Nvidia, TSMC, and Semiconductors Hit Hard by Election Comments | Herd on Wall Street

Morning traders, it is a stormy, humid day on Wednesday, July 17th in JC, and the tech market feels it too.

$NVIDIA (NVDA.US)$ fell 5% after a Bloomberg report that President Biden considered punishing chipmakers if they kept trading chips to China.

My name is Kevin Travers, and here are stories from the moomoo herd on Wall Street today.

Within industries tracked by moomoo, Nvidia led the way for a major pullback in Semiconductors, and Semiconductor equipment fell hard, down 5% and 8%. $Arm Holdings (ARM.US)$ fell 7.6%, $Advanced Micro Devices (AMD.US)$ fell 7.5%. $ASML Holding (ASML.US)$ , a semiconductor lithography supply company posted upbeat earnings and guidance, but the news from Biden came at the wrong time, the stock fell 10%, and rounded out the trio at the lowest decliners on the Nasdaq 100.

$Intel (INTC.US)$, a U.S.-based chipmaker climbed 4%, the highest on the Dow Jones, sending the index to a new record.

$Taiwan Semiconductor (TSM.US)$ was not safe from the potshots, and fell 6% after comments from Presidential candidate Trump, who said Taiwan should pay for the military aid the U.S. provides. The firm is due to report earnings tomorrow alongside tech giant Netflix. Analysts tracked by YHahoo finance expect earnings of $1.4/share on revenue of $20B.

$GlobalFoundries (GFS.US)$, a NY-based semiconductor and foundry firm shot up 9%, the highest on the Nasdaq 100 on the news, as investors looked at U.S.-based alternatives.

Crude oil futures jumped 1.5% Wednesday, Bitcoin climbed 0.43% to $64k/coin. Gold climbed while silver fell 2.3%, while the U.S. 2-year fell back and the U.S. 10 years climbed.

Within indexes, the Dow continued its record climb.

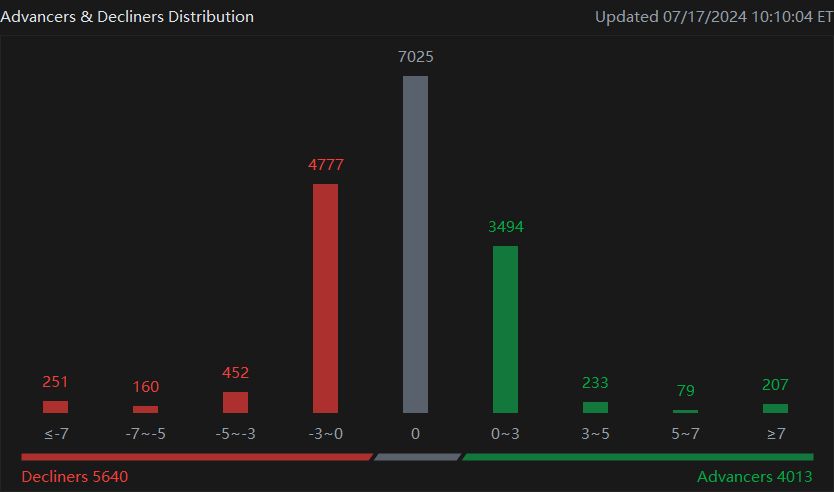

The market pulled back Wednesday. After 10:30 am EST, the $S&P 500 Index (.SPX.US)$ fell 1%, the $Dow Jones Industrial Average (.DJI.US)$ was falling 0.39%, and the $Nasdaq Composite Index (.IXIC.US)$ fell 2.3%.

Overall 5400 equities climbed, while 4000 fell.

This week will be a light one for macroeconomic news, with many Federal Reserve speakers and Initial Jobless claims on Thursday.

Federal Reserve Governor Adriana D. Kugler said Tuesday she anticipates "it will be appropriate to begin easing monetary policy later this year" if economic conditions continue to evolve in a favorable manner with more rapid disinflation and employment softens while remaining resilient. She addressed the National Association for Business Economics Foundation in Washington.

"If the labor market cools too much and unemployment continues to increase and is driven by layoffs, I would see it as appropriate to cut rates sooner rather than later," Kugler said. "Alternatively, if incoming data do not provide confidence that inflation is moving sustainably toward 2 percent, it may be appropriate to hold rates steady for a little longer."

Federal Reserve President Jerome Powell spoke Monday, saying the Fed would likely lower rates before inflation to 2%.

Yesterday, a user told me to check out Shopify, which climbed 8% after a BofA upgrade.

Mooers, what are you watching today? Comment below and I may feature your comment tomorrow!

Disclaimer: This content is for informational use only and is not a recommendation or endorsement of any particular investment or strategy. Indexes are unmanaged and cannot be directly invested into. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors' financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances, before making any investment decisions. Past performance does not indicate or guarantee future success. Moomoo makes no representation or warranty as to its adequacy, or timeliness for any particular purpose of the above content. The data and information provided has been obtained from sources considered to be reliable, but moomoo does not guarantee that the foregoing material is accurate or complete. See the link in the Moovers Community post for more information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

rising sun : If a country wants to be strong and number one in the world is not determined by chips. Instead, people unite and open up to the outside world to attract foreign investment, so that the national happiness index rises and the economy is in good condition for a long time.

Kevin Travers OP rising sun : What if they want to be number one in producing chips? Hahaha

LittleSoldier : It’s not Thursday?

BuIIy : Either outcome from the election will hurt the semiconductor industry, which has led the bullish market so far. I hope BRICS is cooking something so they can implement measures that make any sanctions from the US ineffective.