Live Stock Financial Podcast. What are you watching on the market?

Live Stock Financial Podcast. What are you watching on the market?

Views 1.9M

Contents 148

Nvidia, Tesla, and Market Rebounds Friday | Herd on Wall St. Podcast

Good afternoon, traders. It's finally Friday, July 26; the market is open, and prices are taking back some losses felt in a pullback midweek.

My name is Kevin Travers, here are stories from the herd on Wall St today.

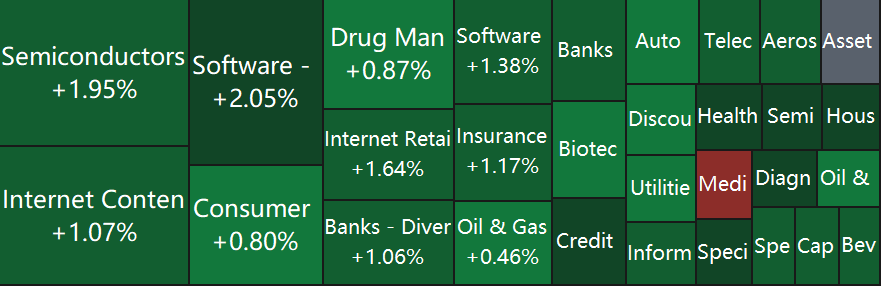

$3M (MMM.US)$ lifted the low end of its full-year earnings outlook on Friday after reporting second-quarter results above market estimates, it flew 19%, yanking the Dow higher as the highest advancer. $DexCom (DXCM.US)$ fell 41%, the lowest on the S&P 500, after the medical device company surprised Wall Street with a steep cut to guidance. DexCom stock was down 40% Friday, on track for its worst decline on record. The stock slid last fall on fears around anti-obesity drugs, or GLP-1s -- the company designs and sells continuous glucose monitors for diabetics -- but that doesn't appear to be dragging shares lower Friday. DexCom said it now expects fiscal 2024 revenue of about $4 billion to $4.05 billion, lower than a prior call of $4.2 billion to $4.35 billion. $Coursera (COUR.US)$ jumped 44% Friday after reporting a Q2 loss Thursday night that came in lower than the previous quarter. The AI tech education company posted 155 million total users, revenue of $170M, and GAAP earnings of $0.15, but adjusted earnings of $0.09/share. Friday morning, the firm enjoyed a maintained 'sell' opinion from an analyst at Goldman Sachs. Every sector on the market was climbing Friday, and industries of Semiconductors, Software, and Credit companies climbed.

In macroeconomic news the market was green not just for the sake of regaining ground; the much-awaited PCE numbers for June showed core prices grew at the same rate as last month, at 2.6%, while overall prices fell from 2.6% to 2.5%.

Consumer sentiment numbers also came in from the University of Michigan, showing that consumer confidence fell to an eight-month low of 66.4 this month from 68.2 in June. Consumers expect prices to climb at an annual rate of 2.9% over the next year.

Moderate inflation and resilient economic growth indicate the U.S. economy isn't landing at all, Global X's Scott Helfstein told Wall Street Journal in a note.

"Growth is well above pre-COVID trends, and prices are stable," Helfstein said. "Forget soft landing; this is the no landing economy."

Thursday, GDP numbers for the second quarter came out higher than expected and doubled last quarter at 2.8%. Gross Domestic Product numbers collected by the Bureau of Economic Analysis come out once a month, as the BEA records data on consumer prices and services from the previous quarter. The number becomes more accurate as the quarter progresses until economists agree on the final number.

PMI numbers came out Wednesday morning, about 20 bps higher than estimated at 55.3 vs 55.1. Last month, the index was at 54.8, so prices producers paid climbed in July.

Tuesday, existing home sales for June came in at 3.8M, about .1M lower than estimated.

Yesterday, users asked how to interpret PCE. It is a direct measure of inflating prices, and the Fed wants to see that number closer to 2%. One user said they did no think the Fed was watching inflation as closely as the job market, which Fed president Jerome Powell brought up in the last few times he spoke.

Traders, what are you watching today? Comment below and I will share it with moomoo tomorrow!

Disclaimer: This content is for informational use only and is not a recommendation or endorsement of any particular investment or strategy. Indexes are unmanaged and cannot be directly invested into. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors' financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances, before making any investment decisions. Past performance does not indicate or guarantee future success. Moomoo makes no representation or warranty as to its adequacy, or timeliness for any particular purpose of the above content. The data and information provided has been obtained from sources considered to be reliable, but moomoo does not guarantee that the foregoing material is accurate or complete. See the link in the Moovers Community post for more information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Goh Choon Keat :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Laine Ford : I like that stock