NVIDIA surpasses 3 trillion dollars in total market value! Late suppliers have surged by 5% or more, is there still room for growth?!

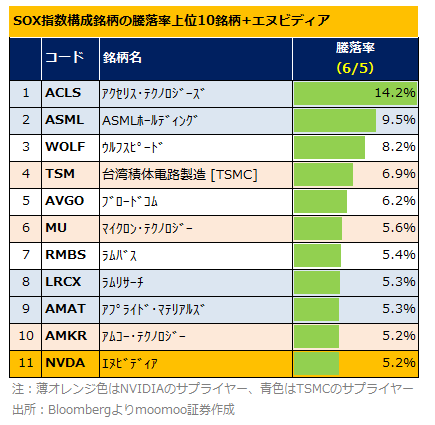

If you look at those faces, NVIDIA suppliers stand out. For example, a major semiconductor contract manufacturer's $Taiwan Semiconductor (TSM.US)$and the memory giant's $Micron Technology (MU.US)$ , and provides semiconductor packaging and testing services $Amkor Technology (AMKR.US)$ that's it.

Furthermore, NVIDIA is Fabless, and semiconductor production is outsourced to foundries such as TSMC. Therefore, TSMC's suppliers can be viewed as NVIDIA's secondary suppliers. The companies shaded in blue in the table above are TSMC suppliers. For example, a major exposure measure company $ASML Holding (ASML.US)$ and semiconductor parts manufacturers $Axcelis Technologies (ACLS.US)$ , semiconductor manufacturing equipment manufacturer's $Lam Research (LRCX.US)$ with $Applied Materials (AMAT.US)$ that's it.

1) Delay correction

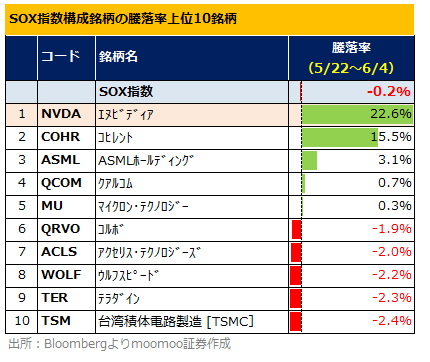

After announcing good financial results and stock splits on 5/22, NVIDIA shares rose 23% until 6/4. In contrast, NVIDIA's suppliers remained slightly higher, and there were also many stocks that fell. For example,5/22 to 6/4From the perspective of the gain/fall rate of the SOX constituent stocks, it's almost ENubidia “One Man Wins”It was a state of affairs. Since there was a clear sense that NVIDIA suppliers were late,A purchase aimed at correcting delaysIt looks like it's in.

After announcing good financial results and stock splits on 5/22, NVIDIA shares rose 23% until 6/4. In contrast, NVIDIA's suppliers remained slightly higher, and there were also many stocks that fell. For example,5/22 to 6/4From the perspective of the gain/fall rate of the SOX constituent stocks, it's almost ENubidia “One Man Wins”It was a state of affairs. Since there was a clear sense that NVIDIA suppliers were late,A purchase aimed at correcting delaysIt looks like it's in.

2) Good materials surrounding semiconductor stocks

●The world's largest with cutting-edge EUV (extreme ultraviolet) exposure measuresASML will ship the latest semiconductor manufacturing equipment to TSMC by the end of the yearThen it was reported. According to the Bloomberg article, ASML's main customer is TSMC and $Intel (INTC.US)$It is planned to obtain an EUV exposure device with a high NA (number of apertures) by the end of the year. Since major semiconductor manufacturers indicated the possibility of refraining from purchasing cutting-edge devices in their financial results announcements from April to May, this news was good news.

●The world's largest with cutting-edge EUV (extreme ultraviolet) exposure measuresASML will ship the latest semiconductor manufacturing equipment to TSMC by the end of the yearThen it was reported. According to the Bloomberg article, ASML's main customer is TSMC and $Intel (INTC.US)$It is planned to obtain an EUV exposure device with a high NA (number of apertures) by the end of the year. Since major semiconductor manufacturers indicated the possibility of refraining from purchasing cutting-edge devices in their financial results announcements from April to May, this news was good news.

● $Tesla (TSLA.US)$CEO Elon MuskThis year, we will procure semiconductors totaling 3 billion to 4 billion dollars from NVIDIAI commented that it was a plan to do it. Tesla's AI-related investment in 2024 is expected to rise to about 10 billion dollars, of which less than 40% is expected to go to NVIDIA's AI semiconductors.

●Target stock price increases and purchase recommendations for semiconductor stocks by major securitiesThey came one after another. For example, Barclays assumes that the outlook for semiconductor manufacturing equipment is expected to improve, $Applied Materials (AMAT.US)$ Ya $KLA Corp (KLAC.US)$The investment decision was raised. Bank of America reported on 6/5,”Considering NVIDIA's dominance in manufacturing AI semiconductors, the company's stock could rise another 30%I wrote” (Target share price is $1,500)。

Furthermore, Bank of America invited the vice president in charge of NVIDIA's hyperscaler business at the global technology conference hosted on 6/5. The question and answer session indicated that NVIDIA's hyperscaler business would continue to be strong. I'd like to discuss the details at another time.

3) Investors' risk orientation recovered due to expectations of interest rate cuts and a sense of security about the future of the US economy

●The one for May that was announced on 6/5Number of US private sector employeesIt was only an increase of 1520,000 people,Market expectations175,000 people ofIt fell far below. In response to that, there is a strong view that there is a high possibility that the number of people employed in the non-farm sector (statistics with a higher level of importance) scheduled to be announced on 6/7 will also slow down,Expectations for interest rate cuts, which had been a bit far away, have swelled again。

●The one for May that was announced on 6/5Number of US private sector employeesIt was only an increase of 1520,000 people,Market expectations175,000 people ofIt fell far below. In response to that, there is a strong view that there is a high possibility that the number of people employed in the non-farm sector (statistics with a higher level of importance) scheduled to be announced on 6/7 will also slow down,Expectations for interest rate cuts, which had been a bit far away, have swelled again。

●It was announced on 6/5ISM Non-Manufacturing Business Climate IndexIt became 53.8,It exceeded market expectations of 51.0. Since the ISM manufacturing business climate index announced the day before fell below market expectations, concerns about the future of the US economy had surfaced, but in response to a strong non-manufacturing business climate index,A sense of security about the future of the US economy has spread。

Of the above,3) is thought to be more important for feet. The Federal Reserve places importance on monetary policyThe number of people employed in the non-farm sector was 6/7This is because it will be announced (21:30 Japan time).If it slows as expected by the market, expectations for interest rate cuts will intensify further. inverselyIf it doesn't live up to expectations, it may be a development where the upper price is heavy。

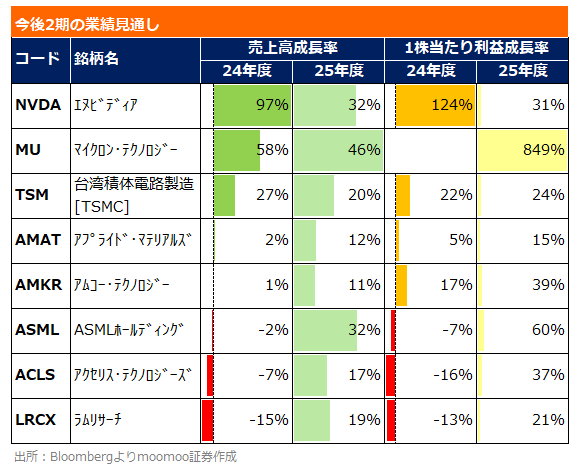

June 7(local time)Last day with rights to NVIDIA's stock splitBut it's there. There is a possibility that NVIDIA stocks will also move significantly depending on the results of the number of people employed in the non-farm sector. On the other hand,Judging from the movement of semiconductor stocks on 6/5, momentum for review purchases is increasingIt can also be said. If both events pass successfully, $NVIDIA (NVDA.US)$Review purchases against supplier stocks may continue. The earnings outlook is good $Micron Technology (MU.US)$ Ya $Taiwan Semiconductor (TSM.US)$ 、 $Applied Materials (AMAT.US)$ 、 $Amkor Technology (AMKR.US)$ Things like that would be worth paying attention to.

Created 6/6/24 Market Analyst Amelia

Source: Company materials and created by MooMoo Securities from Bloomberg

Source: Company materials and created by MooMoo Securities from Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

takfujimaki : Bank of America bought in the 6/5 report that “considering NVIDIA's superiority in manufacturing AI semiconductors, there is a possibility that the company's stock will rise further 30%” (target stock price is 1,500 dollars).

“I bought” in the sentence is “I wrote it,” isn't it?

moomoo Community Administrator takfujimaki : Thanks for pointing that out.

We will scrutinize the content and make corrections as soon as possible.

moomooニュース奈々 takfujimaki : Takfujimaki-samaThank you for using moomoo every time. The points you pointed out have already been corrected. We will do our best not to make such mistakes in the future. We look forward to working with you in the future.

takfujimaki moomoo Community Administrator : I'm sorry for getting bogged down. When it bothers me, I just point it out.

takfujimaki moomoo Community Administrator : I'm sorry for getting bogged down. When it bothers me, I just point it out.