Nvidia, Tesla, Apple, Palantir, AMD Top Options Volume as Holders Exit 0DTE

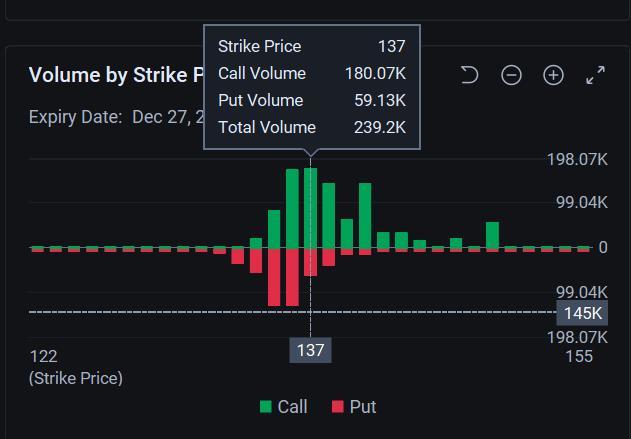

As of 2:16 p.m. Friday, volume already reached 171,000 for call options that give the holders the right to buy Nvidia shares at $137 by the end of the trading day. That's more than six times the open interest. The price of that contract tumbled 84% as the stock fell 2.5% to $136.48, pushing the call option out of the money with less than an hour left before it expires.

In total, 3.17 million Nvidia options changed hands so far, making it the most-active stock option. That's followed by 2.69 million in Tesla options and 990,790 Apple options. Closely behind is Palantir, with 741,090 options traded so far. Rounding out the top 5 is

$Advanced Micro Devices (AMD.US)$ with 629,640 options.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more 44

44 5

5

Sundar Subbarama : How a sell off in Stock is influenced by Call or Put options? Can someone explain in clear terms. Thanks

Ethan Tax Man Sundar Subbarama : Call options: Contribute indirectly by discouraging buying or triggering hedging.

Put options: Directly amplify sell-offs via hedging and bearish sentiment.

Market dynamics between options and stocks often create feedback loops that intensify price movements

Sundar Subbarama : Thanks Ethan.

74234152 : Big monney market movers

Adrianlim90 : 1

104769780 : 1

khyin78 : Thank you.

Pearl33 : thank you

103826785 : thank you