. Therefore, it opened after-hours trading with a 7% decline.

Many people may not understand why the stock price would drop so drastically when the earnings report is good. This involves the model and mindset of stock market operation. First of all, Nvidia's drop from $140 to $90 is a stock split where retail investors take over and institutional investors sell off. Since the stock split occurred at the end of July, there is still a considerable amount of time until the earnings report on August 28. If the stock price continues to fall during this period, the institutional investors will have no room to sell, resulting in no profit. Moreover, Nvidia's fundamentals are there. When off-exchange funds in the range of $400-$1200 did not capture this opportunity and enter the market, they hesitated and bought in, resulting in the rebound market of $90-$130 during this period.

In order for the institutional investors of a stock to completely sell off, there must be buyers to take over, and the stock price cannot plummet. Therefore, they need to use positive news to continuously increase the stock price, attract retail investor funds to enter, and then sell their shares. Therefore, the earnings report is a good opportunity. In this rebound market, the institutional investors are both buying and selling. When the earnings report is released, it's all about speed. When the earnings report is released, we also see a 7% decline.